Stocks rallied Monday after a big sell off Friday. The drops from Friday were not entirely erased but wow what a come back. Traders and investors were set up for a bad Monday. Almost every stock chart I looked at this weekend was a great set up to the downside. The only bit of caution was that many were oversold and might bounce.

And that is exactly what happened. All 10 picks to the downside now look pretty good for a move higher should they continue. But the party did not get everyone involved. While the major indexes were up almost 1.5% Monday, Treasury Bonds barely moved. The US Treasury Bond ETF (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) ended up 0.05% on the day. This after dropping over 1.5% Friday. Bonds were having no fun at this party.

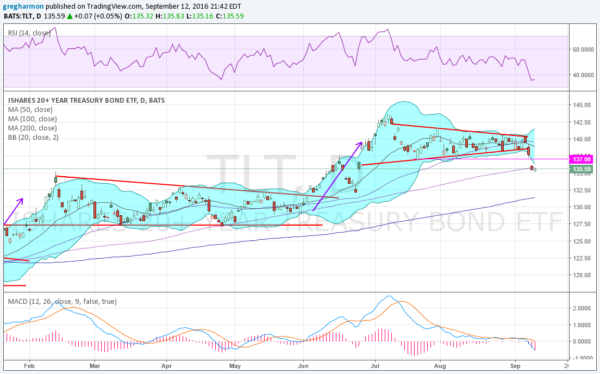

The chart above shows the price action in Treasuries this year. They moved higher out of a descending triangle in June and then consolidated again. The consolidation in a symmetrical triangle broke to the downside Thursday last week.

Friday gapped lower to the 100 day SMA and Monday held under that 100 day SMA. The target on the break to the downside is a move to 133.50. The RSI continues in the bearish zone and the MACD is falling and negative. Despite the rebound rally in stocks, bonds look like they could continue to cry in the corner at the party.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.