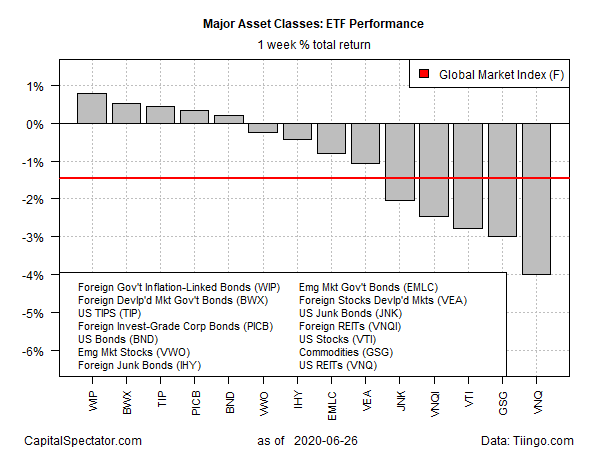

Amid news of rising coronavirus cases in the US and elsewhere last week, investors favored bonds at the expense of risk assets, based on a set of exchange-traded funds representing the major asset classes for the trading week through June 26.

Inflation-linked government bonds outside the US-led fixed-income rally last week. SPDR FTSE International Government Inflation-Protected Bond (NYSE:WIP) rose 0.8%. The advance marks the fund’s first weekly gain in three weeks.

US inflation-indexed Treasuries were last week’s third-best performer. The iShares TIPS Bond (NYSE:TIP) rose 0.4%, the ETF’s third straight weekly gain that boost TIP to a record close.

Driving demand for inflation-linked bonds: renewed worry that inflation may be a rising risk in the years ahead, thanks to a recent surge in fiscal and monetary stimulus in the US and around the world to combat the economic loss due to Covid-19. In the shorter term, however, disinflation/deflation may prevail if the aftershock of the coronavirus blowback lingers.

“We are going to be facing now a significant amount of supply shocks in the global economy,” predicts Nouriel Roubini, a professor of economics at New York University.

“Eventually the inflation genie is going to get out of the bottle.”

Last week’s biggest loser: US-listed real estate investment trusts (REITs). Vanguard Real Estate (NYSE:VNQ) lost 4.0% — the third weekly decline for the fund.

For the major asset classes generally, prices fell 1.5%, based on the Global Markets Index that uses exchange-traded funds (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, has lost ground in two of the past three weeks.

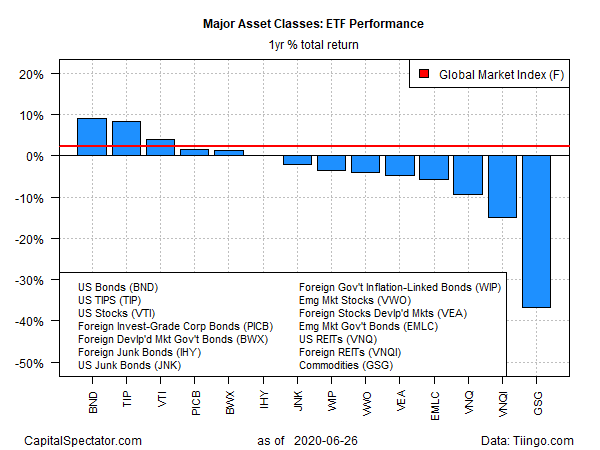

For the one-year trend, US investment-grade bonds are still the top-performer and continue to hold a small lead over the number-two one-year gain via inflation-linked Treasuries. Vanguard Total Bond Market (NASDAQ:BND) is ahead by a solid 9.4% over the trailing 12-month period, based on total return. The iShares TIPS Bond (TIP) is a close second with an 8.6% gain.

Broadly defined commodities continue to post the deepest one-year loss by far for the major asset classes. The iShares S&P GSCI Commodity-Indexed Trust (GSG) is off more than 38% at Friday’s close vs. the year-earlier price.

GMI.F’s one-year return is a modest 2.2% increase.

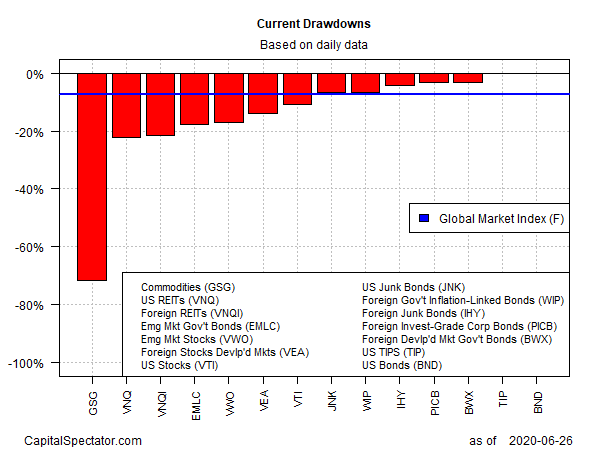

Ranking asset classes by current drawdown continues to show a wide range of results, ranging from a 70%-plus peak-to-trough decline for commodities (GSG) to the zero drawdowns for US investment-grade bonds (BND) and inflation-indexed Treasuries (TIPS).

GMI.F’s current drawdown: -7.3%.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.