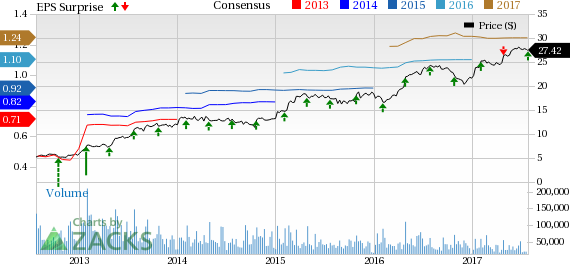

Boston Scientific Corporation (NYSE:BSX) posted adjusted earnings per share (EPS) (after considering certain one-time adjustments other than amortization expense) of 23 cents in the second quarter of 2017, up 21% from the year-ago quarter.

Considering amortized expense adjustments, the quarter’s adjusted EPS came in at 32 cents, up 18.5% from the year-ago adjusted number. This figure although remained a penny ahead of the Zacks Consensus Estimate, it fell within the company’s adjusted EPS guidance range of 30–32 cents.

Without these adjustments, the company reported earnings of 11 cents per share, in comparison to a loss of 15 cents per share in the year-ago period.

Revenues in Detail

Revenues in the second quarter were up 6% year over year on reported basis and up 7% on operational basis (at constant exchange rate or CER) to $2.26 billion. The figure topped the company’s guidance of $2.19–$2.22 billion and also exceeded the Zacks Consensus Estimate of $2.21 billion.

Organic revenue growth in the second quarter (excluding the impact of changes in foreign currency exchange rates and sales from the acquisitions of EndoChoice Holdings and Symetis SA) was 6% year over year.

Geographically, in the second quarter, the company achieved operational growth of 9% in the U.S. (up 7% organically), 4% in Europe (up 2%); up 7% in the Asia, Middle East and Africa region (up 7%) and up 12% in the emerging markets (up 14%).

Segment Analysis

Boston Scientific currently has three global reportable segments: Cardiovascular, Rhythm Management and MedSurg.

The company generates maximum revenues from Cardiovascular. Sales from its subsegments — Interventional Cardiology and Peripheral Interventions — were $603 million (up 5% year over year at CER) and $273 million (up 7%), respectively, during the second quarter.

The second largest contributor to Boston Scientific’s top line was Rhythm Management, which includes Cardiac Rhythm Management (CRM) and Electrophysiology. CRM reflected a 2% year-over-year increase in sales to $480 million at CER in the reported quarter.

Worldwide, sales from pacemakers (within CRM) increased 4.9% to $151 million while defibrillators were down 1.2% to $329 million.

Electrophysiology sales went up 11.7% year over year at CER to $67 million.

Other segments like Endoscopy, Urology and Pelvic Health and Neuromodulation (under the MedSurg broader group) recorded sales of $400 million (up 12% at CER), $280 million (up 10%) and $154 million (up 14%), respectively.

Margins

Gross margin expanded 205 basis points (bps) year over year to 71.9% on 1.1% fall in cost of products sold. Adjusted operating margin also expanded 240 bps to 24.3% in the reported quarter. During the quarter, selling, general and administrative expenses went up 4.6% to $815 million, while research and development expenses increased 9.9% to $244 million. Royalty expenses reduced 15% to $17 million in the quarter.

Balance Sheet

Boston Scientific exited the second quarter with cash and cash equivalents of $195 million, up from $156 million at the end of the sequential last quarter. At the end of the second quarter, the company had a total long-term debt of $5.84 billion, a marginal increase from $5.14 billion at the end of the first quarter.

Guidance

Boston Scientific has provided an update to its full-year 2017 guidance.

The company raised its 2017 revenue guidance to the range of $8.89-$8.99 billion (annualized growth of 6-7% on reported basis and growth of 6-8% on operational basis including contribution of approximately 120 bps from EndoChoice and Symetis) from the earlier band of $8.80–$8.90 billion (annualized growth of 5-6% on reported basis and growth of 6-7% on operational basis). The current Zacks Consensus Estimate for revenues is $8.87 billion, below the guided range.

Adjusted EPS guidance range for 2017, has been slightly increased to $1.22−$1.27 from the earlier range of 1.22−$1.26. The Zacks Consensus Estimate of $1.24 is within this guided range.

The company also provided its third-quarter 2017 financial guidance. Adjusted earnings are expected in the band of 29–31 cents per share on revenues of $2.18–$2.21 billion. The Zacks Consensus Estimate for EPS stands at 31 cents while for revenues, it is $2.19 billion.

Our Take

Even amid challenging economic conditions, a competitive environment and severe currency headwinds, Boston Scientific posted a better-than-expected second quarter, with earnings missing the Zacks Consensus Estimate and revenues, ahead of the mark. While foreign exchange headwinds continue to pose challenges, we are concerned with the company’s recent recall of one of its prime products, Lotus range of heart devices. Also the unimpressive defibrillator performance within the company’s core CRM segment continues to remain a drag for the overall growth.

Nevertheless, Boston Scientific is leaving no stone unturned to strengthen its core businesses and invest in new technologies and global markets, which accounted for higher sales across all its geographies in the second quarter. We are also encouraged with the company gaining a number of approvals for its products, both in the domestic and overseas markets.

Among the recent developments, worth mentioning is the company’s recent acquisition of Switzerland-based Symetis SA, in a bid to fortify its structural heart business in Europe. This apart, the company received an FDA approval for the RESONATE family of implantable cardioverter defibrillator (ICD) and cardiac resynchronization therapy defibrillator (CRT-D) systems. It also received CE Mark for the Vercise Gevia Deep Brain Stimulation (DBS) System and the first MR-conditional directional DBS system for treatment of movement disorder symptoms in patients with Parkinson’s disease, dystonia and essential tremor.

Zacks Rank & Other Key Picks

Currently, Boston Scientific carries a Zacks Rank #4 (Sell).

Some other better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Becton, Dickinson and Company (NYSE:BDX) and Thermo Fisher Scientific Inc. (NYSE:TMO) . Notably, PetMed sports a Zacks Rank #1 (Strong Buy), while Becton, Dickinson and Company and Thermo Fisher Scientific carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10.00%. The stock has soared around 108.5% over the last three months.

Becton, Dickinson and Company has a long-term expected earnings growth rate of 11.25%. The stock has rallied around 14.4% over the last three months.

Thermo Fisher Scientific has a long-term expected earnings growth rate of 12.25%. The stock has gained around 8.4% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research