**These are my thoughts on the SPDR S&P 500 (ARCA:SPY) ETF in my Daily Trade Ideas which includes many, many more charts and setups. Subscribe to my nightly Daily Trade Ideas on the right to see the rest of this letter.**

“My mission in life is not merely to survive, but to thrive; and to do so with some passion, some compassion, some humor, and some style.” Maya Angelou

A pretty quiet Friday all in all as we continue to consolidate recent gains.

Really great action for the most part that will lead us nicely to the upside again and by mid-week or so we should get some new buy levels appear.

We didn’t do much Friday but I did add to Clovis Oncology (NASDAQ:CLVS) and also tried a bounce trade in Priceline.com (NASDAQ:PCLN) that showed me a small loss so I was out.

Let’s move right to the charts.

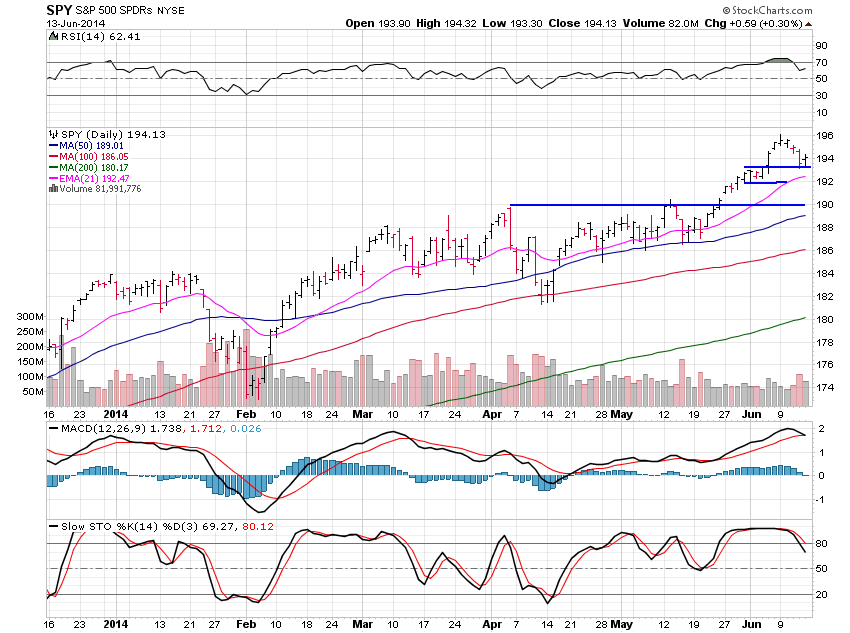

SPY is so far holding the 193 level I talked about but I think a little more downside looks to be in order.

192 would be a nice level to test but if that fails then we should probably move back to fill the gap near 190 and that would be fine as well.

This is a good example of what I mean when I talk about the great swing trading environment we are in at the moment.

We saw a nice breakout in SPY at 190, then 193 and then hit the 196 level I’ve talked about, before reversing.

Had you held you’d just be giving up recent gains so why not book gains once we reverse from a resistance level and then reload as we move off support.

I did not take this trade but we did the same thing in several leading stocks.