Investing.com’s stocks of the week

Throughout your schooling, whether in the trading room or the classroom you were taught that Bonds reflected, among other things, inflation expectations. If that is true then the question arises as to how far into the future are those expectations? Is the timing constant or changing?

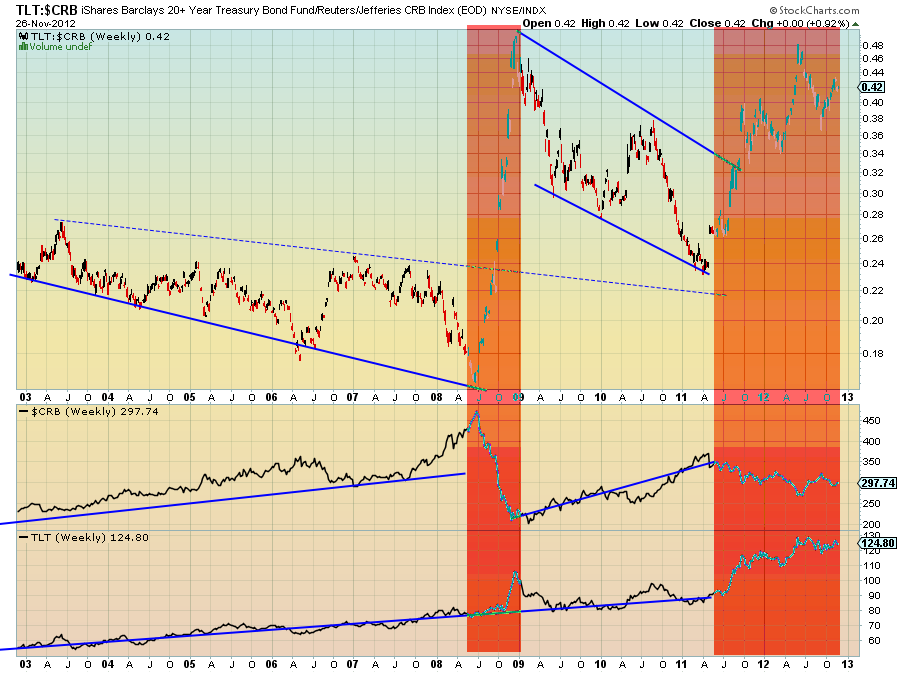

I find the whole concept flawed when looking at the price action. The ratio chart below of US Treasury Bonds (TLT) against the CRB Index tends to show quite the opposite. For very long periods, 2003 to mid 2008, and then again 2009 through mid 2011, as inflation was rising the price of Bonds was also rising, meaning that the yield was falling. You can toss out all sorts of arguments about the change to real rates and the risk free rate over this period.

What I see: there is a strong correlation between bond prices and the CRB Index during these times. When a long trend in the Stock Market is happening. In fact the times where the correlation has weakened or inverted have happened in times of crisis, highlighted in orange. The Financial crisis is the first and the combination of the European debt crisis and US Fiscal debacle is the second.

If you want to know that we are out of the current round of crises, and ready for a long trend in stocks, watch for the correlation between Bonds and Inflation to return.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post