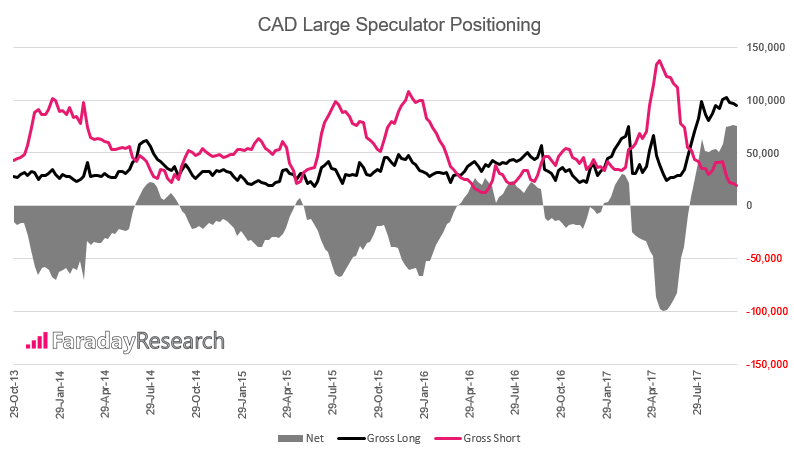

Ahead of Wednesday’s meeting and, despite recent warnings from Bank of Canada (BOC) that policy could move in either direction, large speculators remained joyfully net-long the Canadian dollar at levels not seen since 2012. One dovish meeting and a worrisome monetary-policy report later, price action strongly suggests this may not have been a good idea. Oh the wonders of hindsight.

Furthermore, CAD could now find itself vulnerable to further weakness if soft data continues to materialize and concerns over further easing (even if prematurely) resurface. Whether this situation happens only time can tell but for now we’ll focus on USD/CAD technicals to see where we are.

After a particular bearish year, USD/CAD is showing promising signs of a bullish trend emerging on the daily chart. Following a break of the May 2016 trendline, bullish momentum has increased and range expansion is underway. Furthermore, it closed above the 1.2778 swing high in another constructively bullish signal, albeit marginally so.

Had it cleared the level more convincingly, we’d have more confidence the structural level had been breached. Yet with it, we’d also have the added problem that the wide range expansion day could be too bullish for its own good. Simply going long after such an expansive candle rarely yields a similar, consecutive candle. Which is why we’d prefer to wait for signs of compression on the daily timeframe before considering a long position.

Although it closed above the upper Keltner band, there are no immediate signs of exhaustion to warn of a deeper retracement. If we are to see reversal candles and bearish divergences form, then we’d be on guard for such an event. Either way, patience here is key to allow us to enter on a low-volatility move.

So from a tactical standpoint, for us to express an interest in a long position, we’d prefer to see at least two days of compression or a low-volatility retracement. This, combined with evidence of range expansion on lower timeframes, could provide the signal we seek – assuming it’s coupled with bullish momentum.