The US bond market is going the wrong way…

As I outlined in my bestselling book The Everything Bubble: The Endgame For Central Bank Policy, when the US completely severed the US dollar from the Gold Standard in 1971, US sovereign bonds, also called Treasuries, became the bedrock of the financial system.

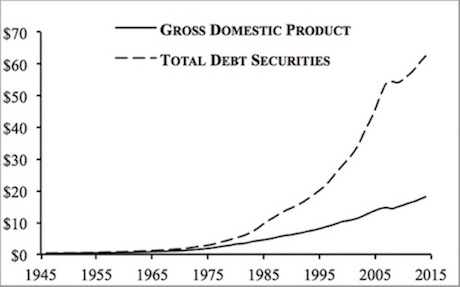

From this point onward, these bonds represented the “risk-free” rate of return, the baseline against which ALL risk assets (including stocks) were valued. What followed was exponential debt growth as the US took advantage of this fact to go on a massive debt binge.

Debt vs. GDP in Trillions USD.

ALL of this debt requires US bond yields to continue to fall. Put another way, in order for this massive debt bubble to be maintained the bond markets must make it continuously cheaper/easier for the US to pay/service its debts.

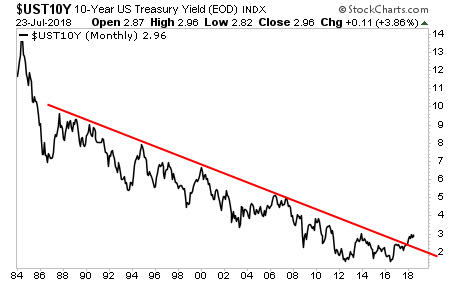

Which is why the recent breakout of bond yields is a MAJOR concern.

As you can see, the yield on the 10-Year US Treasury has broken above its long-term trend line… in the WRONG direction. This chart is telling us that it has become more expensive for the US to issue/service its debts.

Granted, this is not a systemic issue yet, but unless yields reverse soon, the Everything Bubble will begin to burst.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.