The "Bond Freak" is wondering what's going on. I have an answer from Lacy Hunt at Hoisington Management.

Record 30-Year Long Bond Gyrations

What's Going On?

Given that a deflationary crash is underway with the Fed about to slash rates to zero, the yield on the 30-year long bond ought to be dropping.

In the initial phases of this stock market decline, that's what happened. The last four days of rout undid a major portion of the yield plunge.

Why?

I posed that question to Lacy Hunt at Hoisington Investment Management, one of the largest bond firms in the world with over $4 billion assets under management.

Redemptions

The answer in one word answer is redemptions.

"Pension plans, nonprofit corporations, leveraged hedge funds and others are selling what they have a profit on, not what they need to," said Lacy in a phone conversation.

"They need funds for operations and to make pension payouts.'

Since the start of the year, the yield on the 30-year bond has plunged from 2.3% to well under 1.0%. Even at 1.43%, Hoisington is having a banner year because the firm is long on duration. Hoisington's average duration is over 20 years.

Despite the banner year, his firm too was met with redemptions.

"They are selling what they can." It's that simple.

Stock Market Actions

The stock market is down over 20% in a record 16 days.

Today's 10% Plunge is the Worst Since 1987

Fund managers do not want to sell junk bonds or stocks in this decline, so they are selling what they are ahead on and what is liquid.

Action in Gold Similar to Long Bond

By keeping illiquid junk bonds and stocks pension plans are keeping losers and dumping winners.

Leverage on the Rise

Please recall a $1 Trillion Powder Keg Threatens the Corporate Bond Market

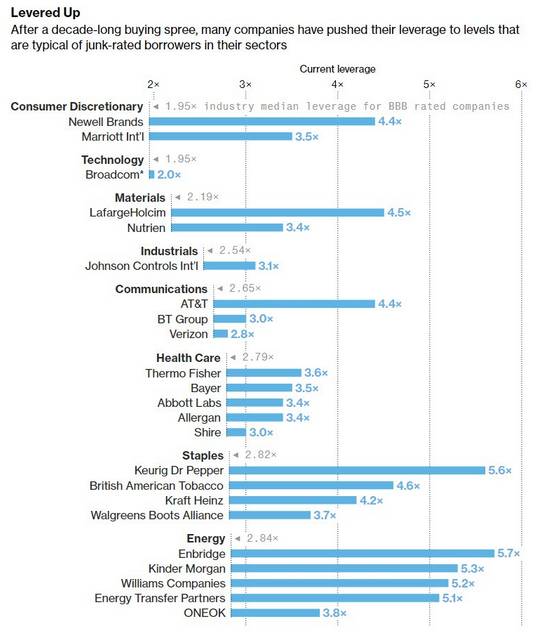

Levered Up

- After a decade-long buying spree, many companies have pushed their leverage to levels that are typical of junk-rated borrowers in their sectors.

- Bloomberg News delved into 50 of the biggest corporate acquisitions over the last five years, and found more than half of the acquiring companies pushed their leverage to levels typical of junk-rated peers. But those companies, which have almost $1 trillion of debt, have been allowed to maintain investment-grade ratings by Moody’s Investors Service and S&P Global Ratings.

- This M&A-fueled leveraging of corporate balance sheets contributed to a surge in debt rated in the bottom investment-grade tier and now represents almost half of the outstanding market, Bloomberg Barclays index data show.

The above article and chart is from October 11, 2018. The leverage (and bubble) is bigger today.

Junk Bond Bubble in Pictures: Deflation Up Next

Flashback July 17, 2019: Junk Bond Bubble in Pictures: Deflation Up Next

Over half of the U.S. bond market is a step or two from junk. Downgrades will take it there.

Guess what happens then?

Pension plans will be forced to sell assets into a declining market. A day of reckoning awaits.

Pleaser check out the above link. It is loaded with good charts that I now need to revisit.

No V-Shaped Recovery

One final point I failed to make.

Lacy believes:

"Recession is coming and there will be a rebound but a very weak one, not a V-shaped recovery."