Investing.com’s stocks of the week

Yesterday the Dow Jones fell another 1000 points and this is turning out to be the worst stock "correction" in years.

Zero interest rate policies in place in the United States and other countries have effectively made money very cheap to borrow, especially for large corporations.

So, investors in Wall Street have been operating under the notion that if they can borrow money for 1% a year and get 10% back from the stock market, well, that's just good business.

Now that 10% return is in question, all those carry trades are coming right off the table in the biggest unwind of our time.

This is what happens when people focus so hard on short term gains that they can't see past their own noses.

Today's Highlights

Stocks Crashing

Watch the Deficit

Crypto Decoupling

Please note: All data, figures & graphs are valid as of February 9th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

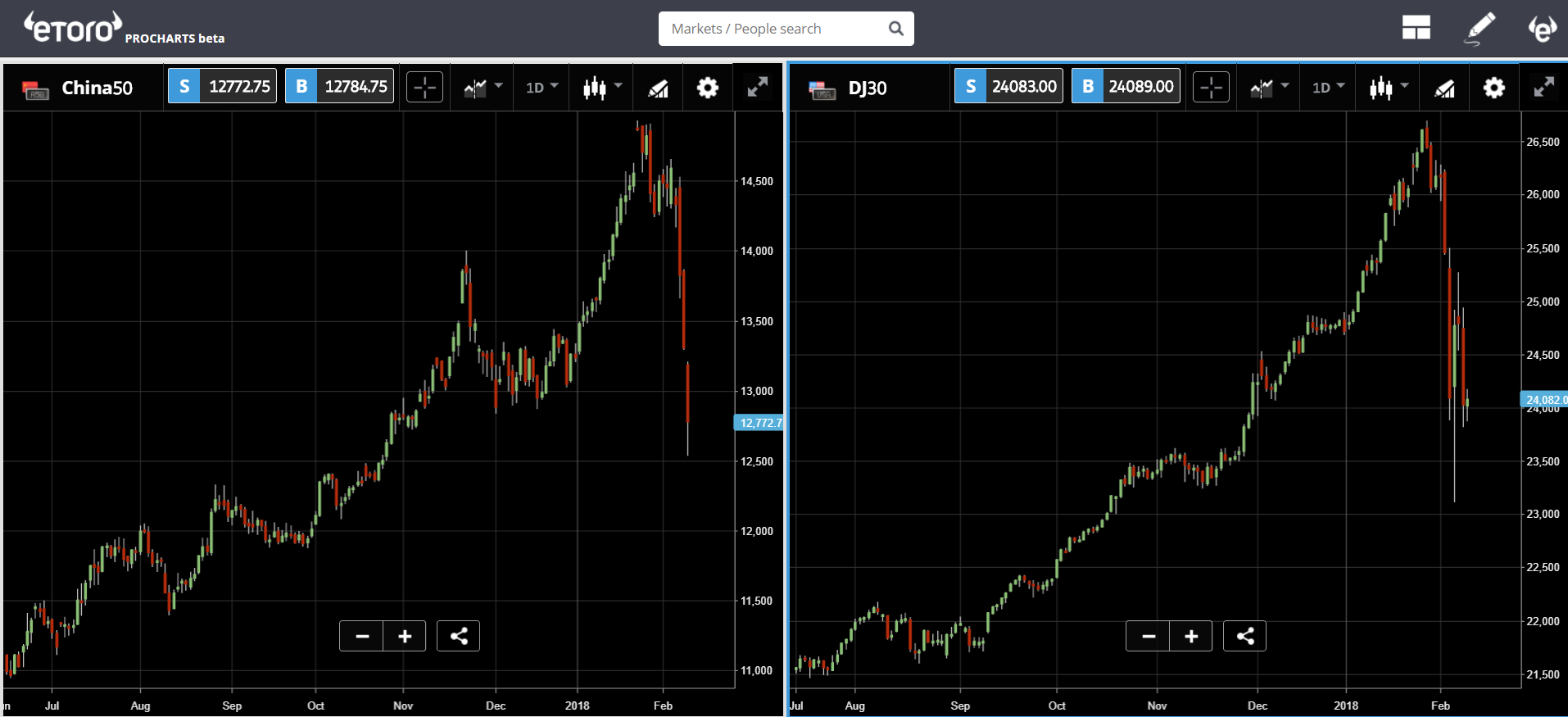

The crash continued in Asia this morning with China enduring the worst of it. The FTSE China 50 fell 5.68%. While that may be a tiny intraday move for a cryptocurrency, it's massive for a stock index. These things are literally designed not to fall.

Overall, the trend is still up and we are seeing some temporary support, so it wouldn't surprise me to see the cowboys on Wall Street trying to save things before the weekend and buy in on this dip. Be careful there pardner.

Politicians & Bankers

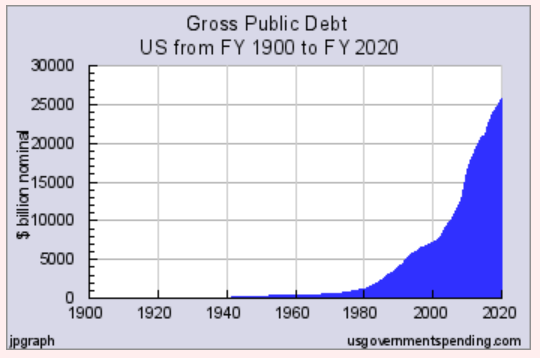

The US Government did in fact shut down last night when Libertarian-Republican Rand Paul refused to sign off on the current budget. Paul is upset that Republicans have been condemning Dems for raising the deficit for years only to do the same once in power.

No matter, the bill has now passed the Senate and should to the house for a vote in the next few hours. If passed, it should keep the government open for another two years, allowing them to continue borrowing massive amounts of money from future taxpayers.

Check out this rad Bitcoin chart!!... oh wait.

Yesterday, Bank of England's Governor Mark Carney did indeed make a rather unexpected shift in policy.

The UK's central bank is happy about the way the economy has been progressing but has grown very worried about extreme inflation.

They are now ready to step in and try to curb inflation by raising the interest rates.

The GBP/USD did react to this statement by rising sharply but the move faded and reversed rather quickly.

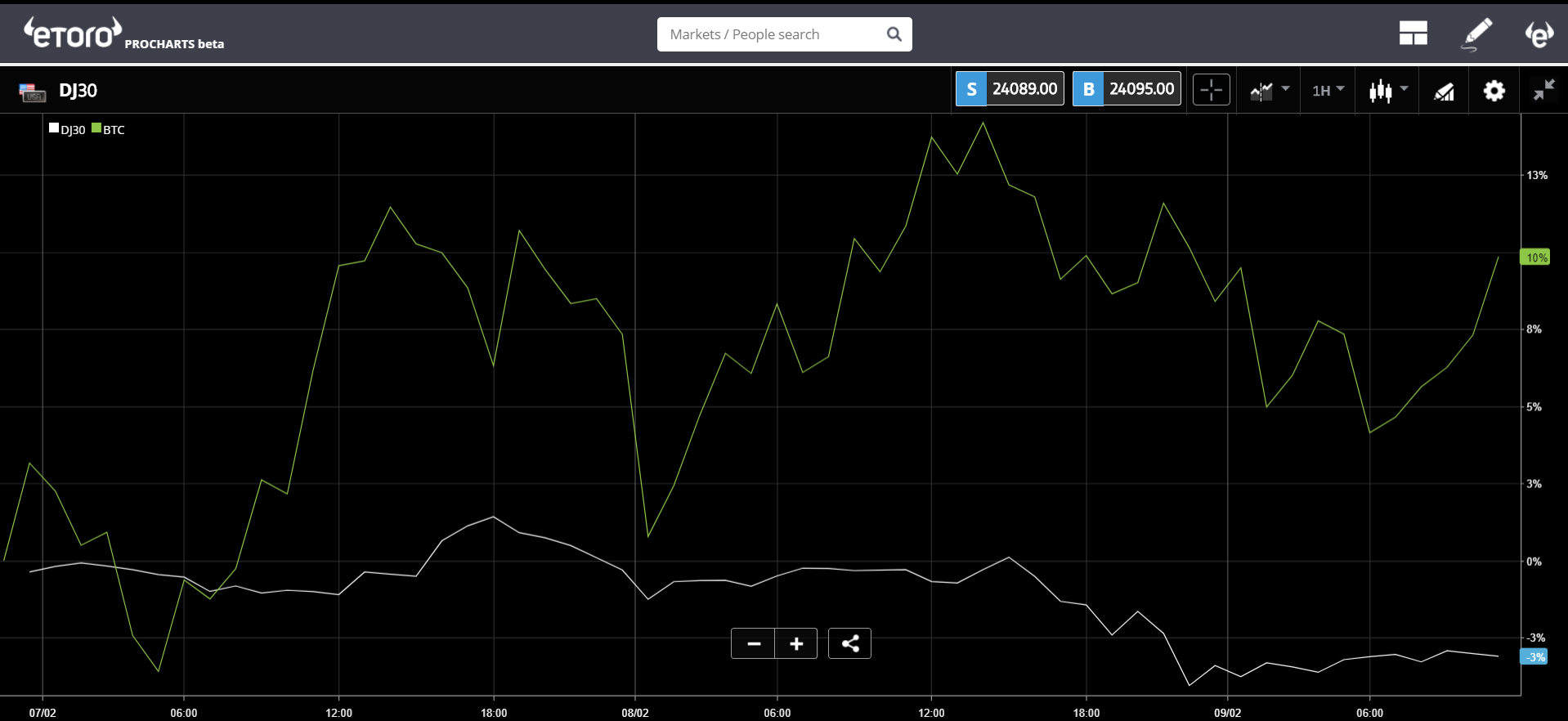

Crypto Decoupled

The crypto markets managed to break their correlation from the stock markets. As the Dow fell, Bitcoin began a mild recovery.

The cryptocurrencies are certainly not yet in the clear though. Here we can see that bitcoin still has a massive resistance to break before the downtrend can be considered over.

The cool thing is we're also seeing some divergence among the cryptos themselves.

Take a look at BCH breaking away from the pack around noon yesterday, and ETC surging all by itself in the last few hours.

This is an excellent sign that market participants are starting to analyze each coin for itself rather than lumping them all into the same idealistic basket.

The choice of BCH and ETC admittedly is a bit strange. Both are controversial forked coins, so it's interesting to see the market preferring them at present time. Still, it's good to see a bit of risk appetite returning to cryptos. Let's see how long it lasts.

Have a perfect day!

@MatiGreenspan

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.