Forex News And Events

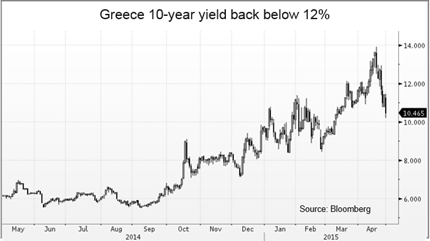

The dollar is under a lot of pressure since mid-March as traders started to price in a delayed first rate hike by the Fed from June to September 2015. In addition, the faltering US economy is raising concerns about its ability to generate sustainable growth in a strong dollar environment. The disappointing GDP figures triggered US government bonds sell-off. The U.S. 5-year yields are up 20bps to 1.45% since its low from March 17 while the 10-year yields rose 21bps to 2.05%. However, we think that a big part of the recent US bond market development can be attributed to the recent correction of German yields. Since March 17, the German 10-year yields are up 37bps from 0.049% to 0.37% while the 5-year yields are up more than 18bps to 0.012%, back into positive territory. The pressure eases in Europe as hopes rise for a Greek deal, pulling yields to their levels from late January.

In Greece, the government has difficulties to complete pension payments as certain state social security fund are waiting on subsides from the government. In the meantime in Brussels, negotiations continue after Yanis Varoufakis, Greece’s finance minister, was sidelined from the ongoing negotiations by its own government. Markets welcomed the news and relived the pressure on Greek debt. The 10-year yields peaked at 13.93% on April 21 while 5-year yields reached 20.33%. Greek yields are now back to 10.46% and 16.02%.

BoT Cut Rates (by Peter Rosenstreich)

This week, the Bank of Thailand unexpectedly cut its policy rate a further 25bp, bringing interest rates to 1.50%. Interestingly, despite clear fundamental reasons for Thai baht weakness, the currency has remained ominously resilient. In fact, the THB has been one of the only currencies to appreciate verse the USD, allowing it to remain one of the strongest regional currencies. Yet after a long wait, change in Bank of Thailand’s bias suggests that further THB weakness should be expected. The government, has struggled to create political legitimacy, support economic growth and to lift domestic confidence since taking power. Yet the THB continued to appreciate. A primary rationale for the strong THB has been the improvement to the current account, driven by lower imports. A sizable fall in imports can be attributed to lower oil prices and the slowing economic growth has limited the demands for automotive and capital goods. In addition, yield starved foreign investors have reinvested capital into Thai assets this year to take advantage of higher government debt. The central bank’s decision to cut interest rates was directly geared toward offsetting the negative impact of the THB. This cut had more support, with a vote of 5-2, with two dissenters preferring to hold rates. The accompanying statement was noticeably more dovish, with a heavy emphasis on the effect of a strong THB. It was clear that the BoT was now knowingly worried that exports and inflation would be effected by ‘pressure from recent Thai baht appreciation’. Given the explicit mention of the THB strength, our suspicions that the risk of interest rate cuts will put rates below the all-time low (1.25%) has increased significantly. Our expectations that the THB will outperform regional peers unless the BoT acts, domestic demand and inflation data to remain weak further accommodation should be expected. With further easing and potentially new rules to accommodate outflows, the central bank is committed to weakening THB.

The Risk Today

Peter Rosenstreich

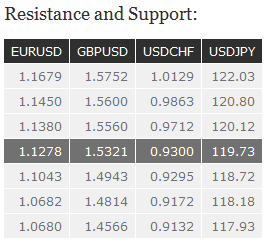

EUR/USD rise is overextended but is showing no signs of weakness yet. The break of channel resistance at 1.1043 indicates an improving short-term technical configuration. A key resistance stands at 1.1245 (27/02/2015). Hourly supports can be found at 1.114 (05/03/2015) and 1.1043 (18/03/2015). In the longer term, the symmetrical triangle from 2010-2014 favours further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. A strong resistance stands at 1.1114 (05/03/2015 low). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD has broken the key resistance at 1.5552 (25/02/2015 recovery high) but has failed to hold above it. Yesterday's sharp bearish intraday reversal favors a short-term phase of weakness above the support at 1.5304. Other supports can be found at 1.5166 (18/03/2015) and 1.5028 (24/04/2015 low). Resistance stands at 1.5498 (29/04/2015) then 1.6287. In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). A decisive break of the key resistance at 1.5166 (18/03/2015 high) is needed to invalidate this scenario. Another key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY continues to consolidate above its key support at 118.18. A break of the resistance at 120.12 (14/04/2015 high, see also the declining trendline) is needed to suggest exhaustion in the selling pressures. An hourly support stands at 118.53. Another resistance can be found at 120.84 (13/04/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF has breached the support at 0.9491 and 0.9450 (26/02/2015 low, see also the 200-day moving average) confirms persistent short-term selling pressures. An initial key support lies at 0.9241 (50% fibo level). Hourly resistances can be found at 0.9413 (30/04/2015 high) and 0.9493 (27/04/2015 low). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a countertrend move. Key support can be found 0.9170 (30/01/2015 low).