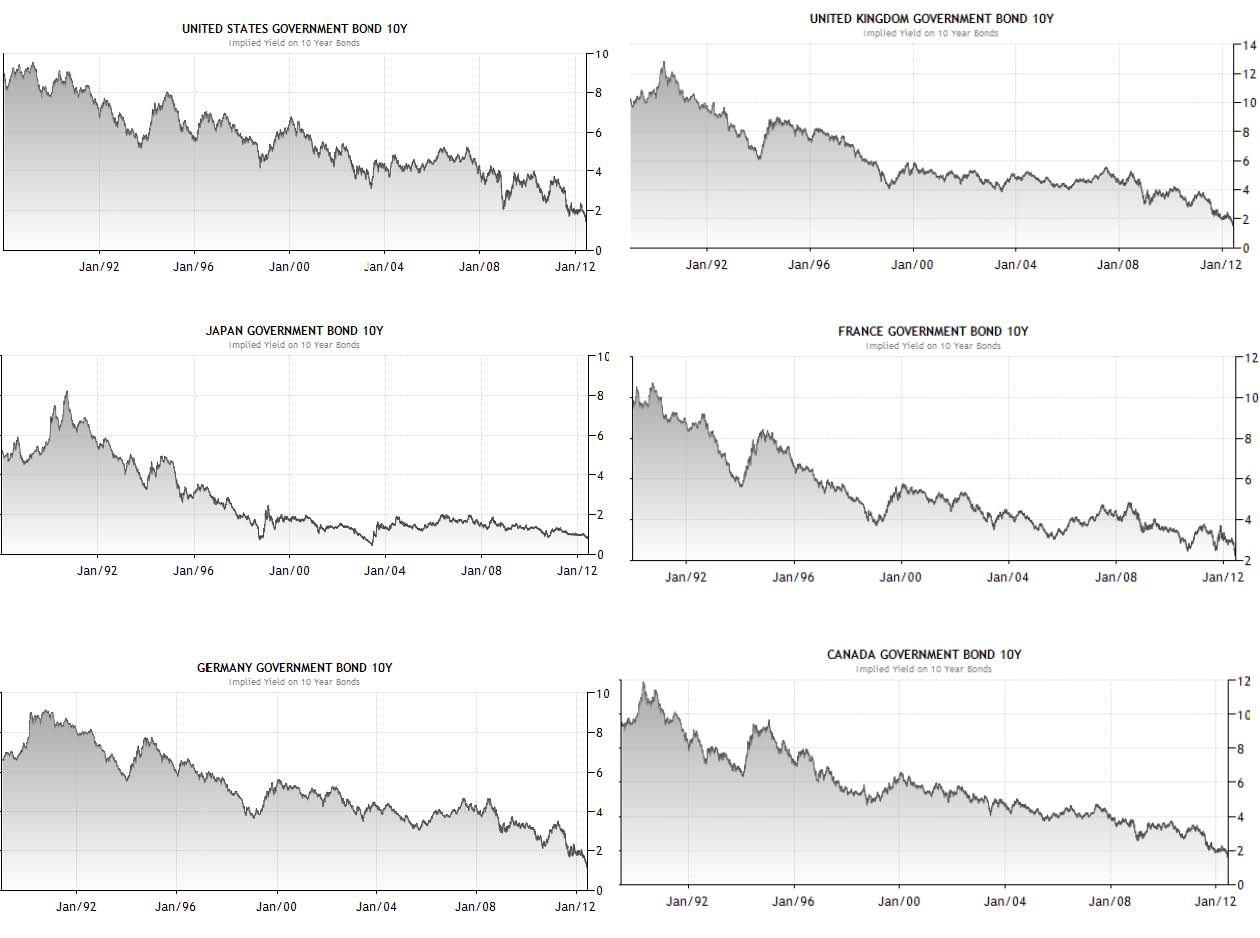

The globe is awash in debt, deficits are exploding and the Euro is about to collapse…right? Well then why in the heck are six countries out of the G-7 seeing their 10-year sovereign debt trade at 2.5% or lower on a consistent downward long-term trajectory? What’s more, three of the six countries witnessing their rates plummet are from Europe, despite pundits continually calling for the demise of the euro zone.

Here is a snapshot of 10-year sovereign debt yields for the majority of the G-7 countries over the last few decades:

Source: TradingEconomics.com

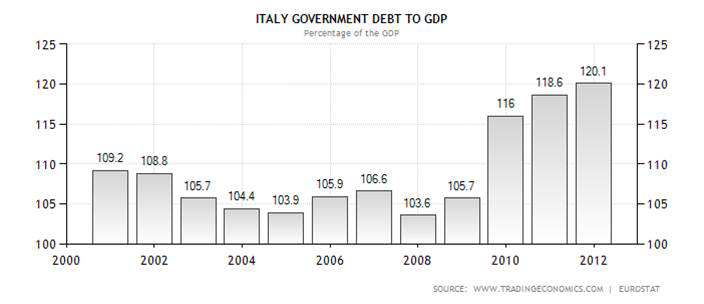

The sole G-7 member missing from the bond yield charts above? Italy. Although Italy’s deficits are not massive (Italy actually has a smaller deficit than U.S. as a percentage of GDP -- 3.9% in 2011), its Debt/GDP ratio has been large and rising (see chart below).

Source: TradingEconomics.com

As the globe plodded through the financial crisis of 2008-2009, investors flocked to the perceived stability of these larger developed countries’ bonds, even if they are merely better homes in a bad neighborhood right now. PIMCO likes to call these popular sovereign bonds, “cleaner, dirty shirts.” Buying sovereign debt from these less dirty-shirt countries, without sensitivity to price or yield, has been a lucrative trade that has worked consistently for quite some time. Now, however, with sovereign bond yields rapidly approaching 0%, it becomes mathematically impossible to fall lower than the bottom-rate floor that developed countries are standing on.

Bond bears have been wrong about the timing of the inevitable bond-price reversal, myself included, but the bulls are skating on thinner-and-thinner ice as rates continue moving lower. The bears may prolong their bragging rights if interest rates continue downward, or persist at these lower levels for extended periods of time. Eventually the “buy-the-dips” mentality dies, as we so poignantly experienced in 2000 when the technology dips turned into outright collapse.

The Flie's In The Bond-Binging Ointment

As long as equities remain in a trading range, the “risk-off” bond binging arguments will continue holding water. If corporate earnings remain elevated and stock buybacks carry on, the pain of deflating real returns will eventually become too unbearable for investors. As the insidious rising prices of energy, healthcare, food, leisure and general costs keep eating away everyone’s purchasing power, even the skeptics will become more impatient with the paltry returns they are earning. Earning negative real returns in Treasuries, CDs, money market accounts and other conservative investments is not going to help millions of Americans meet their future financial goals. Due to the laundry list of global economic concerns, large swaths of investors are still running and hiding, but this is not a sustainable strategy long term. The danger from these so-called “safe,” low-yielding asset classes is actually riskier than the perceived risk, in my view.

More Older Buyers

That said, I’ve consistently held there is a subset of investors, including a significant number of my Sidoxia Capital Management clients, that is in the later stage of retirement and have a rational need for capital preservation and income-generating assets (albeit low yielding). For this investor segment, portfolio construction is not executed due to an opportunistic urge of chasing potential outsized rates of return, but more-so out of necessity. Shorter time horizons eliminate the prudence of additional equity exposure because of the extra associated volatility. Unfortunately, many of the 76 million Baby Boomers will statistically live another 20 – 30 years based on actuarial life expectations, so the risks of being too conservative can dramatically outweigh the risks of increasing equity exposure. This is all stated in the context of stocks paying a higher yield than long-term Treasuries – the first time in a generation.

Short-term risks and uncertainties remain high, with Greek election outcomes unknown; a U.S. Presidential election in flux and an impending domestic fiscal cliff that needs to be addressed. But with interest rates accelerating toward 0% and investors’ fright-filled buying of pricey, low-yielding asset classes, many of these risks are already factored into current valuations. As it turns out, the pain of panic can be more detrimental than being stuck in over-priced assets, driven by rates dancing near an absolute floor.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bond Yields: Where's The Floor?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.