On June 4th, Bill Gross -- aka the “Bond King” -- tweeted: “Global Bond Markets are turning Japanese, I think they’re turning Japanese, I really think so.” Mr. Gross was referring to the similarities between the Japanese bond market and other international bond markets that include high debt levels, extremely low and, at times, negative real interest rates and most importantly, government intervention in bond markets.

The latter will be the primary focus since there is a direct correlation between low interest rates and the amount of government intervention within a country’s bond market. This becomes apparent once you dig into the Japanese bond market and find out how they can finance a deficit that is twice that of any developed country with record-low interest rates.

Debt-To-GDP

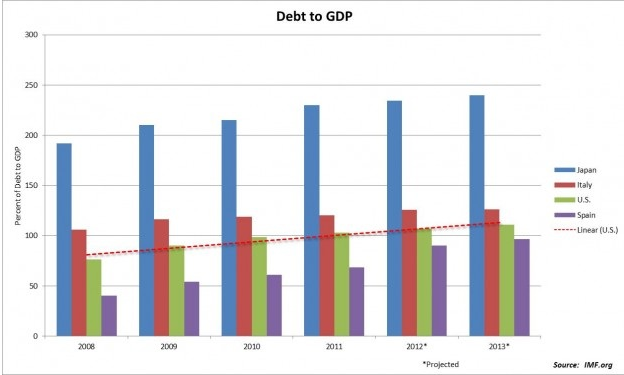

Investors, central banks and governments have all been concerned with debt levels within European countries and even the United States. The International Monetary Fund (IMF) is projecting a debt-to-Gross-Domestic-Product (GDP) ratio for the U.S. and the Euro area to reach 111% and 92%, respectively by 2013. This compares to a projection of 240% by 2013 for Japan (1). Knowing that debt to GDP is one of the main determinants of the ability for a country to repay their debt, one would suspect that Japan is the riskiest country followed by the U.S. However, this is not the case.

Foreign Held Spanish Debt

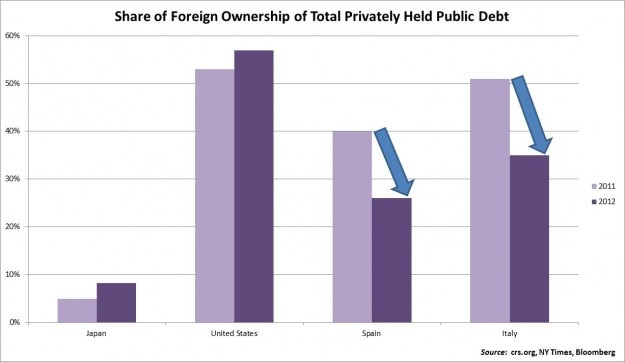

Interest rates are the primary indicator for the riskiness of a government’s debt and Spain is reaching levels that have forced countries such as Greece into crisis. From the beginning of 2011 through March 2012, foreign investors decreased their Spanish debt holdings from 40% to 26% (2). As a result, the yield on the Spanish 10-year note rose above 7%, a level that is considered unsustainable for Spain’s solvency (3). Just like an individual who has poor credit and sees his credit card interest rate jump from 12% to 25%, it will only be a matter of time until Spain cannot make the minimum payment. However, in Japan, the interest rate on the 10-year government bond has not gone above 1.1% for over a year, yet their debt-to-GDP ratio is twice that of Spain (3).

Buying JGBs

Over the past two decades, in Japan’s case, the Japanese Central bank has crowded out foreign investors through government intervention by purchasing Japanese Government Bonds (JGBs). By doing so, they are able to avoid the credit crunch caused by foreign investors dumping their bonds when the investor’s feel like the country’s debt level or political uncertainty has reached levels that are not in line with the rate of return. This scenario is outlined in the chart below.

A recent paper from the IMF outlined the following scenario in Spain: “If the outflow of foreign investors continues, like seen at the end of 2011, then you could see non-residential (aka foreign investors) investments drop to zero.” (4) Japan’s non-residential investments hover around 5% during stable market conditions.

ECB To The Rescue

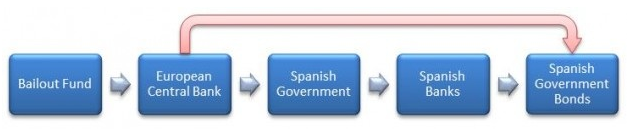

Who has been buying the Spanish bonds as foreign investors dump them? The European Central Bank (ECB) has been indirectly buying them. The ECB provided three-year loans to the Spanish government. First, the ECB lends money to the Spanish government, which then channels the funds to its banking sector, which in return is “encouraged” to purchase Spanish sovereign debt. In addition to the three-year term on the ECB’s loan to Spain, additional provisions prohibited the bailout fund from having the lasting dramatic effect that investors have been looking for.

Follow U.S., Japan's Lead

The multi-stage illustration above clearly shows that the European Union is still lacking the ability to access its debt markets through direct intervention. I believe a more effective strategy would be for the ECB to do outright purchases (red arrow in diagram) of Spanish government bonds directly with limited provisions with regard to the amount of purchases and holding period. The U.S. and Japan have proven that they can take the necessary steps to preserve calm within their bond markets. Even though our fiscal situation is facing a “cliff”, interest rates on U.S. treasury bonds continue to stay near record lows. You can see from the foreign ownership chart above that the U.S. has a large percentage of foreign investors. Foreign investors know that the U.S. stands ready to “do whatever it takes” and that we can actually do whatever it takes and it’s not just jawboning.

Japan's Riskt Strategy

Turning Japanese does not come without its risks. First, since nearly all of Japanese debt is owned domestically and is seeing a zero to negative real return, Japanese investors and savers are the losers. This is apparent in Japan’s GDP per capita which has been stagnant over the past 20 years. Secondly, the demographics will be a significant risk to Japan’s ability to hold down yields over time. In 1980, 23.5% of the Japanese population was between the ages of 0-14 and 9.1% of the population was 65 years old or more. In 2010, this data reversed course with 13.2% of the population between the ages of 0-14 and 23.1% of the population 65 years or older. This compares to a U.S. population with 12.8% over 65 years old (5). Projections by the Health and Welfare ministry are that 40% of Japan’s population will be 65 years old or greater by the year 2060 (6). That’s a lot of retired Japanese citizens looking to cash in their bonds so they can sip saké all day.

How “Japanese like” the U.S. and other developed nations become remains to be seen. The probability of a prolonged, low interest rate environment has increased over the past year. Such is the case in Japan where savers have been the losers during this low interest rate environment and will continue to be as long as rates remain at suppressed levels. Just as Japan led the way for governments to intervene in government bond markets, they will lead the way if and when the bond bubble bursts. As the demographics in Japan continue their shift toward an aging nation, the JGBs will see increased volatility. At some point, Japanese citizens will be ready to retire and will need to cash in their JGB’s. When that happens, the Japanese government will have to come up with the funds or you could see some very upset Japanese bond holders.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bonds: Turning Japanese

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.