I've been paying close attention to bonds as the global markets react to rising inflation and global central bank moves recently. The Federal Reserve has yet to take any actions to raise rates, but we all know it will come at some point. Longer-term bonds are acting as if these risks are much more subdued than many traders/investors believe. This has me questioning if global central banks have overplayed the stimulus game?

Why would traditional safe-haven assets fail to act in a manner that reflects current market risks like they would typically do? Why have precious metals failed to reflect these risks also properly? Is there something brewing in traders' minds that are muting or mitigating these traditional safe-haven assets?

Bonds Continue To Slide After COVID Rally

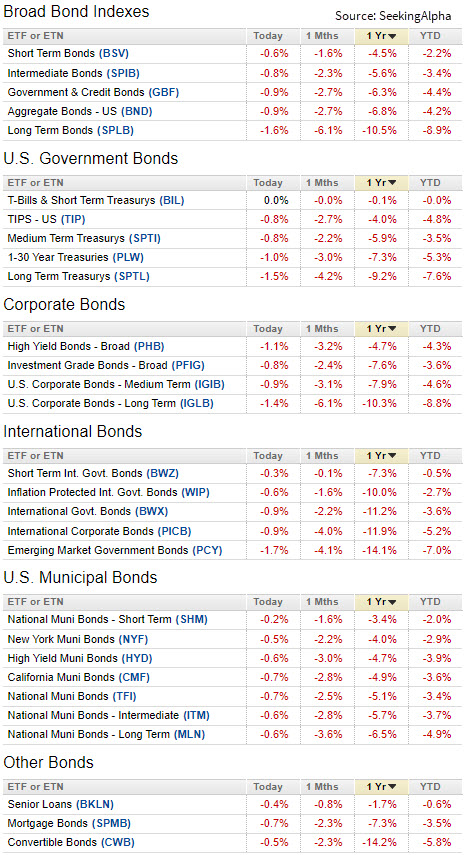

This table, reflecting the recent downward trend in bonds, highlights the weakened safe-haven tendencies. These assets would generally present with rampant inflation and the possibility of multiple Fed rate increases.

(Source: SeekingAlpha.com)

This iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) weekly chart shows how risks climbed when COVID hit in February 2020. Yet, take a look at how price has consolidated below $156 and has continued to trend lower over the past six months.

After a brief move higher, to levels near the $147 to $155 level, TLT has moved decidedly lower over the past 6+ months. This downward price trend illustrates the diminishing fear levels as traders piled into the post-COVID rally phase. This move suggests traders believe inflation may be temporary or that the Federal Reserve has room to raise rates without disrupting the global economy. I think the current premise and price trend in TLT vastly underestimates the amount of disruption a series of Fed rate hikes would cause the international markets.

The Federal Reserve will likely consider all options before taking an aggressive move to raise rates. Additionally, the Fed may decide to allow foreign central banks to move more aggressively to raise rates while it decides to take a more measured approach to inflation.

The key to future rate increases is how supply chains open up and how consumers continue to engage in economic activities. Any sudden shift by consumers, or further disruptions in supply for manufacturing and consumer staples/discretionary items, could prompt the Fed into taking aggressive actions.

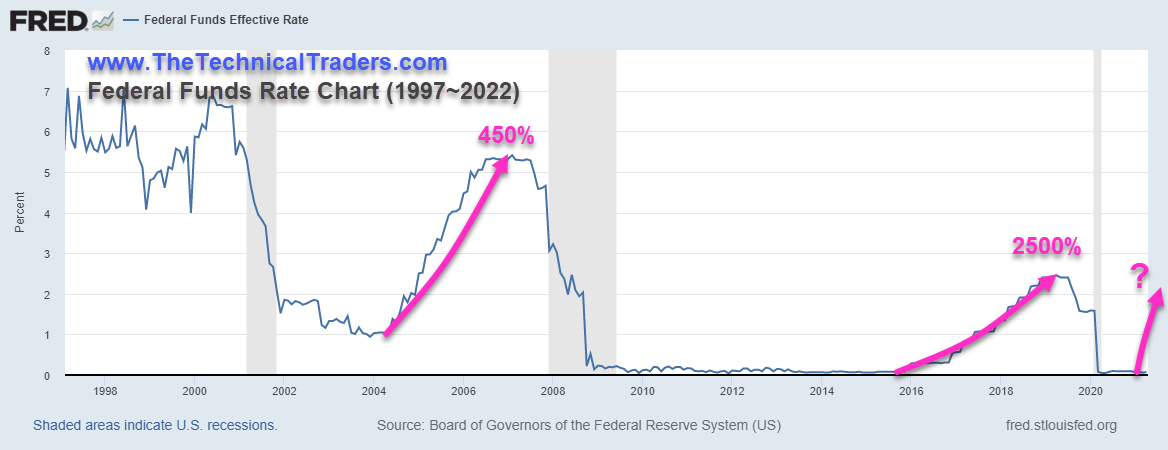

From where the Fed Funds Rates currently are, a move above 0.50% would reflect a +500% rate increase. This may prompt some type of “pop” in certain asset bubbles.

(Source: St. Louis Fed)

Traders should stay keenly focused on market risks and bond levels throughout 2022 into 2023 as any sudden shift away from current trends could spell trouble. Right now, bonds are pricing in minimal risks – which may be a mistake.

The market dynamics and trends are changing from what we have experienced over the past 40 years for stocks and bonds. The 60/40 portfolio is costing you money now, and bonds can’t keep up with inflation and are more or less yield-less.