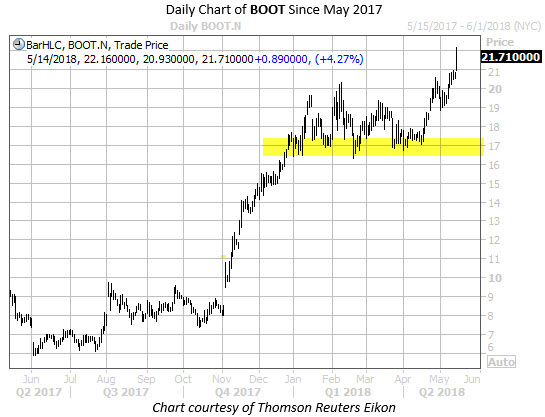

Western apparel retail chain (NYSE:BOOT) is slated to report its fiscal fourth-quarter results today after the market closes. On the charts, BOOT has had a strong run, gaining 150% over the past nine months, and yesterday reaching a more than two-year high of $22.17. The stock has also established a floor at the $17 level in recent months, which acted as support for BOOT when it first began trading back in late 2014.

Digging into earnings history, BOOT has posted a positive return the day after five of the company's last seven reports. In fact, last November, the retail stock posted an impressive 17.9% gain the day after earnings. Currently, the stock sports an average post-earnings swing of 6%, regardless of direction. This time around, the options market is pricing in a 19% next-day move, per data from Trade-Alert. From the equity's current price of $21.75, a move of this magnitude to the upside would put the shares north of $23 -- territory not seen since August 2015.

Boot Barn stock is heavily shorted, too. The 5.15 million shares sold short represent 26.3% of the equity's available float. At BOOT's average daily trading volume, it would take more than two weeks for the shorts to cover their bearish bets -- meaning there's ample fuel for a short squeeze, should the shares continue their run higher.

Analysts, meanwhile, are mostly upbeat toward Boot Barn ahead of earnings, with six of seven brokerages maintaining a "strong buy" rating. However, the stock's average 12-month price target comes in at $22.56 -- a slight premium to current levels. This leaves the door open for price-target hikes on strong earnings report.