The bond markets have experienced a hiccup in the first part of this year, with the 10-year bond rising 45 basis points in yield, to 2.85% from 2.40%, and the 30-year bond rising 37 basis points in yield, to 3.11% from 2.74%. Our feeling is that these yields are rising in one measure to compete with the blistering start to the stock market (which itself has seen bouts of volatility in the past week).

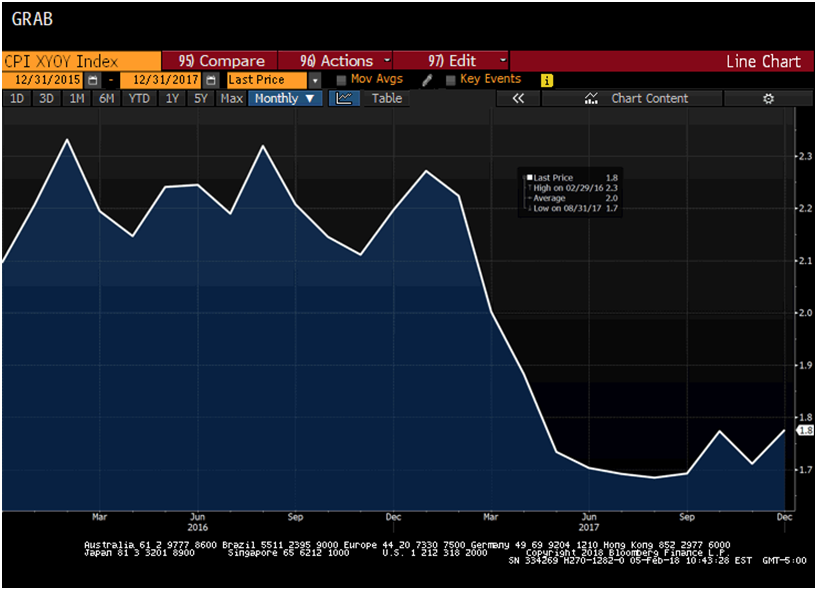

It is ironic that, in Janet Yellen’s last week as chair of the Federal Reserve Board, a bond market that had focused on low economic growth and stubbornly low inflation was suddenly concerned about too fast a growth rate and inflation’s heating up.

Source: Bloomberg

However, core CPI is still well below where it was in 2016 at the time of Trump’s election. There has been some growth in wage inflation, but it is clear that so far it has not leaked over into the general inflation numbers.

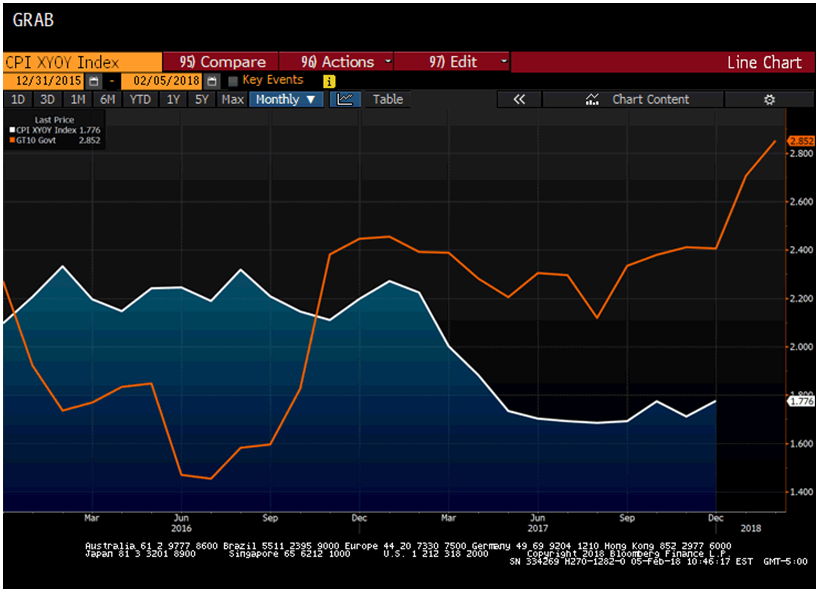

Source: Bloomberg

The spread between the 10-year Treasury bond yield and core CPI has risen sharply. There is a certain amount of logic in real yields rising relative to the jump in equities over the past year. This increase in yields reflects in part a continuation on the path to normalcy: This is the Fed continuing to slowly raise short-term interest rates and starting to shrink its balance sheet. (See my colleague David Kotok’s piece.) David’s point is that a 3% 10-year Treasury note yield is not a shocking development.

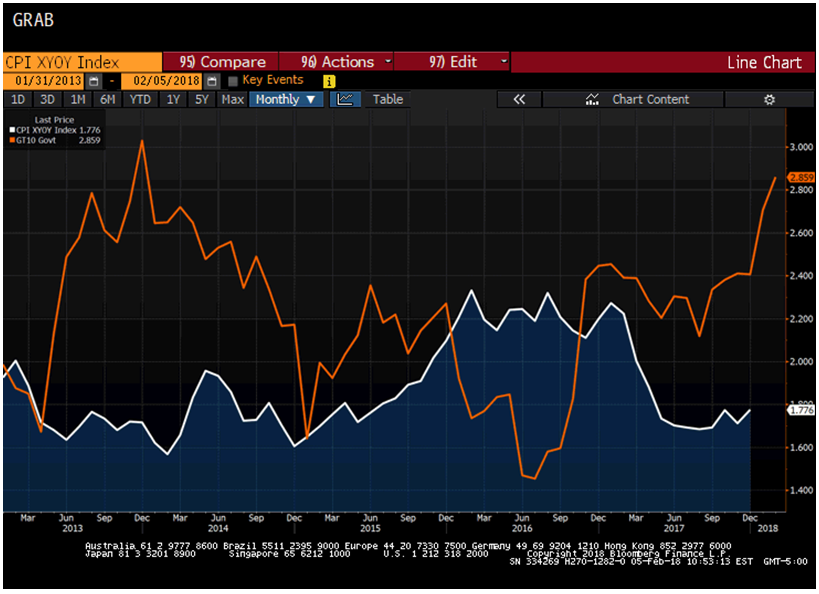

Source: Bloomberg

The bond market’s rise in yields has occurred without an accompanying jump in inflation. In the context of REAL yields, we can see in the above graph that bond market yields compared to core inflation are back near levels that we last saw at the end of the “Taper Tantrum” of 2013. Bond yields may move higher; but if they do, they will start to represent value.

On the municipal bond side we witnessed a January slump in issuance. December’s record $67 billion of new-money issuance in front of the new tax bill gave way to less than $17 billion of issuance in January. Municipal bond yield curves were marked down during the month – mostly out of sympathy with the rise in Treasury yields. There was markedly subdued trading in January, mostly because of the paltry supply. And usually when we see this type of a rise in Treasury yields, that rise is accompanied by municipal bond outflows (witness the post-Trump sell-off as well as the Taper Tantrum of 2013). January saw an INCREASE in net flows into bond funds, which belies the rise in overall yields. We think that some of the volatility witnessed in the equity market in the past week may result in some reallocation into bond funds. Cumberland spent the first part of January mostly selling to meet what retail demand was there post-January 1. That demand was somewhat muted this year as the traditional January 1 bond fund flow bought new issues that were pumped into the bond market in advance of the tax bill. We are waiting for more municipal bond supply (and it should now start to rise after the very low January), and we believe that some additional supply will bring clarity to the muni market. Certainly, if a temporary supply bulge plus some eventual bond fund selling were to push long tax-free yields to the 4% range (last seen in the Trump sell-off), then Cumberland would look to extend portfolios.

Finally, the dramatic volatility exhibited in the stock market this week certainly was ratcheted up by concerns over the rise in overall yields. In addition, investors are demanding an additional yield premium for their reignited concerns about inflation. The bottom line is that this rise in yields, while core inflation is not climbing, will provide an eventual opportunity for investors.