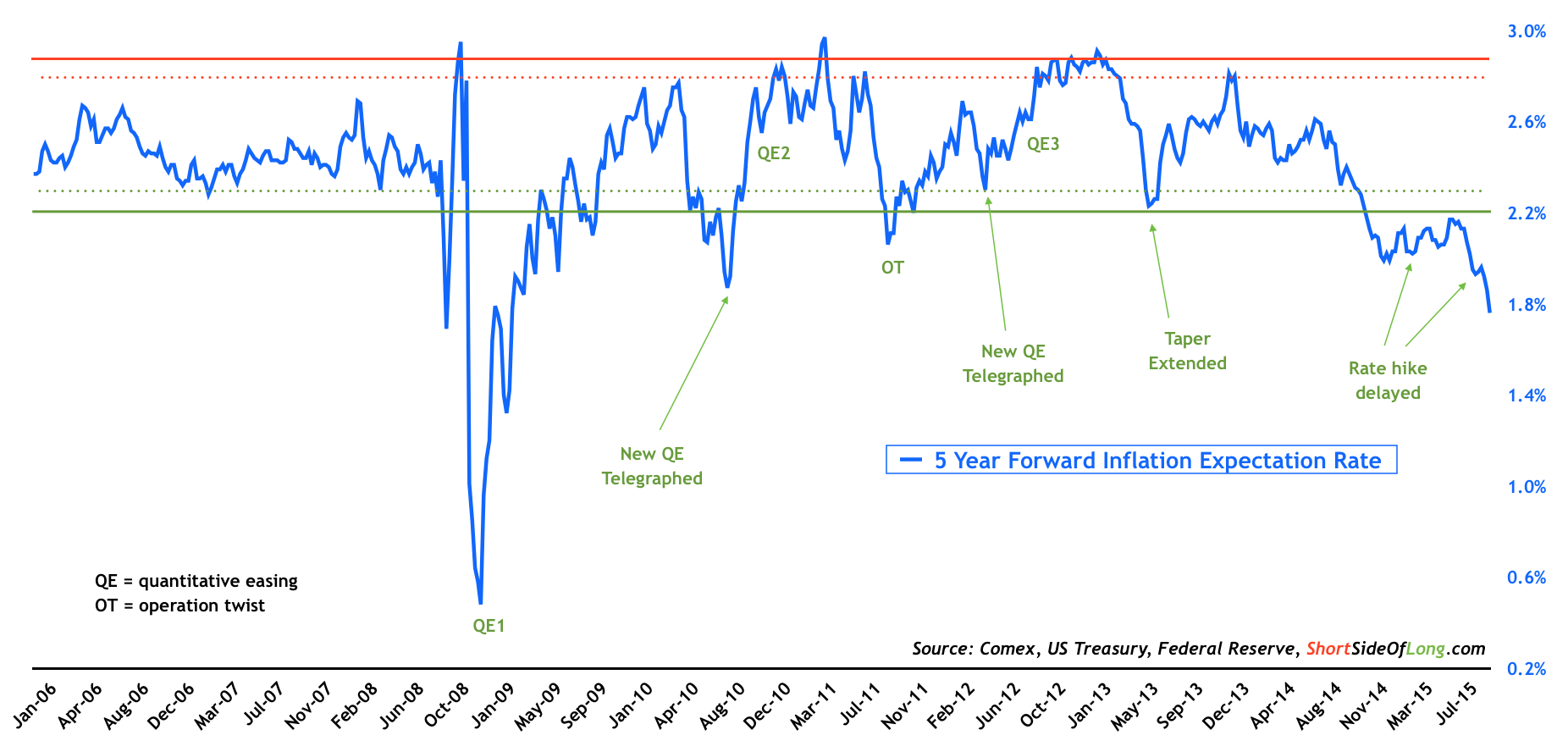

Inflation expectations have collapsed, so can the Fed really hike?

Source: Short Side of Long

Unless you have been hiding in a cave (maybe that’s not a bad idea considering the latest market volatility), you should be well aware of the contrasting monetary policy around the globe. After all, the powerful greenback rally from June 2014 into March 2015 mainly occurred due to shift and divergence of future yield differentials. Readers should already know that many of the global central banks have either started QEs (BoJ, ECB) or continue to cut interest rates (PBOC, RBA, etc).

On the other hand, the FOMC’s desire to get out of ZIRP is well advertised, but every time it comes close to initiating its exit strategy, the market refuses to co-operate. After all, market participants are addicted to the constant stimulus of cheap credit, so it is quite understandable. However, Pavlovian investors need bigger and larger doses each time something goes wrong.

Currently, the Federal Reserve seems trapped yet again. Inflation expectations on a 5 Year Forward rate have collapsed in recent weeks and are at the lowest levels since The Great Recession. Historically, such low inflation expectations and potential deflation risks have been strong market signals for further accommodative monetary policies, rather than tightening.

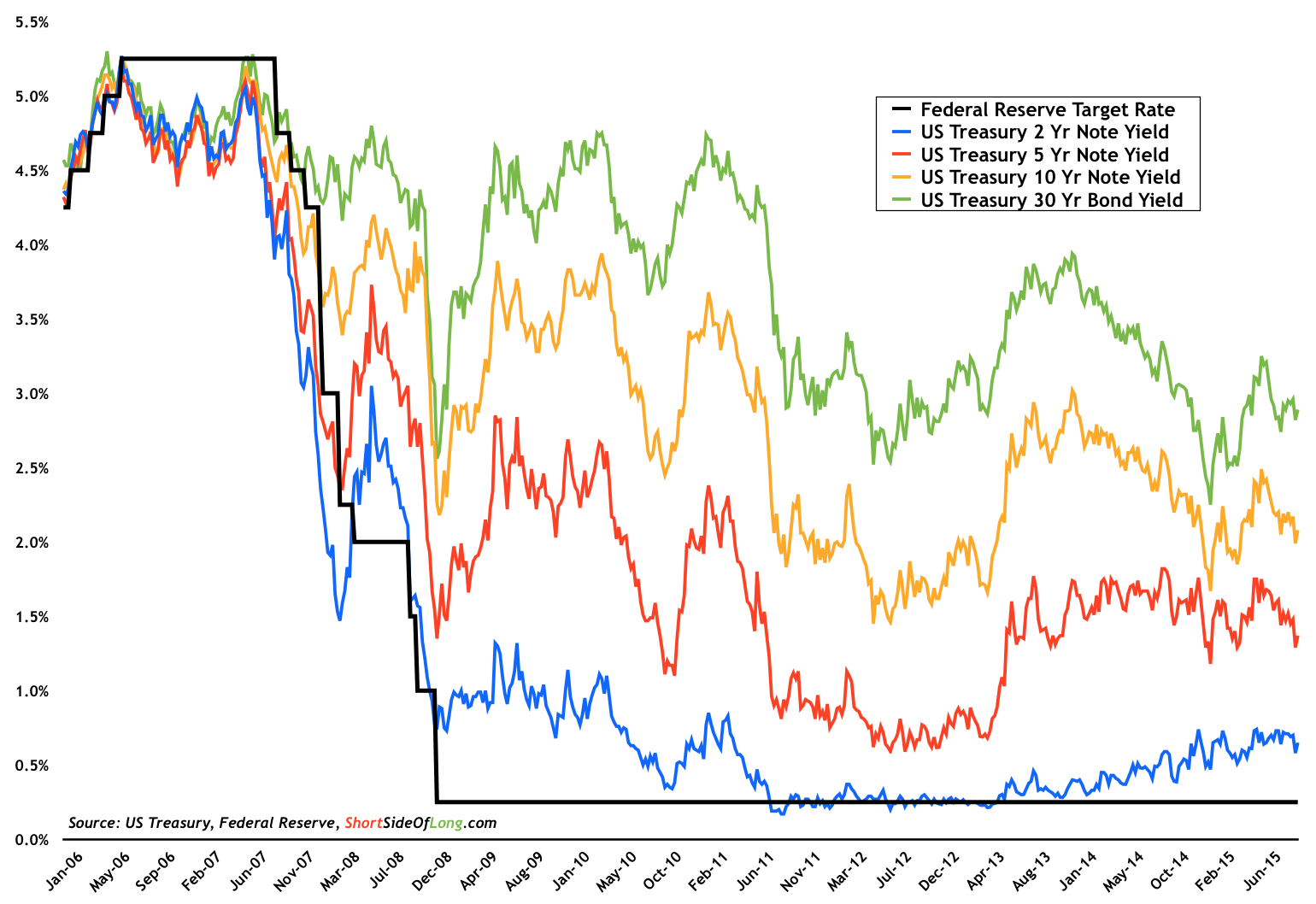

US Treasury maturities have fallen, despite hawkish FOMC speeches

Source: Short Side of Long

During the Global Financial Crisis of 2008, the collapse of inflation expectations prompted Ben Bernanke to cut rates towards 0% and eventually starting the first round of the so called Quantitative Easing program (just a fancy name for creating money out of thin air). As the recession ended in June 2009 and recovery got under way, any time the economy slowed and deflationary risks re-emerged, the FOMC stepped up by either “telegraphing” or initiating a new round of stimulus measures. Each time this played out via Treasury yields front running the Fed’s dovish stance, and started their downtrend (in other words, bond market rallied).

Lately, the so-called partnership between the bond market and the Federal Reserve seems to be somewhat disconnected. Despite the fact that the Fed stayed on hold during their September 2015 meeting, immediately afterward many important FOMC members spoke hawkishly about their intentions to hike rates by year-end. However, Treasury yields (via U.S. 2-, 5-, 10- and 30-year yields, chart above) aren’t buying it, as yields have started to drop and spreads steepen. Bond markets are signalling that the probability of a rate hike this year isn’t even on the table anymore, and March 2016 is barley above a 50-50 possibility.

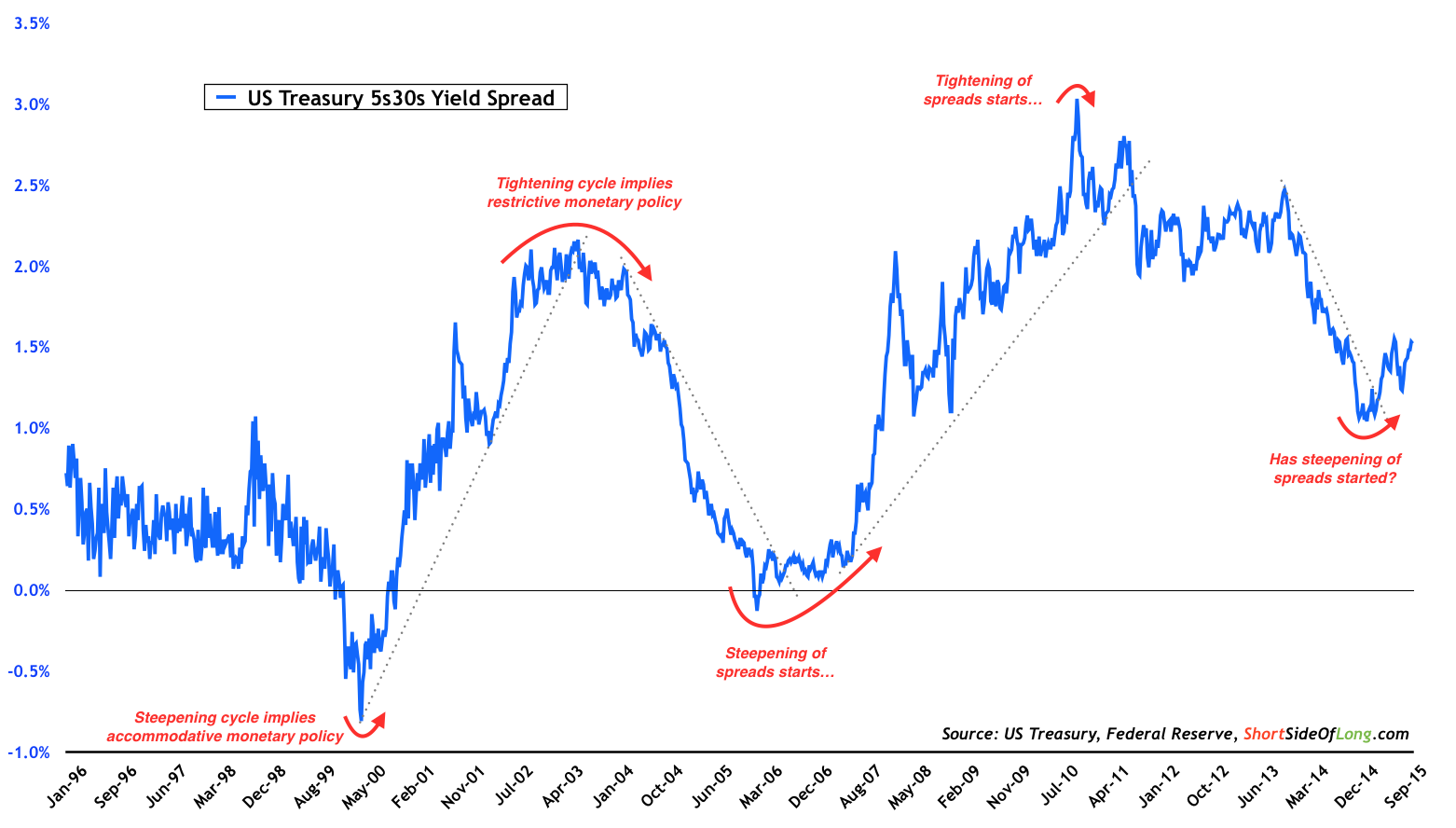

Treasury spreads including 5s30s are at the steepest level in a year

Source: Short Side of Long

Obviously, improvement in the economic data would change the bond market's mind, but will the Federal Reserve really initiate its tightening cycle with such low inflation expectations? Certain prominent investors, such as Ray Dalio, worry about the repeat of 1936/37, where the FOMC tightened monetary policy prematurely, sending the economy back into recession and creating in turn The Great Depression.

If you were to believe the current message coming from the 5s and 30s yield spread, a breakout above the current level would see us starting a new steepening trend. In other words, more stimulus might be underway…