Boston Beer Co. Inc. (NYSE:SAM) reported robust second-quarter 2017 earnings, wherein both top line and bottom line topped estimates. Moreover, both earnings and sales improved year over year. While this marked the company’s third straight earnings beat, sales returned to growth after three consecutive misses.

Results benefited from top-line gains accompanied by gross margin improvement and lower operating costs owing to the company’s cost saving initiatives.

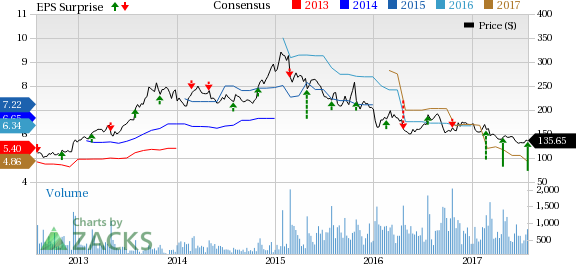

Following the solid results, the stock jumped nearly 14.6% in the after-hours trading session on Jul 27. However, the shares of Boston Beer have declined 5.9% in the last three months, underperforming the industry’s growth of 4.5%.

Q2 Highlights

Boston Beer’s second-quarter earnings per share of $2.35 surpassed the Zacks Consensus Estimate of $1.29 and improved 14.1% year over year. The outperformance stemmed from solid top-line growth and gross margin expansion partly offset by rise in advertising, promotional and selling expenses. Moreover, the company’s earnings included a tax benefit of 2 cents owing to the adoption of the new Accounting Standard "Employee Share-Based Payment Accounting" ("ASU 2016-09") effective Jan 1, 2017.

Net revenue rose 1.3% year over year to $247.9 million. Excluding excise taxes, revenue increased 1.3% year over year to $264.7 million. Revenues, both including and excluding excise taxes, surpassed the Zacks Consensus Estimate of $228.9 million. Core shipments remained flat at 1.1 million barrels, while depletions were down 3%.

In the second quarter, depletion volumes were primarily impacted by persistent decline in the Samuel Adams and Angry Orchard brands, as well as fall in Coney Island. This was partly mitigated by growth in Twisted Tea, and Truly Spiked & Sparkling brands, alongside slight gains from the shift in its second- quarter end timing, particularly related to the fourth of July holiday.

Though the company pointed to some improvement in the depletion trends from the beginning of the year, it stated that trends in the craft beer and cider categories continue to remain soft. Further, challenges related to a competitive retail backdrop persist, providing lot of drinking options.

Further, the company continues to project soft depletion trends for 2017. Evidently, depletions for the year-to-date period through the 29 weeks ended Jul 22, 2017 are estimated to have declined nearly 7% from the comparable year-ago period in 2016.

Costs & Margins

Gross profit increased 5.6% year over year to $134 million, while gross margin expanded 230 basis points to 54.1% in the quarter. The improvement in gross margin can be attributed to higher revenue per barrel that resulted from better pricing and package mix, along with lower brewery processing cost per barrel due to its cost saving initiatives.

Advertising, promotional and selling expenses rose 7.1% to $67.8 million due to higher salaries and benefits costs along with media spending, offset by fall in point-of-sale costs and lower freight to distributors. General and administrative expenses slumped 11% to $19.4 million due to a favorable stock-based compensation, consulting and legal costs.

Financials

As of Jul 1, 2017, Boston Beer had cash and cash equivalents of $71.7 million and stockholders’ equity of $421.7 million.

In first-half 2017, the company generated approximately $61 million of cash from operating activities, while it deployed nearly $16.7 million toward capital expenditure, primarily to be invested in breweries.

Growth Plan

Management remains committed to a three-point growth plan. One, revival of the Samuel Adams and Angry Orchard brands through packaging, innovation, promotion and brand communication initiatives. Further, it targets maintaining momentum for the Twisted Tea brand.

Two, accelerated focus on cost savings and efficiency projects, with savings directed for further brand development. In this regard, the company has adjusted the organization to the new volume environment, while at the same time retained its capability to innovate and return to growth. Evidently, the results of these initiatives reflected in gross margin improvements and lower operating expenses in the second quarter. Further, this has led the company to increase spending on brands during the quarter. On the back of this early success, the company reiterated the previously revealed target of improving gross margin by one percentage point every year through 2019.

Third, long-term innovation, with current focus maintaining the leadership of Truly Spiked & Sparkling brand and ensuring it reaches full potential.

Moreover, Boston Beer remains focused on making investments to revive hard cider category and Angry Orchard brand, while maintaining category leadership. Though management is prepared for not so impressive bottom-line results in the short term, it remains on track to boost long-term profitability. Going forward, the company remains optimistic about the future of craft beer and cider category growth.

Guidance

For 2017, the company narrowed its previously stated earnings per share guidance range based on an uncertain volume outlook. The company now estimates adjusted earnings per share, excluding the impact of ASU 2016-09, in the range of $5.00–$6.20 compared with the prior guidance of $4.20–$6.20. However, the company stated that the actual results may deviate significantly from current projections. Moreover, the company affirmed that 2017 will include 52 weeks as against 53 weeks in 2016.

Other assumptions for earnings include depletions and shipments changes of -7% to +1%. The company anticipates revenues per barrel to increase 1–2%. Gross margin is anticipated to range from 51–52% due to increased cost savings. Investment in advertising, promotional and selling expenses are envisioned to increase in the range of $20–$30 million.

Effective tax rate for 2017 is anticipated to nearly 37%, excluding the impact of ASU 2016-09. However, the company revised capital expenditure guidance for the year to $35–$45 million, which will be directed toward investment in breweries. Earlier, the company had forecasted capital spending of $30–$50 million.

Zacks Rank

Boston Beer currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the same industry include Heineken NV (OTC:HEINY) , sporting a Zacks Rank #1 (Strong Buy) as well as Constellation Brands Inc. (NYSE:STZ) and Carlsberg (CO:CARLa) AS (OTC:CABGY) , both carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Heineken has surged about 16.1% in the last three months. It has a long-term EPS growth rate of 8.9%.

Constellation Brands, with a long-term EPS growth rate of 18.2%, has advanced 12.7% in the last three months.

Carlsberg has jumped nearly 10.1% in the last three months. Moreover, the company has a long term EPS growth rate of 8.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Carlsberg AS (CABGY): Free Stock Analysis Report

Heineken NV (HEINY): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Original post