Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The Federal Reserve meets during the first week of November to decide whether or not to increase interest rates. The probability of a rate hike in November stands at only 8.8% while increasing to 63.3% at the December meeting. With the elevated likelihood of an interest rate hike before year end, income focused investments, both fixed income and bond-like equities, are adjusting to this potential outcome.

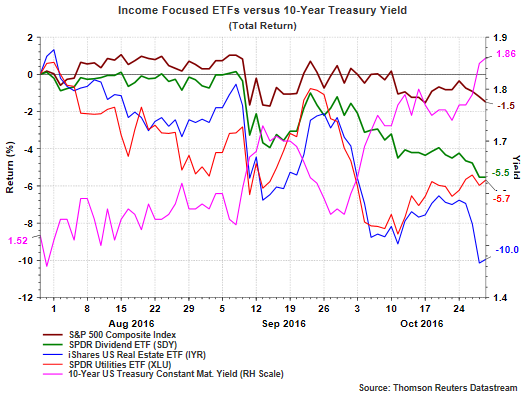

As can be seen in the above chart, over the last three months, the yield on the 10-Year Treasury has increased over 30 basis points while a few selected income focused ETFs are down five percent or more, with REITs (iShares US Real Estate (NYSE:IYR)) down 10%.

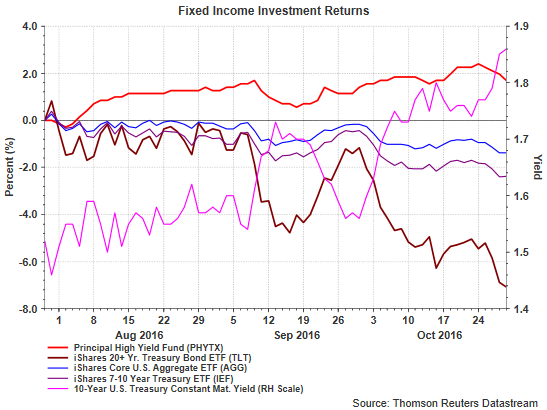

The same return outcome is occurring with some fixed income investments. As the below chart also shows, bond investments are adjusting to a potentially higher interest rate environment as well. Longer term bonds, as represented by the iShares 20+ Year Treasury ETF (iShares 20+ Year Treasury Bond (NASDAQ:TLT)), have fared worse than bonds of a shorter maturity and is down over 7%.

A Fed rate increase before year end is not a certainty; however, with market rates adjusting to a higher level, bond like equities and longer term bonds remain under pressure.