Summary

The corporate bond market has sold-off over the last year.

But it has done so in conjunction with a widening of the Treasury market.

The Treasury market continues to tighten.

I wrote about the Fed statement earlier this week (see this link). Today, I'll be taking a general survey of the bond market -- looking at yield spreads -- to see if we're seeing any stress or areas of concern.

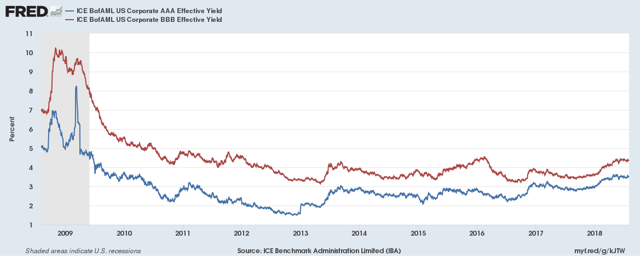

Let's start with the corporate bond market:

The chart above shows the effective yield of AAA (in blue) and BBB (in red) bonds. While both are at reasonable levels, each is also at high levels for this cycle. The AAAs (in blue) are at ~3.5%, which is their highest level since 2009. As for the BBBs, they are also near their respective highest level for the last nine years. On one hand, we should expect this result; the Fed is, after all, raising rates. At the same time, does this mean that traders are selling these issues, sending them to concerning levels?

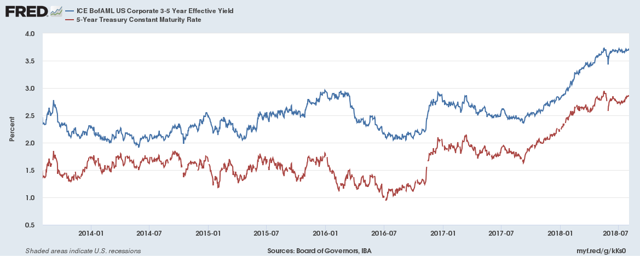

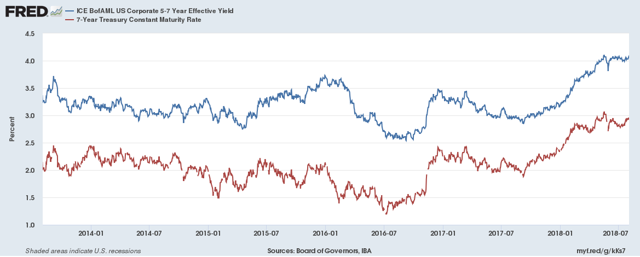

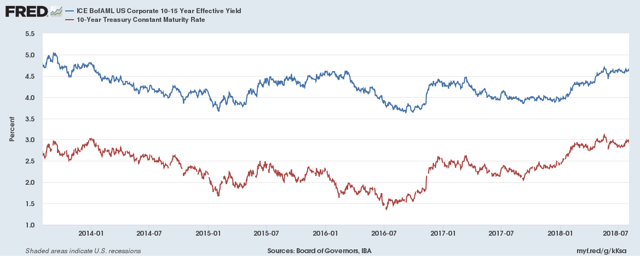

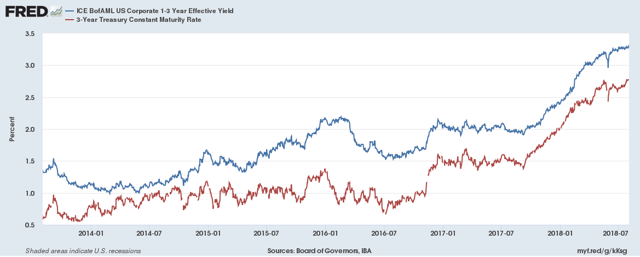

No. Let's look at various maturities of the corporate market and compare them to their corresponding treasury securities:

Above are charts for four maturity ranges of the corporate bond market (in blue) and the longest-dated Treasury bond of that series (in red). All have risen at more or less the same rate and during the same time. This is to be expected: Treasury yields are the baseline for the entire fixed income market; as they rise and fall, so to do most other yields.

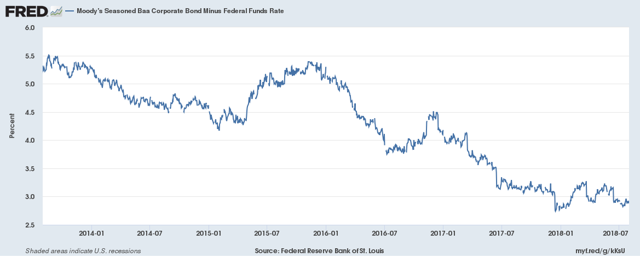

And then we have the corporate spreads relative to the Treasury market:

The Aaa and Baa spreads relative to the treasury rate are near a five year low. This tells us that traders are either buying corporates are, at least, not selling them as the Fed has raised rates.

The coup de gras of this is the CCC yields:

If there was a problem in the corporate market, this is where we'd be seeing it: the junk bond market. Instead, yields recently dipped, indicating that traders are buying this section of the corporate market.

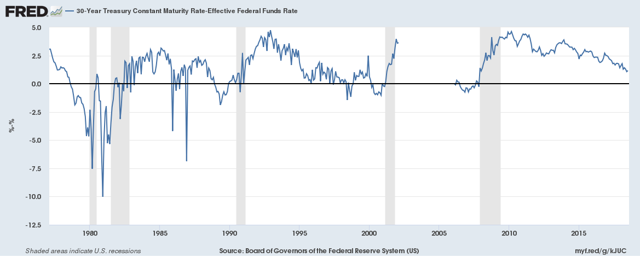

Turning to the Treasury market, let's look at two yield spreads, starting with the 30-Year/FF rate:

While still positive, this rate is still compressing. But it has a while to go before it turns negative.

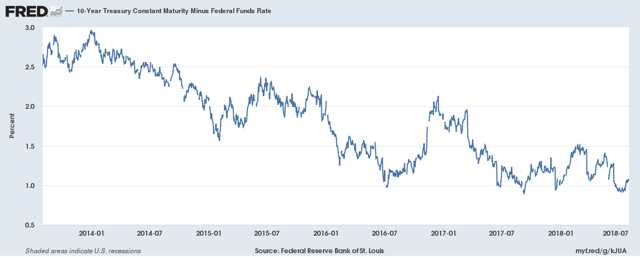

The 10-Year-FF rate spread dipped below 1% in July but has since returned to the >1% world. This won't last forever, however, especially with the Fed raising rates.

So, there isn't any meaningful stress in the corporate bond market while the Treasury market continues to tighten.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.