In a zero-interest-rate world, high-yield bonds are one of the last places of refuge for investors looking to earn a decent return on their capital. Today, the average yield on the Barclays High Yield Bond Index is about 7.3%, or nearly 6.3% (630 basis points) higher than 5-year Treasuries.

Bond Classes

Within the high-yield universe there are several different ratings classes: BB, B and CCC. For the most part, BB-rated bonds yield about 5.5% today (457 basis points over 5-year Treasuries), B-rated bonds yield 6-7% (613 basis points over 5-year Treasuries), while CCC+ rated bonds yield significantly higher, depending on the issuer (1100 basis points over 5-year Treasuries) or about 12%. While this is a helpful guide, it must be remembered that each bond must be analyzed individually from a credit perspective.

Current yields and spreads are discounting a 5% default rate, but the actual rate of default in 2012 is unlikely to be that high. Most likely, no more than 3.5% of high-yield issuers will default. Therefore, investors are being overcompensated for the risks they are taking by investing in this asset class.

Recent Activity

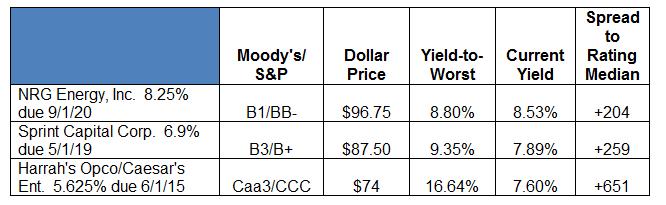

The most attractive opportunities are bonds that are trading at wider spreads as compared to the average for their ratings category. Here are some examples of bonds purchased in the last month:

Gaming Bonds

A quick word about the Harrah’s/Caesar’s Entertainment bonds. While they obviously have a very low rating, it should be noted that the company has repurchased $650 million of this $1 billion bond issue, financed by two private equity firms that own the company. Further, this is a short-maturity bond (3 years) and most of the company’s debt matures after they do. The combination of the private equity firms’ multibillion-dollar investment with the short maturity of these bonds -- coupled with an improving gaming market -- strongly suggests that these bonds will be paid off at maturity, providing a 16.64% total return. This bond is illustrative of those that were issued by large LBOs with low ratings, high yields and a low likelihood of default.

The U.S. economy remains sluggish and is likely to struggle in the months and years ahead. That's at least the case until wiser heads prevail in Washington, where real discipline must be restored to the federal budget. Such an environment will make credit analysis particularly important in the high-yield sector. But a combination of wide spreads, low defaults and a significant number of bonds trading at wider spreads than their ratings category offer investors the opportunity to earn attractive, risk-adjusted yields on their money in a zero-interest-rate world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bonds In A Zero-Percent World

Published 05/03/2012, 10:23 AM

Updated 05/14/2017, 06:45 AM

Bonds In A Zero-Percent World

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.