US State pensions face $1 trillion dollar funding gap in a world increasingly dependent on centralized promises. Even more troubling, this number is trending higher at an alarming rate: Greece-Like Problems Lurking In The United States

CalPERS, California's largest public pension fund, recently reported a 2.4% net return on investments for the 12-months that ended June 30, 2015. This is well below its 7.5% assumed investment return - though the press release doesn't clearly spell this out.

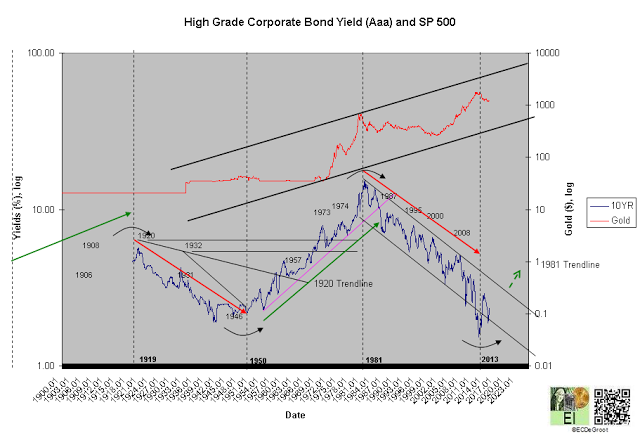

Why are CalPERS returns falling? Public pension funds are loaded with bonds as the interest rate cycle turns against bonds for decades (chart). That's right, decades. CalPERS, like many US State pension funds, have huge holdings of US Treasury Bonds in increasingly illiquid bonds that cannot be sold in size as confidence fades.

Politicians from both sides of the aisle, following the doctrine of self preservation, will raise taxes in a desperate attempt to save failing pension plans and a failing economic/social system. Perhaps this is why Donald Trump, at best considered a wildcard for the 2016 election by the political establishment, is soaring in the polls. Higher taxes, while providing a temporary fix for central planners, will send state and local economies into a vicious downward spiral not seen since the Great Depression. Municipal bankruptcies will soar as local economies will fold under the weight of Greece-like austerity.

Chart

Headline: Calpers Misses Target With 2.4% Return in Past Fiscal Year

The California Public Employees’ Retirement System, the largest pension in the U.S., said it earned 2.4 percent last fiscal year, below its target rate as financial-market turbulence depressed stock and bond returns.The $300 billion fund earned 1 percent on public-equity holdings and 1.3 percent in fixed-income investments, said Ted Eliopoulos, chief investment officer. Real estate returned 13.5 percent, while private equity gained 8.9 percent.