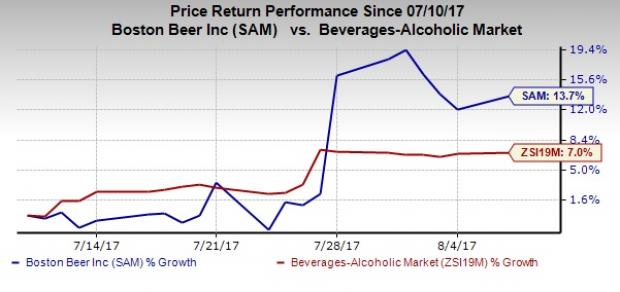

Shares of The Boston Beer Company, Inc. (NYSE:SAM) have rallied 11.1% after it posted solid second-quarter 2017 results on Jul 27. Also, this Zacks Rank #2 (Buy) stock was up 13.7% in the last month compared with its industry’s gain of 7%.

Currently, the industry is placed at the top 7% of the Zacks classified industries (18 out of 256). Also, its shares have outpaced the broader Consumer Staples sector’s gain of 3.9%, which is placed at the top 13% of the Zacks classified sectors (2 out of 16).

Let’s delve deep to explore more about the stock, which boasts a VGM Score of “A.”

Sturdy Q2 Results

Boston Beer posted solid second-quarter 2017 with both earnings and sales surpassing estimates and increasing year over year. This marked its third straight earnings beat, while sales returned to growth after three consecutive misses. In fact, the company outpaced the Zacks Consensus Estimate in the trailing four quarters, with average earnings beat of 50%.

Results benefited from top-line gains accompanied by gross margin improvement and lower operating costs owing to the company’s cost saving initiatives. Further, gross margins expanded in the quarter attributable to higher revenue per barrel that resulted from better pricing and package mix, along with lower brewery processing cost per barrel.

Consequently, management raised the lower-end of its previously stated guidance range and expects its adjusted earnings in the range of $5.00–$6.20 per share compared with the prior guidance of $4.20–$6.20. This, in turn, has led to an uptrend in estimates in the last 30 days.

The Zacks Consensus Estimate of $5.73 and $5.74 for 2017 and 2018, respectively, has increased 87 cents and 38 cents. Moreover, the estimates for the third quarter have increased from $2.09 to $2.13 over the same time period.

Other Strengths

Being one of the largest premium craft brewer in the U.S., Boston Beer, commands a robust portfolio of globally recognized brands. Also, the company distributes its beverages in Canada, Europe, Israel, the Caribbean, the Pacific Rim, Mexico, and Central and South America through a strong network of wholesale distributors.

Going forward, we expect its continued focus on pricing, product innovation and brand development to boost its operational performance and position in the market.

Further, we remain encouraged by Boston Beer’s three point growth plan focused on revival of Samuel Adams and Angry Orchard brands, cost saving initiatives and long-term innovation. In addition, management seeks strategic opportunities to expand business through inorganic means, which help it in capturing considerable market share.

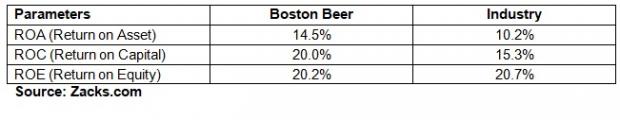

Boston Beer vs. Industry

Concerns

Though Boston Beer’s second-quarter 2017 earnings and sales topped estimates, depletion trends continued to be soft. Depletion volumes in the quarter were primarily impacted by persistent declines in the Samuel Adams and Angry Orchard brands as well as a fall in Coney Island brand.

However, the company pointed to some improvement in the depletion trends from the beginning of the year while it stated that trends in the craft beer and cider categories continue to remain soft. Further, challenges related to a competitive retail backdrop persist, thereby providing lot of drinking options. In the mean time Boston Beer continues to project soft depletion trends for 2017.

Bottom Line

We expect the company’s strategies to likely overcome the soft depletion trends, but this might take some time.

Meanwhile, you may also count upon some other top-ranked stocks such as Constellation Brands, Inc. (NYSE:STZ) , Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) and Limoneira Company (NASDAQ:LMNR) , carrying the same bullish rank as Boston Beer. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Constellation Brands, with a long-term earnings growth rate of 18.2% has delivered an average positive earnings surprise of 11.7% in the last four quarters.

Ollie's Bargain Outlet, with a long-term earnings growth rate of 19% has pulled off an average positive earnings surprise of 14.6% in the last four quarters.

Limoneira has come up with an average positive earnings surprise of 14.7% in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

Constellation Brands Inc (STZ): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Limoneira Co (LMNR): Free Stock Analysis Report

Original post

Zacks Investment Research