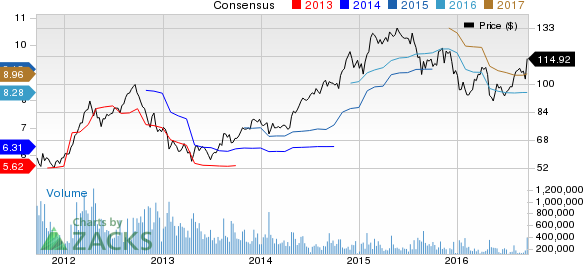

Meat processor Tyson Foods Inc. (NYSE:TSN) seems to be rallying on a high growth momentum at the moment. The company has seen its stock price surge 19.65% over the past three months and nearly 37.35% on a year-to-date basis. Further, it sports a Zacks Rank #1 (Strong Buy). Let’s delve deeper into the underlying factors and find out the reason behind this stellar performance.

What's Driving the Stock?

Tyson Foods has been posting better-than-expected results over the past several quarters, backed by continuous product innovation and strong momentum in most of its business segments. Management has strongly focused on innovation, making it a crucial aspect of their growth strategy.The company reported positive earnings surprises in three of the last four trailing quarters with an average surprise of 12.24%.

Keeping in view the increased health consciousness among customers and their choice of nutritional food products, Tyson’s complete antibiotic-free Nature Raised Farms brand has been further enhanced with the addition of Individually Quick Frozen products. Moreover, the company is striving to eliminate the use of human antibiotics from its U.S. broiler chicken flocks by the end of Sep 2017. Such initiatives are projected to boost demand for company’s products going forward.

Tyson also remains confident about each of its operating segment to operate above its normalized range, as was stated at the Consumer Staples Conference held on Sep 8, 2016. Domestic chicken production is expected to go up, although fed cattle and hog supplies are estimated to remain short even in fiscal 2017. However, the company anticipates the prepared foods segment to gain from operational improvements and positive pricing.

Tyson’s optimism as well as its growth momentum is displayed in the positive sentiment prevailing among analysts covering the stock. Analysts expect earnings for fiscal 2016 and 2017 to grow 43.33% and 6.76% year over year respectively.

The company anticipates its earnings per share to be 40% higher year over year and achieve a four-year compound annual growth rate of approximately 22%. (Read: Tyson Foods Q3 Earnings and Sales Beat Estimates).

Bottom Line

As a prudent investment strategy advises one to buy outperforming stocks at the right juncture, we suggest you to do the same with Tyson to boost the value of your portfolio.

Here are some other stocks one can count on like Sanderson Farms Inc. (NASDAQ:SAFM) , Omega Protein Corp. (NYSE:OME) and The Kraft Heinz Company (NASDAQ:KHC) . While Sanderson Farms and Omega Protein sport a Zacks Rank #1, Kraft Heinz carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

TYSON FOODS A (TSN): Free Stock Analysis Report

SANDERSON FARMS (SAFM): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

KRAFT HEINZ CO (KHC): Free Stock Analysis Report

Original post

Zacks Investment Research