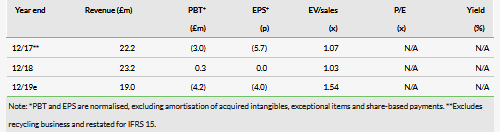

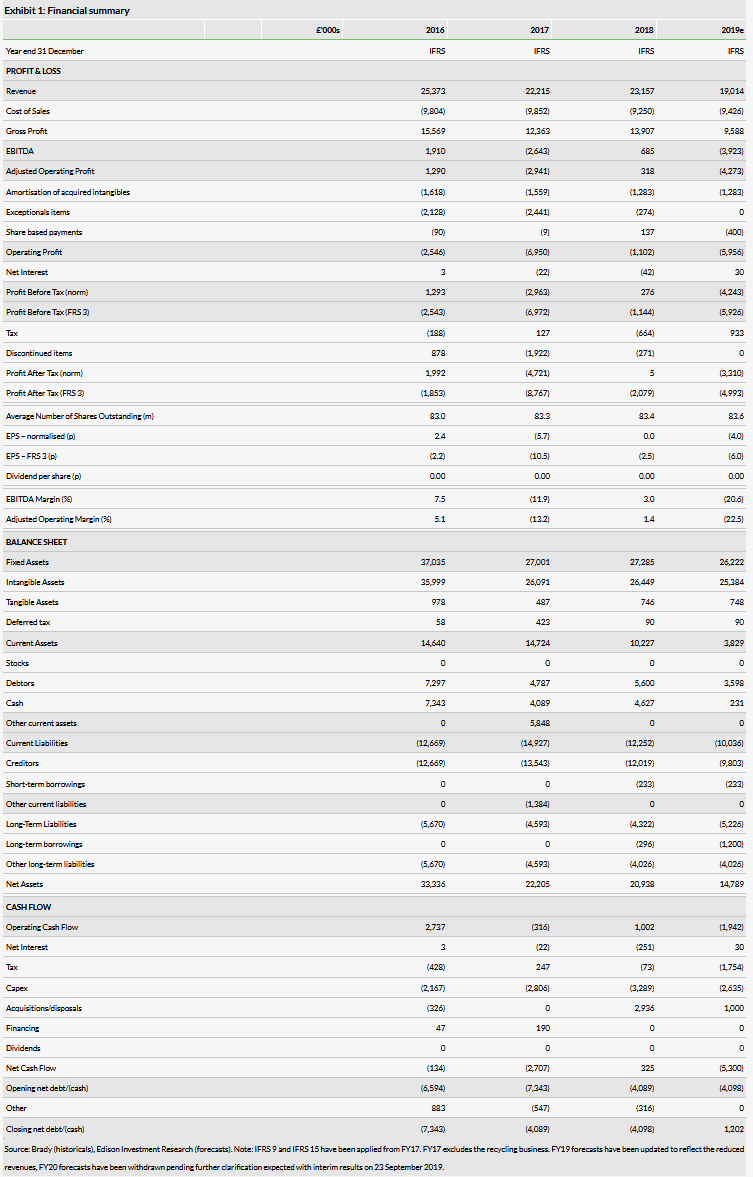

With the company expecting FY19 revenues of c £19m, c 22% down on our previous forecasts (£24.3m), new sales have slowed markedly since Brady’s last trading update on 30 May. This represents a perfect storm for Brady with it trying to affect a turnaround in the face of significant market and business uncertainties. We have revised our FY19 forecasts and now anticipate a PBT loss of £4.2m in FY19 (previously £1.0m) with FY19 net cash falling from £2.7m to £1.2m net debt. We have withdrawn our FY20/21 forecasts pending further clarification expected with the interim results on 23 September. However, as a market leader in the attractive E/CTRM space, as and when Brady demonstrates renewed sales momentum it should become an attractive investment on an FY19 EV/sales multiple of 1.5x.

Trading update: Sales momentum stalls

In its trading update on 21 August 2019, Brady announced that FY19 revenues would be c £19m, c 22% down on our previous forecasts (£24.3m), due to the pipeline of revenues from new customers ‘maturing’ but not expected to materialise in FY19. Brady noted that recurring revenues are ‘in line with expectations’ and new business bookings are anticipated in H219, although not at the levels previously anticipated. This represents a marked slowdown since the previous trading update on 30 May, attributable to a difficult market environment and elevated business uncertainty. EBITDA guidance was not provided.

Investment case: Clarification pending

In our view, there are a number of factors that may have contributed to the sales slowdown, including the escalating US/China trade war, an increasingly uncertain commodities trading environment, stiffening market competition and uncertainty around Brexit. Although Brady has indicated that new sales leads continue to progress, closing deals appears to have become increasingly problematic and it is not yet clear which of these possible factors is the primary driver. As and when new business is signed, the consequential impact of IFRS 15 is that an ever-smaller proportion of revenues will be recognised in FY19 as the year end approaches.

Valuation: Forecasts revised, EV/sales of 1.5x

Following the update, we now forecast FY19 revenues of £19.0m, with EBITDA loss of £3.9m and loss before tax of £4.2m. Our previous forecasts were for £24.3m of revenues, £1.3m of adjusted EBITDA and PBT of £1.0m. FY19e net cash falls from £2.7m to net debt of £1.2m. When Brady demonstrates renewed sales momentum, it should become an attractive investment on an FY19 EV/sales multiple of 1.5x.

Business description

Brady is the largest Europe-based E/CTRM player. It provides a range of transaction and risk management software applications, which help producers, consumers, financial institutions and trading companies manage their commodity transactions in a single, integrated solution.