Recently the Federal Reserve released their April 2014 Senior Loan Officer Opinion Survey showing banks generally eased their lending policies for commercial and industrial (C&I) and commercial real estate (CRE) loans - and experienced stronger demand for both types of loans over the past three months. Additionally, this week saw the release of growing consumer credit [our analysis here]. Is this economically good news or bad?

Follow up:

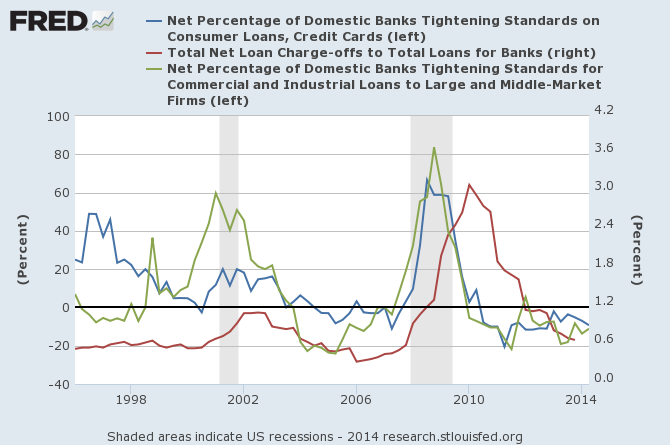

Do banks really understand when to tighten or loosen lending?

It seems the banking industry sees trouble coming and tightens - but it is already too late. There is a continuous boom-bust cycle. Banks loosen until they see an increase in loans being written off - red line on graph below - and then start tightening. There appears to be no scientific method of understanding the "correct" lending requirements except by crossing the line and then reacting.

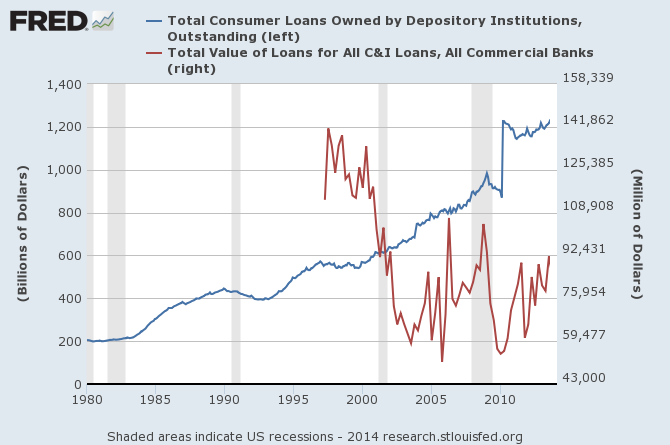

Do Banks Understand When to Keep Loans on their Books or Securitize Them?

The majority of bank loans are for consumers. It seems before 2000 banks understood consumer economic cycles, and dumped loans off of their books in advance of recessions. In the Great Recession, banks were caught with a high level of commercial and industrial loans.

Why are people or businesses borrowing?

I have the same issue with borrowing as I do with government deficit spending - it does not matter how much you borrow (or deficit spend) as long as the spending is biased towards future benefit. Buying ice cream provides no long term economic benefit. Economist and entrepreneur Warren Mosler opined:

Yes, lending has picked up some. Here's some longer term perspective and note how said lending is a seriously lagging indicator, which makes sense. We could be seeing borrowing to pay utility bills, fund unsold inventories, etc. etc. all of which is followed by less spending. or it could be proactive borrowing to spend due to 'feeling good about things' that leads to a 'virtuous' up cycle. Problem is, imho, the federal deficit is too small and the auto stabilizers too aggressive for the 'borrowing to spend' to get ahead of it, which is why I've been writing about the downside risk for the last few quarters, with that narrative still intact and, to me, supported by the data. (yes, others see it differently)

It does matter why one borrows if there is no future benefit for debt whilst the debt is being repaid. It simply puts the economy in a position of paying back tomorrow for things enjoyed today - which lowers the real future spendable funds.

Would It be Better to Save and Purchase or Buy on Credit?

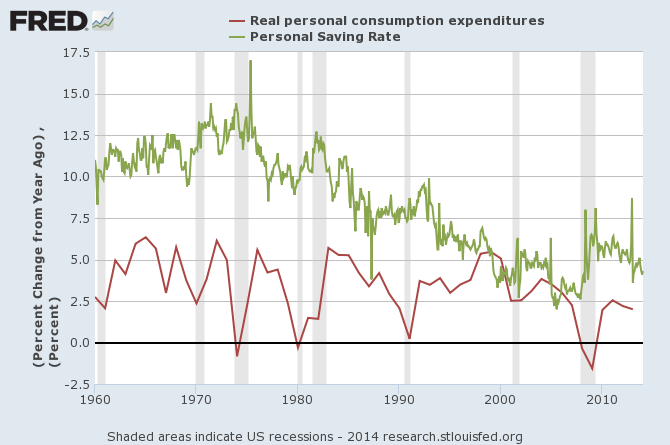

There is correlation between the declining savings levels of consumers (green line in graph below) and declining personal consumption (red line in graph below).

How much of consumer spending is frivolous, or simply does not make sense financially?

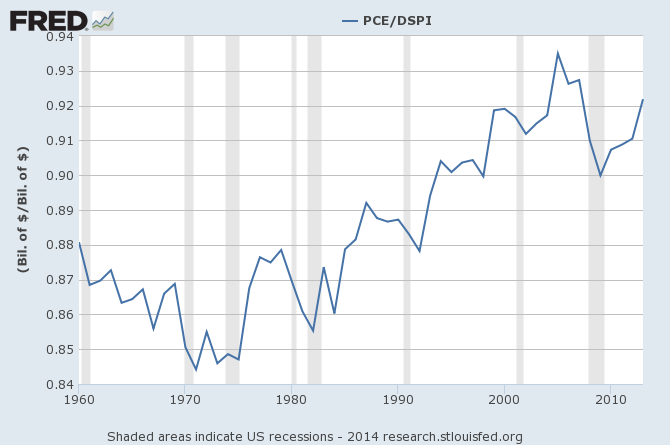

Here I have no answers or statistics. We know that credit is important - but so is savings. At this point the ratio between income and spending is approaching historical highs - which indicates a declining ability to spend more, unless use of credit (borrowing) increases further.

My Takeaway

My tea leaves are saying the median consumer is tapped out between spending the paycheck and credit limitations - although the business sector seems in relatively good shape. The primary way left to grow borrowing (for consumption) in 2014 is to loosen lending requirements. This sets up the next boom / bust cycle - and potentially our next Great Recession.

I am at a loss to explain why the bank lending requirements should be loosened.

Other Economic News this Week:

The Econintersect Economic Index for May 2014 is showing marginal growth acceleration - but the pattern over a half a year remains in a fairly tight range. The major soft data point remains personal income which is not part of our Economic Index. My position remains that the economy remains too strong to recess, and too weak to grow.

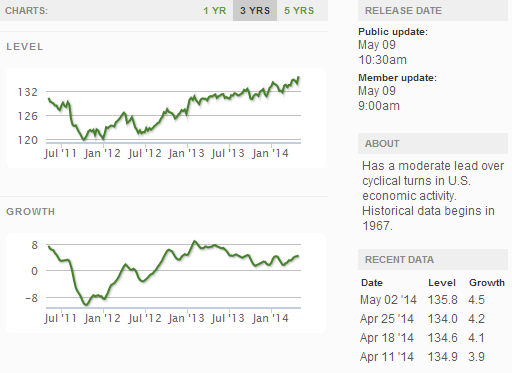

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

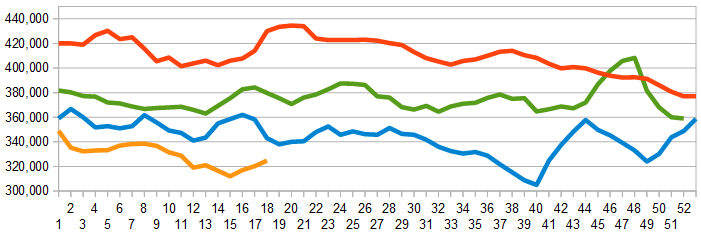

Initial unemployment claims went from 344,000 (reported last week) to 319,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – degraded from 320,250 (reported last week as 320,000) to 324,750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Oryon Technologies (ORYN)

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: