The Boston Beer Company Inc (NYSE:SAM) is America’s leading brewer of world-class beer. The Company has won more than 500 international awards for its better-tasting beers. Samuel Adams Boston Lager(R) is the Company’s flagship brand, celebrated worldwide for its high-quality ingredients and traditional brewing techniques. The result is a beer renowned by drinkers for its full flavor, balance, complexity, and consistent quality. The company sells approximately 60 beers under the Samuel Adams and the Sam Adams brands; 20 hard cider beverages under the Angry Orchard brand; 13 flavored malt beverages under the Twisted Tea brand; and 4 hard seltzer beverages under the Truly Spiked & Sparkling brand name, as well as approximately 40 beers under A&S Brewing trade name. It markets and sells its products to a network of approximately 350 wholesalers, who in turn sell to retailers, such as pubs, restaurants, grocery stores, convenience stores, package stores, stadiums, and other retail outlets in various countries. ValuEngine Smart Ratings.

We have heard a lot from beverage industry analysts over the past few years vis-a-vis craft beer. Much of this analysis has been of the sort that warns of an impending shake out of the market–even as the segment continued to enjoy growth rates of 10% or more.

However, we often wonder whether this sort of argument represents little more than wishful thinking on the part of macro brewers such as the giants Anheuser Busch Inbev (BR:ABI) SA NV (DE:ABI) or SABMiller (LON:SAB). We definitely think that craft beer is far more competitive than it used to be, but we also don’t see drinkers switching back to Bud or Miller anytime soon.

Of course, the grand daddy of the craft beer “movement”–whether they get the credit or are even remembered as such–is the Boston Beer Company. Makers of what was once pretty much the only craft beer one could find at a grocery or bar, Samuel Adams Boston Lager, Boston Beer rarely gets credit and–unfortunately for them, many drinkers late to the game assume Sam Adams is not a craft beer.

But, Boston Beer is still held in high regard by older craft aficionados, and throughout their history they have taken significant steps to assist and reward their loyal customers. “Back in the day,” the company was one of the first to skip the Wall St insider game of IPOs and provided their customers with an opportunity to buy shares at a fair price when they first went public. They have also innovated in other areas, branching off into ciders and other flavored malt beverages–which is also an unknown fact for many consumers despite the Angry Orchard or Twisted Tea in their hands.

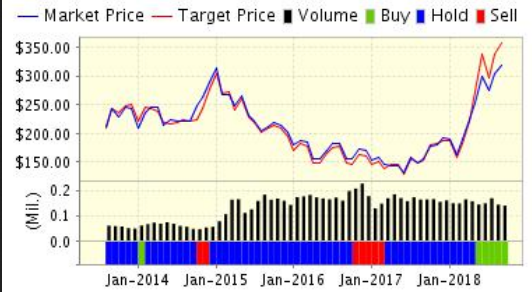

The company has had a notable 2018 so far, despite claims that craft beer was dead, Boston Beer was on the decline, etc. The share price has been up– at times more than 65%. Despite the fact that their flagship brand no longer holds the cache it used to among craft beer drinkers, the other innovative products have room to grow significantly, and they are popular among younger drinkers who may not favor the more radical offerings like sours and IPAs from “hard-core” craft breweries.

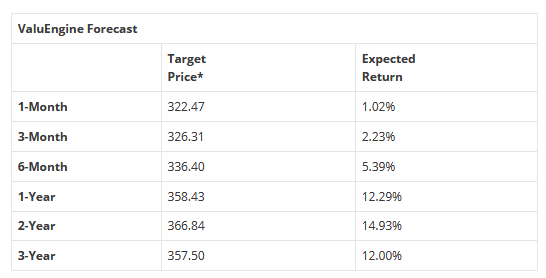

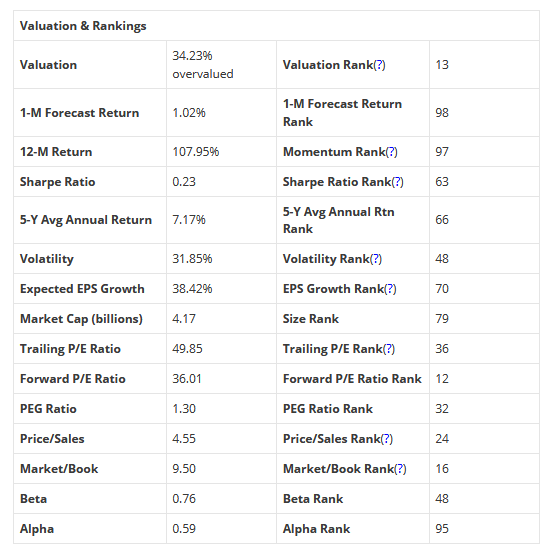

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on BOSTON BEER INC for 2018-09-14. Based on the information we have gathered and our resulting research, we feel that BOSTON BEER INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Company Size.

You can download a free copy of detailed report on the Boston Beer Company (SAM) from the link below.