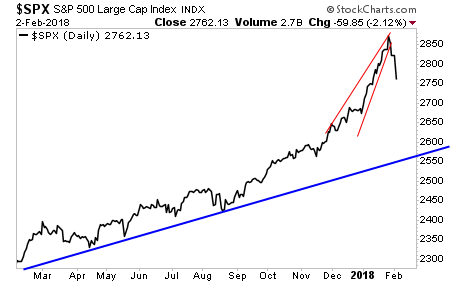

On Friday, the market finally woke up to the reality of rising rates.

The truth is that Central Banks have been printing money for too long, maintaining “emergency” levels of QE despite the fact the global economy is growing.

This has unleashed inflation, which is forcing the bond market to drop. On Friday, stocks finally “got the memo” that conditions are too loose and the US Dollar is falling too fast.

The technical damage was severe and it’s only going to get worse from here.

The truth is that the Fed is WAY behind the curve on inflation. And unless the Fed starts tightening aggressively to support the bond markets, the stock markets could very well crash.

At the end of the day, the entire move in stocks since the Great Financial Crisis was based on the Fed creating a bubble in sovereign bonds.

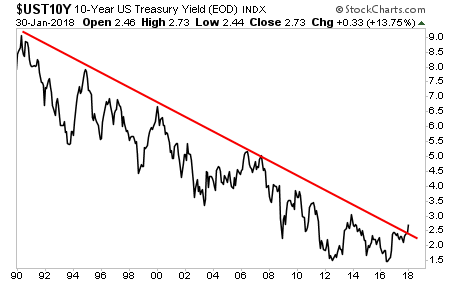

Bonds trade based on inflation.

If inflation rises, so do bond yields.

When bond yields RISE as they are right now, bond prices FALL.

And when bond prices FALL, the massive debt bubble, the bubble that fueled the move in stocks prices, begins to burst.

With that in mind, the yield on the 10-Year US Treasury has just taken out a 25 year trendline. This is the most important bond in the world, and it’s warning us that the debt markets are in serious trouble if the Fed doesn’t act soon.

Globally the world has added over $60 trillion in debt since 2009… and all of this was based on the assumption that bond yields were going LOWER not HIGHER