Forex News and Events

Vicious circle

The largest economy in Latin America experienced a sharp slowdown in the first quarter and is apparently not out of the woods yet, as suggested by the latest economic indicator. Despite a small improvement in January, manufacturing PMI dropped sharply from 50.7 to 46 in April but the index decreased by only 0.2 point compared to March, suggesting that the Brazilian economy is close to the bottom. In addition, industrial production is expected to contract by -3%y/y in March following a decrease of -9.1% in February. March industrial production and April HSBC manufacturing PMI figures are due today at 12:00 and 13:00 GMT.

Brazil’s economy is facing a big problem as growth and inflation are heading in opposite directions, both in the wrong way. The BCB keeps raising rate in an attempt to lower inflation toward the 4.5% target, adding pressure on the potential weak economic recovery. Meanwhile in the US, the Federal Reserve is getting ready to raise interest rate, this will add inflation pressure on Brazil and increase debt service costs, triggering further rate hikes from the central bank and making it difficult for the government to support growth by increasing spending and/or loosening its fiscal policy. As a result, data out of the US will have strong impact on USD/BRL as markets will start to price in the next US rate hike. The dollar appreciated more than 6% against the real since April 28th, trading above 3 real for 1 dollar. We therefore expect USD/BRL to be highly data sensitive, with a stronger response to negative news from the Brazilian economy.

US ADP eyed (by Yann Quelenn)

The US ADP Employment Change is due this Wednesday. The prior figure came in at 189K and market expectations suggest a higher change of 200K. A strong release will provide support for the USD-complex after both the quasi-flat American Q1 GDP growth rate this late April and the deceiving job figures at the end of March. We anticipate that a solid increase of the ADP would negatively impact the major US equites indexes as it would re-engage the discussion about the timing of the Feds rate-tightening policy. Pre-release EUR/USD is trading sideways between 1.1180 and 1.1260 with no conviction in either direction. A key resistance at 1.1290 may be challenged, potential reversal due to study labor data will target key support at 1.1000.

Don’t believe the hype (by Peter Rosenstreich)

When the smoke clears around the UK elections, watch for a strong sterling rally, regardless of who the “winner” is perceived to be. While the outcome is unpredictable with the two main parties level at the polls, the truth of the matter is that no single political party will emerging with a sturdy mandate. Therefore parties will have to share power and water down any controversial key electoral promises. Deep fiscal cuts will be marginalized while “in or out” referendum on EU has become less of an issue to everyday British voters (immigrations remains a touch point). With the sterling free from the uncertainly of pseudo-election chaos, the upside looks tempting. GBP/USD has solid support from the 65d MA with expected recovery strength to target 1.5500/50. EUR/GBP has failed to decisively break 0.7430 resistance indicating a bearish reversal targeting 0.7140 support.

EUR/GBP - Drifting Higher

The Risk Today

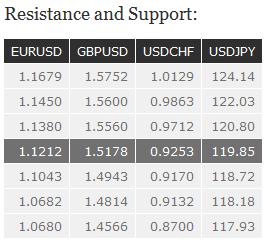

EUR/USD is recovering after its recent sell-off. A key resistance stands at 1.1290 (01/05/2015 high) and 1.137626/02/2015 high). Hourly support can be found at 1.1175 (intraday low). In the longer term, the symmetrical triangle from 2010-2014 favours further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD is showing limited short-term buying interest after break of declining trendline resistance at 1.5175. Hourly resistances can be found at 1.5262 (27/04/2015). Key support lies at 1.5100 (27/04/2015 low) and 1.5028 (24/04/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY remains weak as long as prices remain below the key resistance at 120.10/20 (declining trendline). A support stands at 119.35 (29/04/2015) high then 118.53. Another resistance is given by the recent high at 120.50 then 120.84 (13/04/2015 high).. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favored. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF has broken the key support area defined by 0.9491 (24/03/2015 low) confirming an underlying downtrend. Current bounce is thus far unimpressive,as prices remain near their recent lows. An initial key support lies at 0.9241 (50% fibo level) and 0.9170 (05/02/2015). Hourly resistances can be found at 0.9413 (30/04/2015 high) and 0.9493 (27/04/2015 low). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a countertrend move. Key support can be found 0.9170 (30/01/2015 low).