The current bull market in bonds must end at some time in the future, sooner or later, not until inflation or interest rates rise. So far, the economy remains sluggish, real unemployment is high and inflation is minimal. But, sooner or later, investors will experience either a loss of money, or at best meager returns. If inflation eats away the value of bonds, those who hold gold in their portfolios may be able to compensate.

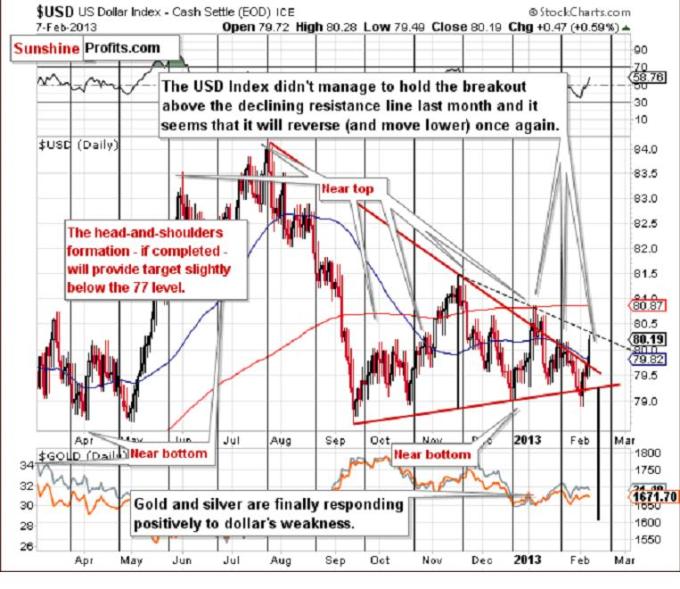

In the short-term USD Index chart, a rally above the medium-term declining resistance line based on the July-August and late-November highs last year was seen this week. As the beginning of the dashed line is at the Nov 2012 top (the one that created the medium-term support line) and the Jan 2013 high (the one that formed after prices tried breaking above the declining resistance line), it might be the case that this line represents the “how far too far can the index move and still go back down." It’s simply our guesstimate based on two facts: each of the previous breakouts failed and the rally stopped right at the dashed line, thus confirming at least some significance.

We still believe the next move seen here will be to the downside. With a cyclical turning point a bit more than a week away, sideways trading in the coming days will likely be quickly followed by a period of declines which could then trigger a rally in the precious metals sector.

At this point, let’s have a look what’s currently going on in the gold market.

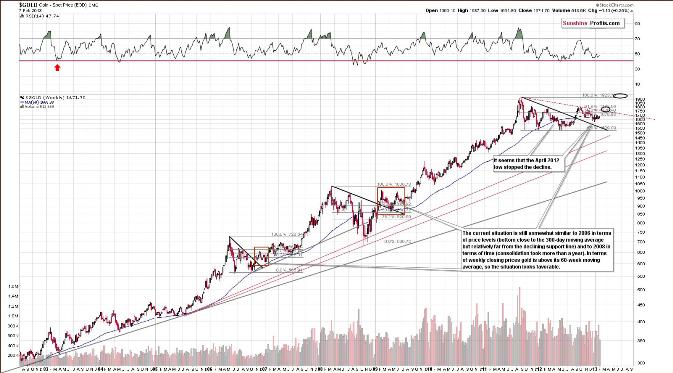

In the long-term gold chart, the situation remains bullish. Gold prices consolidated after breaking out and the yellow metal is technically ready for a big rally. Comments made in our essay on the price of gold in February 2013 remain up-to-date:

The bottom was very likely formed here a few weeks ago when gold prices dipped below the 300-day moving average, which is a very important long-term technical development. Prices now appear to be simply consolidating a bit, which is also in tune with the historical patterns – the rally didn’t always start in a volatile way after the final bottom was reached below the 300-day MA – but it happened eventually many times and on each occasion the rally was worth waiting for.

On a short-term note, it is encouraging that gold did not decline much even though the dollar rallied quite sharply on Thursday. Finally, we would like to share an observation that one of our subscribers shared with us along with our comments:

Q: I note in 2006-07 it took 76 weeks to make a new high for gold and in 2008 it took 78 weeks to make a new high in gold. We are now at week 74 in the gold cycle. Do you feel this is significant? I feel when it does move it will be to almost 1900 before a short- or medium-term correction. “When time is up, price will reverse. Time is more important than price.”--W. D. Gann (famous technical analyst.)

A: Yes, we feel this is significant and we expect to see a more volatile upswing in the coming weeks. We would like to add that the time factor may make this consolidation significant. Less than 40 years ago the correction took gold much lower - about half of the previous high - before the final rally in gold materialized. At this time, we think that the prolonged consolidation might have been enough and gold doesn't have to move even lower - the lack of a rally might have been enough to make people throw in the towel.

Summing up, the situation in gold did not change much this week in terms of price and it remains bullish for the medium- and long term.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bond Market May Collapse While Gold Charts Look Bullish

Published 02/10/2013, 01:55 AM

Updated 05/14/2017, 06:45 AM

Bond Market May Collapse While Gold Charts Look Bullish

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.