Bragg Gaming Group Inc (TSXV:BRAG) has reported its first half year, having acquired Oryx Gaming (a European online B2B platform) in December 2018. H119 continuing revenues grew 48% to C$18.0m, achieving EBITDA break-even. Bragg’s strategy is to expand its B2B presence, both organically and through complementary acquisitions. Key milestones will be the development of EBITDA, as well as the successful payment of the remaining c C$30m of deferred and contingent consideration for Oryx Gaming. In order to focus on the e-gaming opportunity, Bragg has announced a strategic review of its online media division (GiveMeSport) and UK sportsbook (GiveMeBet).

Bragg Gaming – rebranded in December 2018

Bragg Gaming is an online gaming technology holding company, formerly known as Breaking Data Corp. The business was fully rebranded with new management in December 2018, after the acquisition of Oryx Gaming, a predominately European online B2B gaming solution provider. The total cost of the Oryx deal was c C$51m, comprising C$15.1m equity, C$6.4m cash and c C$30m in deferred and contingent consideration. At the H119 results, Bragg announced a strategic review and possible sale of its online sports media outlet (GiveMeSport) and UK sportsbook (GiveMeBet).

Oryx delivers 48% revenue growth

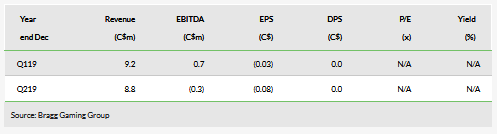

Bragg’s continuing operations are now fully derived from Oryx and the company reported Q219 continuing revenues of C$8.8m, an EBITDA loss of C$0.3m and a net loss of C$6.4m. For the first half, this amounted to 48% revenue growth to C$18.0m vs the prior year, positive EBITDA of C$0.4m and a net loss of C$9.4m. Operating cash outflow for H119 was C$4.2m and net cash was C$1.4m (excluding earnout obligations). Bragg launched 22 new operators in H119, providing a strong pipeline into the second half, and management has stated that trading in Q319 is ahead of internal expectations.

Limited operating history; EBITDA break-even

Bragg Gaming has a limited reporting history and has yet to generate net profit or positive net cash. A key catalyst will be continued high growth from the core Oryx business, combined with expanding EBITDA margins. The implied EBITDA from the deferred consideration suggests a c 7.5x EV/EBITDA for FY20, in line with peers but with much higher growth rates. We note that the company will likely need to raise further capital to satisfy the c C$30m of deferred and contingent consideration from the Oryx deal (due in H120 and H121).

Summary financials (continuing operations)

Business description

Bragg Gaming Group (formerly Breaking Data Corp) is a Toronto-based B2B online gaming holding company. The core asset is Oryx Gaming, a predominately European B2B online gaming platform. Bragg’s online sports media outlet (GiveMeSport) and UK sportsbook (GiveMeBet) are under strategic review, including possible sale.