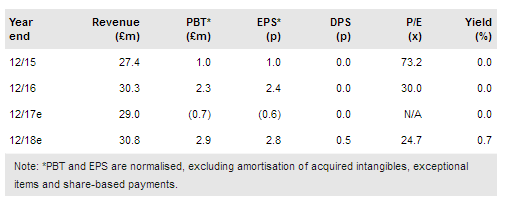

We have revised our forecasts following the newsflow over the last few months. While management has completed its strategic review, the transitioning process is continuing. The group has switched from operating on a divisional basis to global functions. The development team has been unified, and development work has shifted from platforms to ‘microservices’, so that new products can be leveraged across the group. Further, Brady (LON:BRDY) is evolving to a recurring revenue model. We have cut our FY17 forecasts to reflect the current transitioning but forecast revenue and margins to improve significantly thereafter. Given the long-term growth opportunities, notably in agriculture, natural gas and power, we believe the shares look attractive on 14x our cash-adjusted FY19 EPS.

Investment case: E/CTRM is highly attractive space

While commodity markets remain challenging, the E/CTRM market remains a highly attractive software vertical and Brady, as the largest Europe-based E/CTRM player, is well positioned to benefit. Brady’s solutions support a broad range of services to a wide range of commodity businesses including trading companies, financial institutions, producers, manufacturers and recyclers. Brady has more than 400 customers including many blue chip names. The global E/CTRM market is worth c $1.65bn, and is forecast to grow at c 6% CAGR to 2020 (Comtech). Brady’s traditional strengths are in the metals and electricity verticals, and Brady seeks to leverage these strengths into agriculture and European power, respectively. Recurring revenues represented 62% of the total in FY16, which we forecast to remain at similar levels in FY17, but grow to 66% in FY18 and to 69% in FY19.

To read the entire report Please click on the pdf File Below: