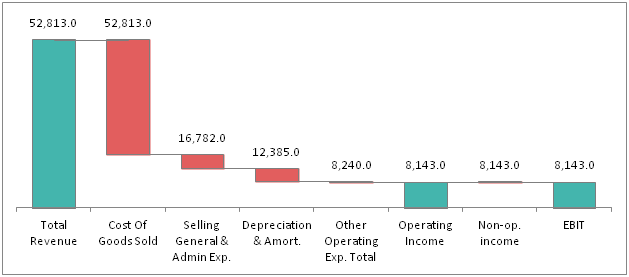

- Financial Performance: EPS of $1.15, GAAP EPS of $1.66, Operating cash flow of $8.7 billion.

- EV Charging Network Partnership with Tesla: Integration of Tesla's ultra-fast chargers into bp pulse.

- Strategic Agreements and Investments: Collaborations with Harmony Energy Income Trust and Advanced Ionics. Investment in Service4Charger GmbH to expand electric vehicle charging infrastructure.

- Shifting dynamics within the Oil Industry: Possibility of a merger if BP's underperformance persists, redefining the UK's role in the global energy market.

Q3 2023 Performance

In terms of financial performance, BP (NYSE:BP) reported an EPS of $1.15, slightly missing the consensus estimate but exceeded the estimate on a GAAP basis with an EPS of $1.66. Although the revenue recorded for the quarter was slightly below market expectations, the company's strong operational performance and cost discipline have contributed to improved cash delivery, generating an operating cash flow of $8.7 billion. This impressive financial performance is a testament to BP's focus on operational excellence and efficiency.

Transition to Renewable Energy and Shareholder Return

BP's transition to low-carbon and renewable energy sources is a major driver for the company's stock. With a strong emphasis on biofuels, convenience and electrification, and offshore wind, BP is strategically positioning itself to reduce carbon emissions and capitalize on the energy transition. The company's efforts to expand its renewables pipeline to 43.9GW net and secure rights for offshore wind projects in Germany highlight its commitment to clean energy growth opportunities. As the world continues to shift towards renewable sources, BP's investments in low-carbon technologies position it well to capture future growth.

The successful execution of its capital allocation framework and the ability to generate attractive shareholder returns are additional factors driving BP's stock performance. With a focus on strengthening the balance sheet and maintaining a steady dividend payment, BP has enhanced investor confidence in its ability to deliver sustainable shareholder value. The potential for share buybacks provides an additional avenue for delivering value to shareholders. The company's strong operational performance and cost discipline also contribute to its ability to generate surplus cash flow, further supporting the execution of its capital allocation framework.

Commitment to Integrated Energy Strategy and Other Strategic Projects

BP's steadfast commitment to its existing strategy of transforming into an integrated energy company plays a crucial role in its future trajectory and stock performance. The company's focus on strategic continuity, safety, and shareholder value resonates well with investors. The steady course towards transformation and value creation outlined by BP during its investor update reinforces its commitment to meeting targets and delivering long-term growth. These factors contribute to BP's appeal as an investment opportunity.

The successful initiation of strategic projects and milestones further bolsters BP's growth prospects. The Tangguh expansion project in Indonesia, the "Bingo" facility in the Permian Basin, and the approval for the Murlach oil and gas development in the North Sea reflect BP's operational excellence.

These achievements affirm the company's growth trajectory and its ability to capitalize on existing assets. BP's progress in securing long-term agreements, such as the LNG supply deal with OMV and the partnership with Woodfibre, augments its position in the renewable energy market, potentially positively impacting its stock performance.

Partnership with Tesla and Renewable Energy Initiatives

BP's strategic partnership with Tesla (NASDAQ:TSLA) to expand its EV charging network is a significant development that further solidifies its position in the growing electric vehicle market. The integration of Tesla's ultra-fast chargers into BP's EV charging subsidiary, BP Pulse, emphasizes the company's commitment to advancing in the renewable energy sector.

This collaboration with Tesla positions BP well to capture market share in the EV charging infrastructure market, potentially driving its stock performance in the upcoming quarters. The successful start-up of the Tangguh LNG facility and BP's expansion into offshore wind highlights the company's commitment to renewable energy sources.

The utilization of landfill gas for renewable natural gas production and the commencement of the Peacock Solar project showcase BP's dedication to sustainability and its contribution to a lower-carbon future. These initiatives align with BP's strategy to diversify its renewable portfolio and reinforce its position as a sustainability leader.

BP's strategic agreements and investments underscore its commitment to renewable energy and the transition to a low-carbon economy. Collaborations with Harmony Energy Income Trust and Advanced Ionics demonstrate its focus on driving a Net Zero future. Additionally, the expansion of its electric vehicle charging infrastructure through investment in Service4Charger GmbH furthers its position in the growing EV market. These initiatives highlight BP's comprehensive approach to energy diversification, potentially impacting its stock performance positively.

Conclusion

In conclusion, BP Plc's strong financial performance, transition to renewable energy, execution of its capital allocation framework, and commitment to long-term value creation position it as an attractive investment opportunity. Given these factors, we suggest to add on to BP Plc's stock, reflecting our confidence in its continued success and growth. Nevertheless, prudent monitoring of market dynamics is required to navigate potential challenges and capitalize on the company's promising trajectory.

Disclosure: We don’t hold any position in the stock and this is not a recommendation of any kind as investing carries risk.

Read More on this Here: https://equisights.com/