BorgWarner Inc. (NYSE:BWA) reported adjusted earnings of 96 cents per share in the second quarter of 2017, beating the Zacks Consensus Estimate of 89 cents. Adjusted earnings also increased from 84 cents per share reported in the year-ago quarter.

Revenues increased 2.6% year over year to $2.39 million, beating the Zacks Consensus Estimate of $2.27 billion. Excluding the impact of foreign currencies and the Remy International acquisition, net revenues went up 7.8% year over year.

Operating income amounted to roughly $300 million, up from $269.4 million in the second quarter of 2016.

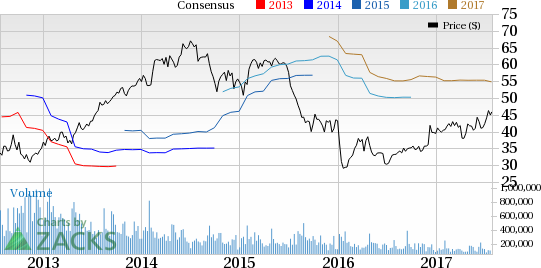

BorgWarner Inc. Price, Consensus and EPS Surprise

Segment Details

Revenues in the Engine segment rose to $1.5 billion, in comparison to $1.4 billion, recorded in the prior-year quarter. Excluding the impact of foreign currencies, net sales went up 4.5% in the segment.

Adjusted earnings before interest, income taxes and non-controlling interest (adjusted EBIT) improved to $244.3 million in the reported quarter from $238.1 million a year ago.

Revenues in the Drivetrain segment increased to $921 million in the second quarter, in comparison to $895 million recorded in the prior-year quarter. Excluding the impact of foreign currencies and the buyout of Remy International, net sales rallied 13.9% year over year. Adjusted EBIT improved to $110 million in the second quarter of 2017.

Financial Position

BorgWarner had $387.1 million in cash as of Jun 30, 2017 compared with $443.7 million as of Dec 31, 2016.

As of Jun 30, 2017, long-term debt shot up to $2.08 billion from $2.04 billion as of Dec 31, 2016.

In the second quarter, net cash from operating activities increased to $399.2 million from $362.2 million in the year-ago period.

Capital expenditures, including tooling outlays, rose to $254 million from $235 million in second-quarter 2016.

The company announced dividend of 14 cents per share. The dividend is payable on Sept 15, to shareholders on record as of Sept 1.

Outlook

For the third quarter, the company expects net earnings to be within the range of 84-87 cents per share. It also projects organic sales growth of 3-6% in comparison to the net sales of $2.1 billion, recorded in the year-ago quarter.

For 2017, the company estimates net sales of around $9.28-$9.38 billion compared with the previous expectation of $8.81–$9.04 billion, reflecting an organic growth rate of 6.5-7.5%.The company expects a negative impact of foreign currencies due to depreciation of the Euro, Yuan and Pound of $100 million.

Further, BorgWarner expects net earnings in the range of $3.65-$3.70 per share compared with the previous estimate of $3.50–$3.60 per share in 2017.

Price Performance

BorgWarner shares have rallied 11.4% in the last one month, substantially outperforming the 5.4% increase of the industry it belongs to.

Zacks Rank & Key Picks

BorgWarner currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the auto space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , all stocks sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has an expected long-term growth rate of 11%.

Volkswagen has an expected growth rate of around 17.3% over the long term.

Daimler has an expected long-term growth rate of 2.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research