Integrated oil giant BP plc (LON:BP)'s (NYSE:BP) affiliate ARCO Midcon LLC recently divested 30% interest in the entity that owns the Olympic Pipeline to a subsidiary of ArcLight Capital.

Deal Details

The deal builds upon BP and ArcLight's recent joint venture agreement regarding the development of refined product infrastructure assets, connected to the Olympic Pipeline. BP will carry out operations in the pipeline following a multi-year operating agreement.

As part of the deal, ArcLight's subsidiary TransMontaigne Partners LP (NYSE:TLP) was given the right of first offer to buy ArcLight's interest in the Olympic Pipeline. The financial terms of the contract are yet to be disclosed.

About the Pipeline

The BP operated Olympic Pipeline system of refined products spans around 400 miles across Washington and Oregon states. It transports gasoline, diesel, and jet fuel. The system incorporates 12-inch, 14-inch, 16-inch, and 20-inch pipelines. The pipeline supplies 300,000 barrels of oil products per day to Seattle, Tacoma, Olympia and Portland. The major shareholder of the pipeline is Enbridge Inc. (NYSE:ENB) , with 65% interest.

About BP

BP is one of the largest integrated energy firms in the world with a strong and diversified portfolio of development projects. During second-quarter 2017, BP reported better-than-expected earnings, primarily owing to higher liquid and gas prices realizations.

However, the oil spill incident of 2010 in the BP-operated Macondo Prospect is still affecting the company. Although BP has cleared the huge litigation expenses related to the spill, it had to divest some of its best operating properties. The asset sales might hinder BP’s future cash generating opportunities going forward. It is to be noted that the lost reserves and production from the group's asset sales cannot be ignored either.

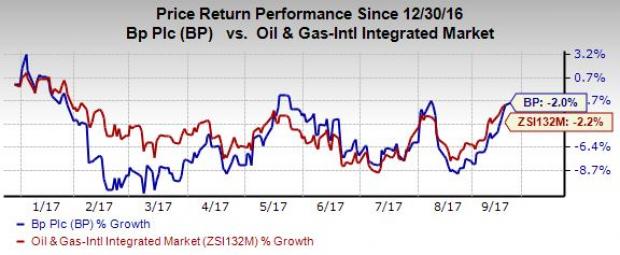

Price Performance

BP has lost 2% of its value year to date compared with 2.2% loss of its industry.

Zacks Rank and Stock to Consider

BP has a Zacks Rank #3 (Hold).

A better-ranked stock in the oil and energy sector is Lonestar Resources US Inc. (NASDAQ:LONE) . It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lonestar Resources’ sales for 2017 are expected to surge 60.2% year over year. The company delivered a positive earnings surprise of 62.5% in the second quarter of 2017.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

BP p.l.c. (BP): Free Stock Analysis Report

TransMontaigne Partners L.P. (TLP): Free Stock Analysis Report

Enbridge Inc (ENB): Free Stock Analysis Report

Lonestar Resources US Inc. (LONE): Free Stock Analysis Report

Original post

Zacks Investment Research