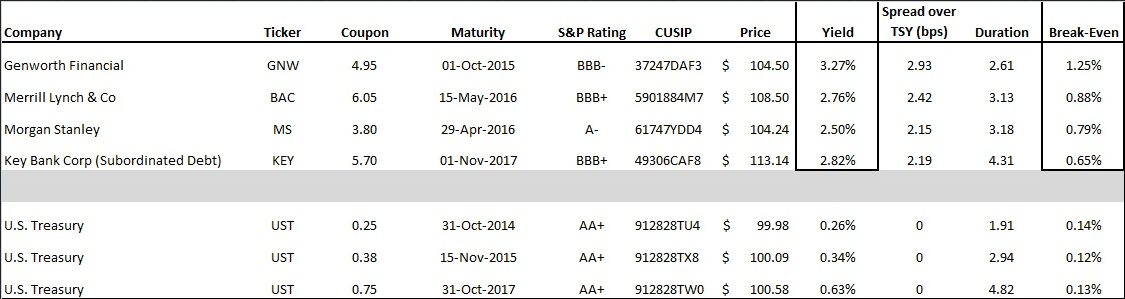

While interest rates remain low, the need for income remains high for investors as market uncertainty can create volatility in asset prices. That said and as the search for yield continues, the risk of rising interest rates remains in the back of investors’ minds. Here are four higher yielding Investment Grade Bonds with Shorter Maturities that may insulate against price risk in a rising interest rate environment.

- Investment Grade Ratings by Standard & Poor’s (AAA through BBB-)

- Maturity is 5 years or less

- These bonds are actively traded in two-sided markets to ensure liquidity

- Bonds are Bullet Structures with no early Call Date

- Fixed coupon that pays semi-annually

- On-the-run U.S. Treasuries are shown for comparison

- Spreads over comparable maturity, on-the-run U.S. Treasuries are measured in basis points

- U.S. Dollar Denominated

Break-Even numbers reflect the instantaneous yield increase (which leads to a decline in price) required to offset the income earned per year. Break-Evens are calculated by dividing the duration from the yield.

To illustrate, Genworth Financial 4.95% Maturing October 1, 2015 can withstand 125 basis points of an instantaneous increase in yield to offset the yield of 3.27% that is earned over the course of one year (3.27% Yield divided by 2.93 Years = 1.25% Yield or 125 basis points).

The 'Break Even' Level

In other words, if an investor purchased the bond at a yield of 3.27% and the yield increased to 4.52% (3.27% + 1.25%), within a year’s time the investor will be flat and will have neither lost or gained. The bond is at the “break-even” level. If the yield increased less, then you will have gained as the income earned was higher than the decline in price. If the yield increased more, then you will have lost more in price than the income earned.

If you believe the Federal Reserve’s stated guidance that short-term interest rates will remain anchored through 2015 which may be extended to beyond, then interest rates may stay low AND long enough to see these bonds perform.

Diminished Price Sensitivity

Remember that as time progresses, income is earned and essentially pocketed while the duration or the price sensitivity diminishes. Any rise in yields several years from now will have less effect on the price as the maturity nears. So in our Genworth example, the duration will shrink significantly from 2.61 to 0.25 Years by mid-2015 assuming the same yield as today. So, the price sensitivity to rising interest rates reduces dramatically as time progresses.

Break-Evens do not account for loss of principal in the event of default.

Watch For Liquidity

Keep in mind that corporate bonds trade over-the-counter. So, prices and yields can vary depending on the broker you use. The best suggestion is to use a broker that offers the most visibility and price transparency for the corporate bond market. This can be achieved by comparing the price to buy and the sale price (aka bid-ask spread). The closer the differential usually means the better the liquidity.

Information and market quotes on the bond investments are provided by Trade Monster’s Bond Trading Center.

As always, every investor should perform their own due diligence when making their investment decisions. Monitor credit ratings and perform due-diligence on companies to ensure credit-worthiness.

Disclaimer

The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.