I mentioned a possible new bond paradigm and yesterday’s action helps build my case. TLT hit 130.61 early yesterday, outpacing the previous June 1 high of 130.38. And, as suspected TBT has fallen off its previous support ledge to a new all time low of 14.46.

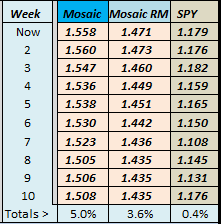

What’s important here (I think) is the position of the VIX relative to bonds (shown above on daily bars). In previous TLT surges the VIX has been pretty much in sync but since mid-June the two have diverged. Clearly there’s a developing change in the relationship between bonds and volatility that bears closer attention (and explanation). Where’s Bill Luby when we need him? In the meantime, bonds are the place to be and our bond-centric Mosaic model continues to outperform SPY.

Consolidation

It was a back and fill day as we wait for Ben Bernanke and earnings reports from Goldman Sachs (GS) in the morning and Intel (INTC) after hours. TLT continued to push higher but reversed to close well off the intraday high while oil continued to recover. It will be an interesting day as many are expecting a negative outcome if Ben doesn’t come through with any QE hints. Meanwhile we have to continue to respect the uptrend.