Earlier we talked about the short comings of funds and why investing in individual bonds makes better sense. A fund’s “one-size fits-all” approach can be convenient but may not be suitable for an individual who is looking for a tailored solution toward reaching their investment goals.

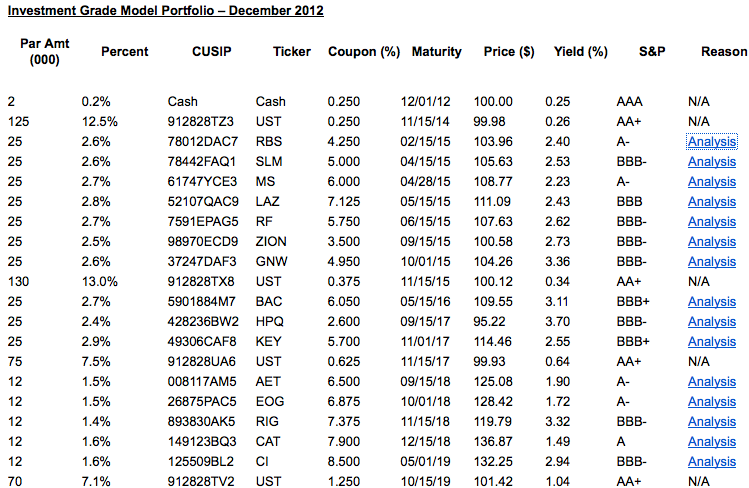

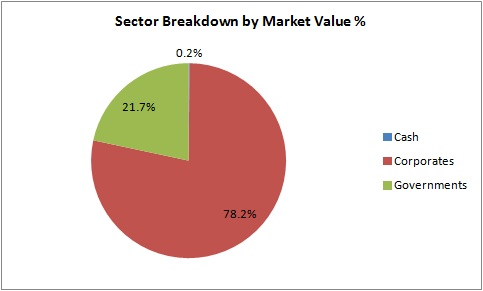

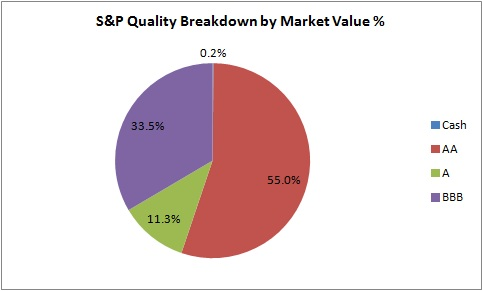

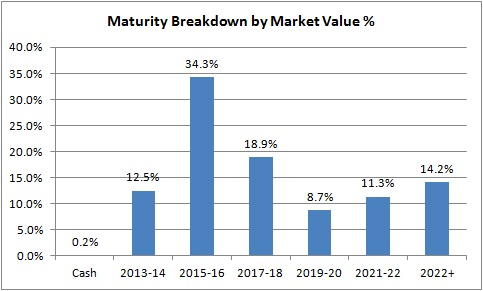

Below is Bondsquawk’s Investment Grade Model Portfolio, which consists of both corporate and government bonds. The portfolio is benchmarked against the Barclays U.S. Government/Corporate Index, which serves as a proxy of the Investment Grade universe. The model is used to illustrate an active bond portfolio and will generally maintain a similar interest rate and credit risk profile as the benchmark. The model may deviate from the index based on outlook and strategy. That said, the model has a total return focus where both income and price changes are considered in determining the allocation.

Guidelines

- $1000 (m) Market Value starting point

- Investment Grade Ratings (AAA through BBB- by Standard & Poor’s Ratings Services at time of inclusion)

- 1 to 30 Years Maturity

- Taxable Bonds

- Fixed Rate Coupon

- U.S. Dollar Denominated Only

- Maximum issuer exposure is 3% except for bonds issued by the U.S. Treasury

Disclaimer

The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.