- Euro rescue fund selling new 16-year bond

- Some analysts say yield rise more alarming

- Today’s Fed meeting keeps markets wary

A bond sale from the euro zone rescue fund pushed German yields to five-week highs on yesterday, as worries grew that a recent rise in borrowing costs resembled the prologue to the brutal sell-off in 2015.

The European Stability Mechanism priced a new three billion euro, 16-year bond, completing its funding targets for the second quarter.

The announcement of the deal late Monday coincided with a rise in benchmark Bund yields and appeared to catch investors off guard, coming on top of 10 billion euros of sovereign bonds due to be sold this week.

Ten-year German yields were up a further 4 basis points at 0.3 percent on Tuesday, levels not seen since mid-March and off a 2016 low of 0.075 percent hit two weeks ago.

With investors also anticipating hawkish signals from the U.S. Federal Reserve at its policy meeting on Wednesday, some analysts wondered whether the recent rise in yields was the start of a more sustained move.

Around this time last year, Bund yields sprang from a record low of 0.05 percent to over 1 percent in a matter of weeks, inflicting double-digit losses on many investors.

“There isn’t much appetite for core paper at the moment with some concern in mind that what happened last year could happen again,” said Patrick Jacq, European rate strategist at BNP Paribas.

Most euro zone bond yields were higher, with 10-year French yields up 3 bps at 0.63 percent.

The rising yields were particularly worrisome with long-term inflation expectations still near record lows, said Peter Schaffrik, RBC’s chief European macro strategist.

The five-year, five-year forward rate – which is often cited by the ECB and measures what 2026 inflation expectations will be in 2021 – is near 1.40 percent, well below the ECB’s target rate of near 2 percent.

Other strategists, like Mizuho’s Peter Chatwell, said the ESM sale caused the rise in yields.

Yields tend to rise before debt sales as investors make room in their portfolios for the new supply. The deal comes on top of scheduled German and Italian bond sales this week.

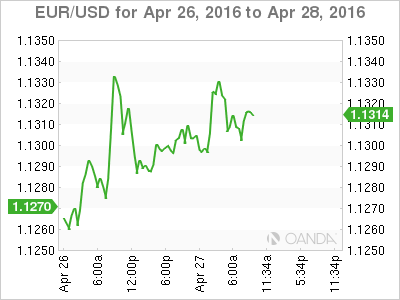

In addition, Wednesday’s Fed meeting could deliver hints of another increase in U.S. interest rates. Rates are expected to remain unchanged on Wednesday, but officials have repeatedly said an increase is possible in June. Markets now price in about one chance in five of a move at the June 14-15 meeting.

“Depending on whether it is an aggressive, neutral or cautious signal that the Fed intends to send out with respect to the June interest-rate meeting, the FOMC get-together might well point the markets in a new direction,” DZ Bank analyst Birgit Figge said.