Bond market risk appetites hold the key to the stock market right now. It is normally the case that equity and debt markets are very closely intertwined, but currently this is truer than ever. And the bond market is signaling the party is nearly over.

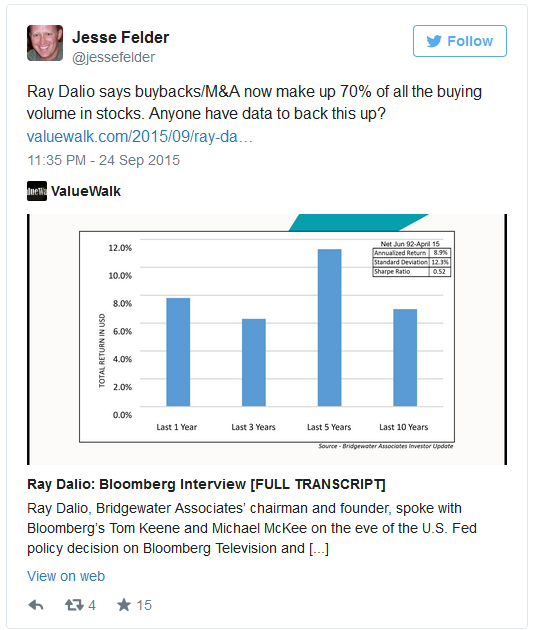

I say that the relationship between bonds and stocks is more important today than ever because mergers and acquisitions activity and stock buybacks have been a major source of demand for equities over the past few years. And, to a very large degree, these have been financed by debt. So companies’ ability to access the credit markets currently has a huge impact on stock prices.

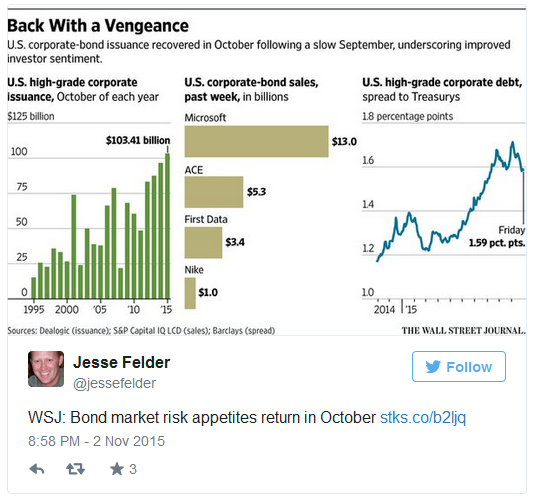

This is evident in the fact that, after shunning corporate bonds in September, investors rushed back into the sector in October. Stocks clearly benefited, seeing one of the largest one-month rallies in quite some time (chart below: iShares iBoxx $ Investment Grade Corporate Bond (N:LQD)).

The Wall Street Journal reports that the rebound in October puts the corporate bond market back on track for another record year of issuance.

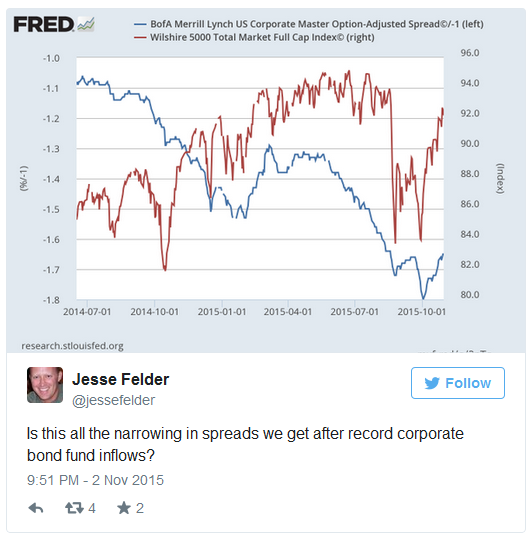

Despite the record investor demand for these funds, however, the interest rate spread between corporate bonds and Treasuries hasn’t narrowed very much at all over the past month. This means that the cost of pursuing buybacks and M&A through new debt issuance is still more expensive than just a few months ago, let alone a year ago.

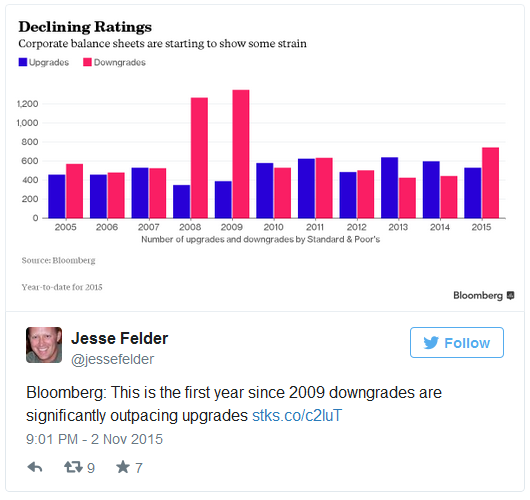

The persistence in spreads may simply be a sign that companies are reaching the limits of their ability to borrow and spend on buybacks and M&A. The ratings agencies are clearly signaling their concern in this regard.

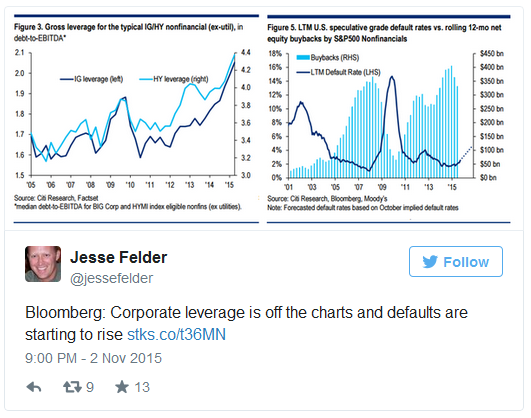

Indeed, corporate leverage has soared far past the peak seen prior to the financial crisis. What’s more, after falling to very low levels, defaults are now starting to grow again.

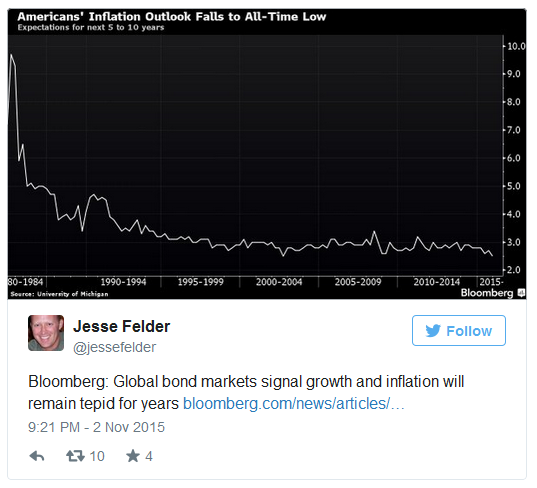

And with the global economy slowing, in many ways back to recessionary levels, it’s hard to imagine how these trends will reverse themselves.

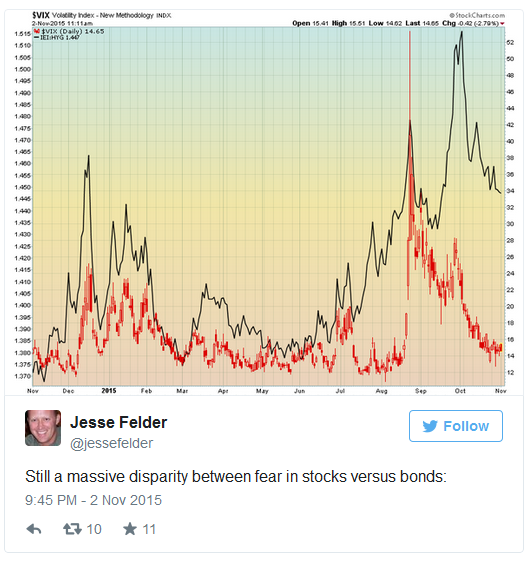

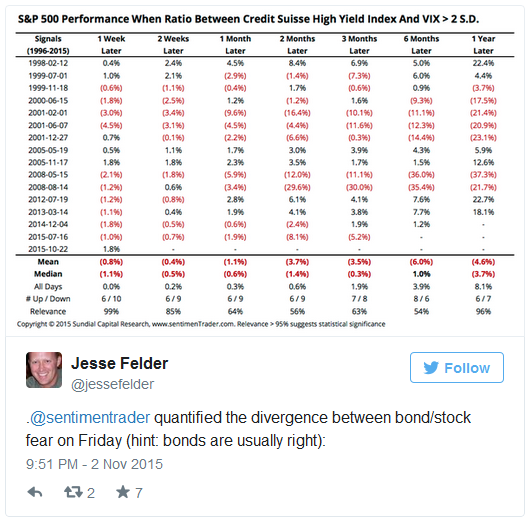

Finally, it appears that the stock market may have overreacted (via the VIX, chart below) to the rebound in the corporate bond market (iShares 3-7 Year Treasury Bond Fund (N:IEI):iShares iBoxx $ High Yield Corporate Bond (N:HYG), chart below). Bonds, as measured by risk appetites, are still pricing in much more fear than stocks currently do.

When this has happened in the past, it’s not been a good sign for the stock market.

Ultimately, it looks like we are in the very late innings of this credit cycle. Companies have now levered up to an unprecedented degree and downgrades and defaults are rising from very depressed levels. Spreads have also now been widening for over a year.

Should these trends continue, more and more companies will begin to find it difficult to access the credit markets. And because buybacks and M&A have become such a critical component of the bull market in equities, the potential end of the credit cycle could mean precisely the same for the equity cycle.