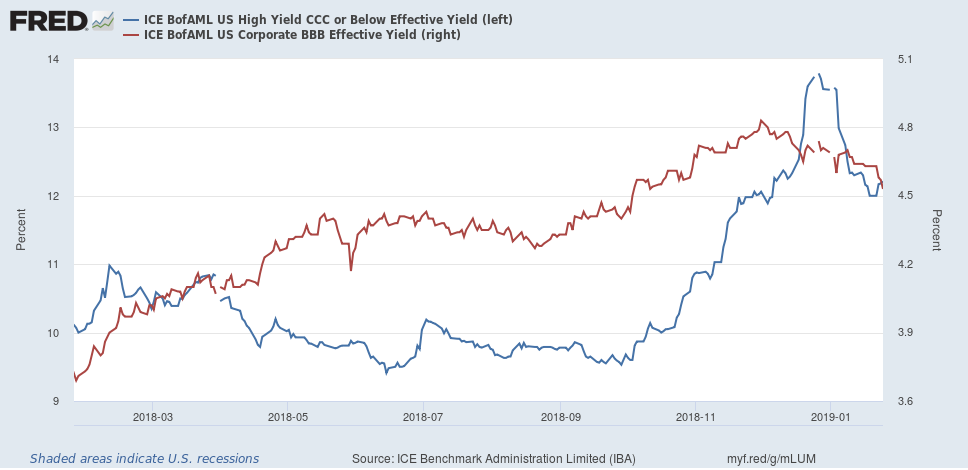

Summary- While lower grade credits have come in a bit, their yields remain at somewhat elevated levels.

- Higher grade corporates are still at decent rates.

- The government yield curve is still very narrow and some of the smaller sections of the curve have inverted modestly.

There were no major U.S. Federal Bank speeches this week, so let's dive into the market overall, starting with corporates.

CCC yields (in blue) widened sharply between 10/18 and 12/18, rising about 425 basis points (left scale). Spreads have tightened a bit since then, coming down to about 12%. A more dovish Fed is the primary reason for this easing of yields. In fact, this week the Financial Times reported that the high-yield market had started to thaw, although that easing didn't apply to all industries. BBBs have also eased, with yields dropping about 30 basis points. Still, both markets are somewhat higher, which is a sign that traders are concerned about risk in this sector.

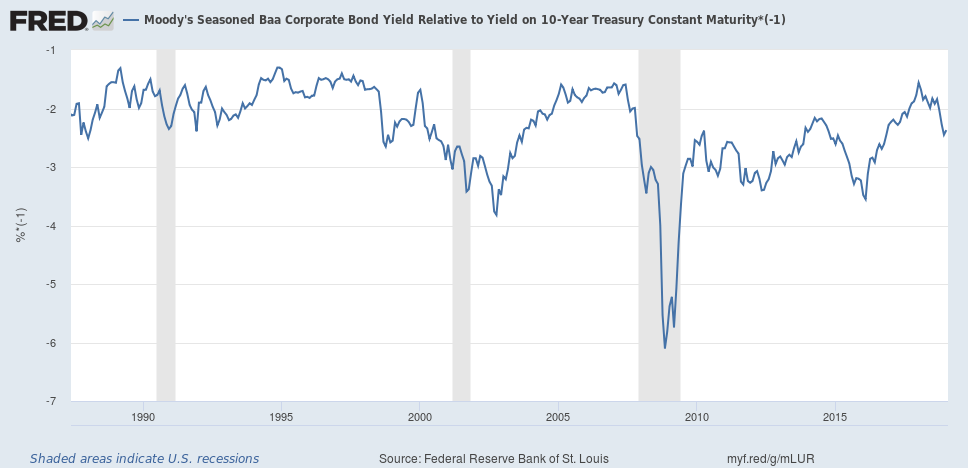

Baa yields are often cited as a good leading indicator, as these yields sit between higher risk junk and lower risk AAA. I've inverted the yield, simply so that down equals bad. Yields have come down a bit, although they are still at decently high levels.

Finally, AAA yields have moved a bit lower but are still at attractive levels.

There is still a fair amount of risk in the lower-grade corporate bond market, thanks to the elevated yields in the CCC and BBB markets. It's possible that we've seen the lowest levels for these sectors of the market for this cycle. At the same time, higher-rated credits are still in pretty good shape.

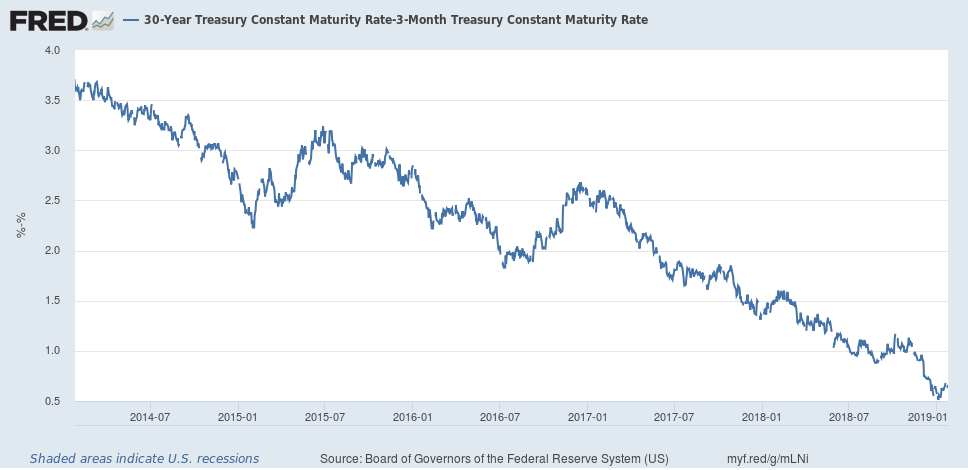

Let's now turn to the government market, starting with the overall spread of the yield curve:

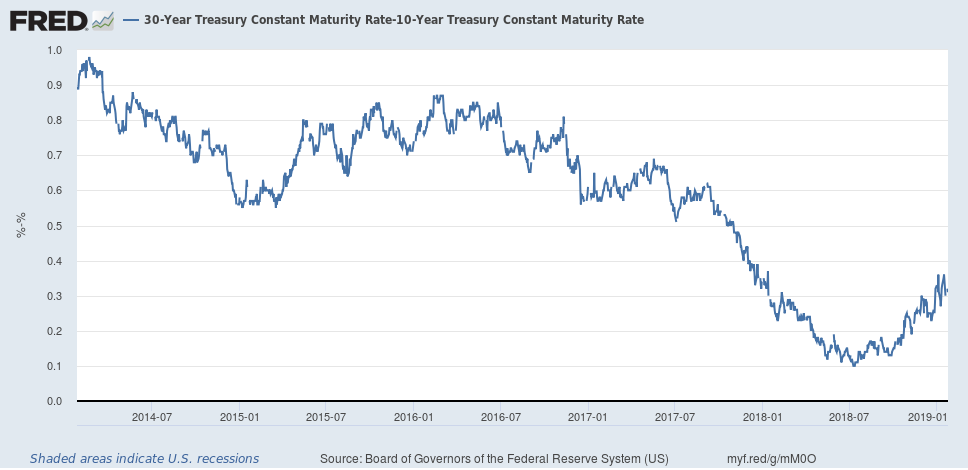

The yield curve continues to flatten. The 30-year-3-month spread dropped to 54 basis points earlier this month; it has since risen to 63 bps. But, the overall direction is clear; it's getting tighter.

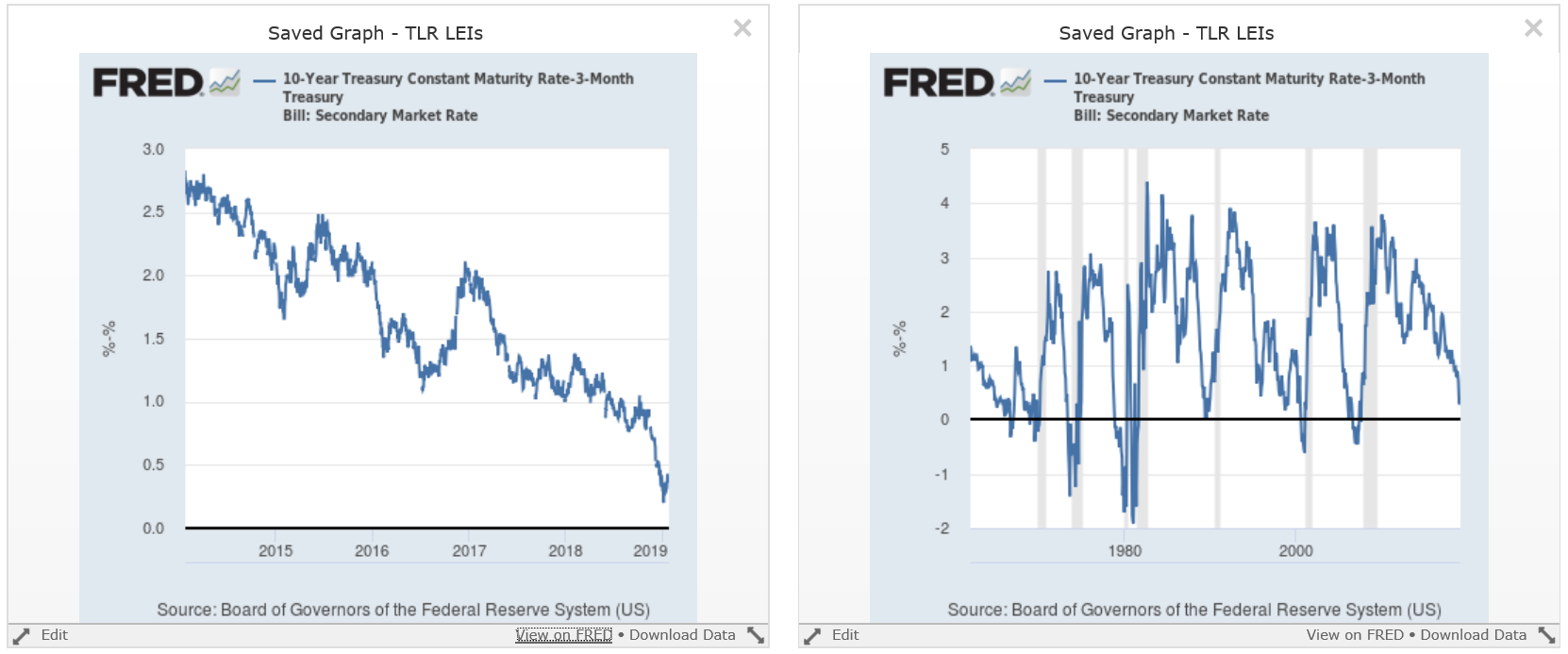

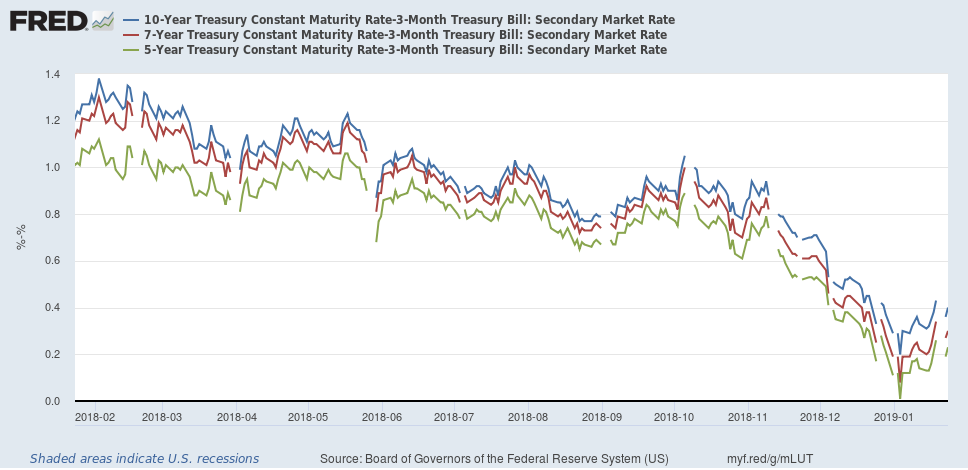

The belly of the curve continues to compress. The 10-year-3-month spread has tightened to 29 basis points but has widened a bit to 43. Still, it remains very low and is indicative of late-cycle movements.

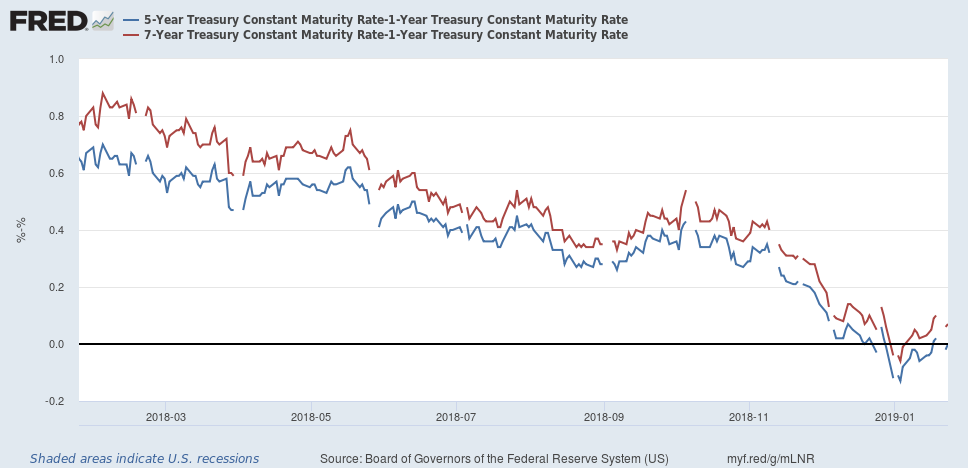

The belly of the curve has widened a bit over the last few weeks. It is, however, still at very low levels as well.

The 7-year-3-month and 5-year-3-month spreads have contracted recently, although have turned positive recently.

Finally, there has been some widening between the 10- and 30-year. However, this section of the curve is still below 40 basis points, which is historically very low.

Overall, the bond market continues to act in standard, end-of-cycle ways. Higher risk corporate credits have sold-off as default fears increase. And with the Fed raising rates and long-end of the curve rallying, the treasury curve has flattened.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.