BP plc (LON:BP)’s (NYSE:BP) unit, BP Trinidad and Tobago (“BPTT”), has announced the commissioning of the Juniper development which yielded its first oil. Juniper started production on schedule and under budget.

Juniper development represents the fifth of BP’s seven upstream major project start-ups and second in Trinidad planned for 2017. The project is anticipated to enhance BPTT’s gas production capacity by an estimated 590 million standard cubic feet a day (mmscfd).

Juniper signifies BP’s first subsea field development in Trinidad, which involves an investment of about $2 billion. It yields gas from the Corallita and Lantana fields through the new Juniper platform, which is located 80 kilometers (50 miles) off the south-east coast of Trinidad in water depth of about 110 meters. Subsequently, the gas flows to the Mahogany B hub through a new ten-kilometer flowline that was established in 2016.

The Trinidad Onshore Compression project in Trinidad was brought online in April. In June, BPTT announced that it has approved development of the Angelin gas field, which is anticipated to begin production in late 2019. Two other gas discoveries were announced by BPTT, which are expected to support future developments offshore Trinidad.

Juniper is BPTT’s 14th offshore platform in Trinidad and its sixth to be build at the fabrication yard in La Brea.

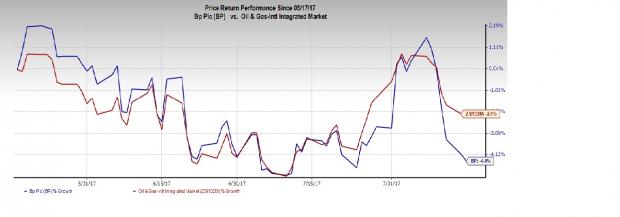

Over the last three months, shares of BP have lost 4.4% compared with the industry’s decline of 2.1%.

BP currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include Range Resources Corp. (NYSE:RRC) , Braskem S.A. (NYSE:BAK) and TransCanada Corp. (TO:TRP) . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources delivered a positive earnings surprise of 250.00% in the preceding quarter. The company beat estimates in three of the trailing four quarters with an average negative earnings surprise of 94.22%.

Braskem delivered a positive earnings surprise of 107.79% in the quarter ending September 2016.

TransCanada delivered a positive earnings surprise of 12.00% in the preceding quarter. It surpassed estimates in two of the trailing four quarters with an average positive earnings surprise of 4.06%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

BP p.l.c. (BP): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research