Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

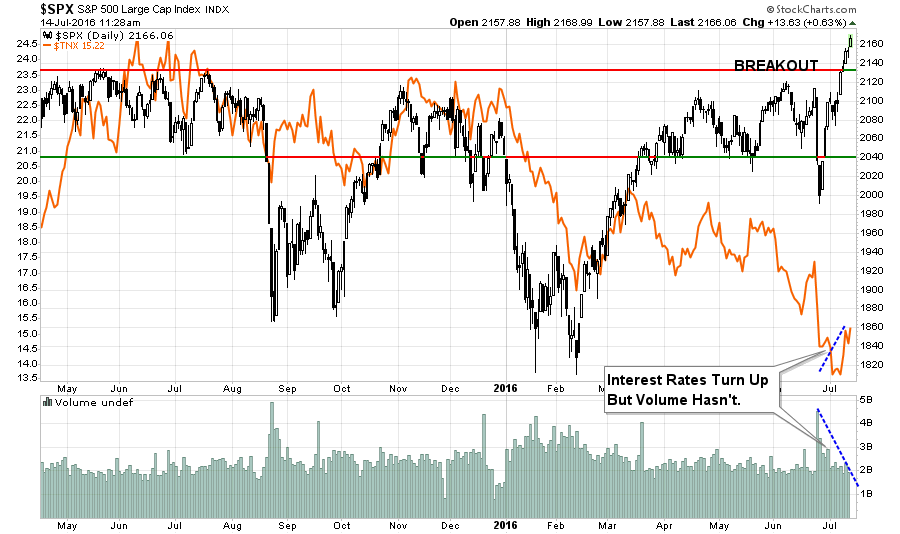

This past Monday, as the markets broke out to new all-time highs, I increased net equity exposure in portfolios. However, I also took one other action -- I shorted interest rates to hedge the bond exposure in accounts.

While the breakout has yet to be confirmed through the end of this week, interest rates have turned up suggesting a rotation, at least temporarily, from ‘safety’ back into ‘risk.’ Unfortunately, a pickup in volume to confirm conviction to the move is still lacking at the moment.

The chart below is updated through Thursday morning. Nothing has changed.

So, while I shorted interest rates to hedge bond portfolios, it was a risk-management decision to maintain allocation structures and protect capital.

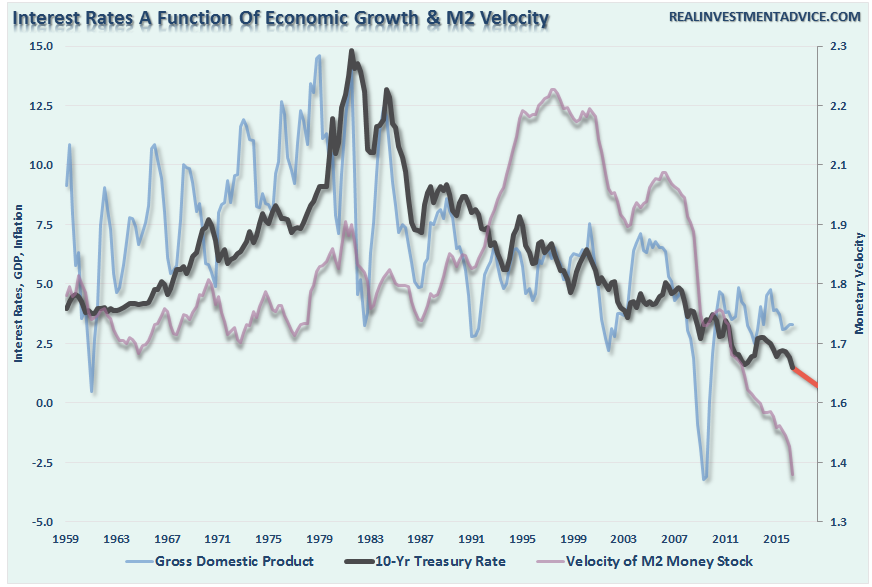

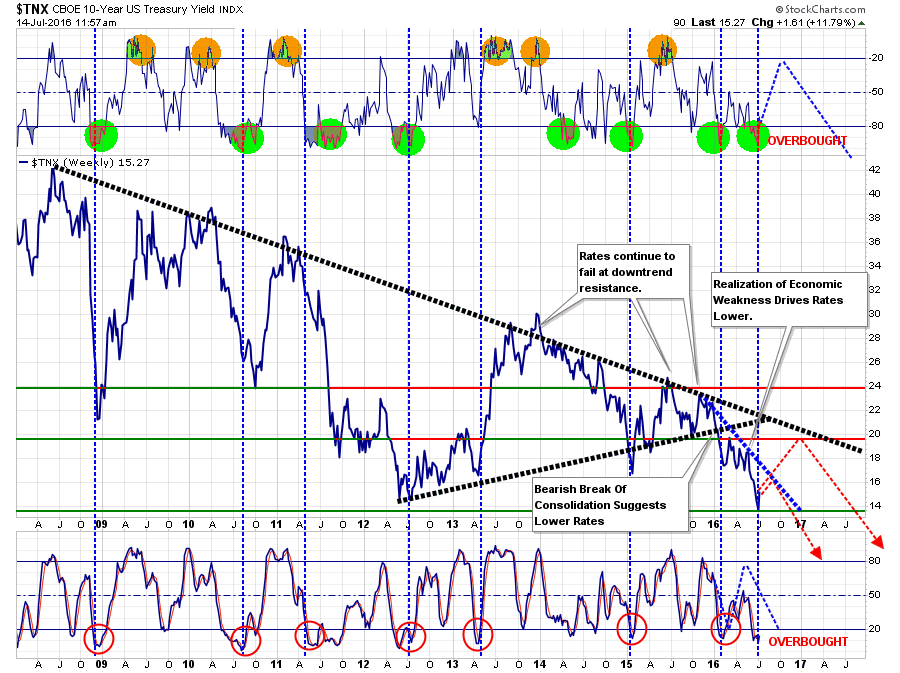

However longer-term, as shown in the chart below, I expect rates to fall further.

How much further?

Like below 1%.

As monetary velocity declines, monetary policy retards the demand for money throughout the system and economic growth continues to weak, interest rates will fall further to reflect the weak economic environment. That will occur during the onset of the next recession.

In the meantime, however, I think there is a reasonable probability, if the market has indeed entered a market “melt up” stage discussed previously, rates could rise back to the top of the current downtrend, around 1.8%-1.9%.

If the current rally fails and we continue to the current long-term market topping process, then rates are likely stall out at roughly 1.6%.

As you can see, we are currently playing with very small ranges. However, when it comes to rates, even small movements can have a large impact on long-duration holdings. From a portfolio-management perspective, hedging interest-rate risk right now is worth the cost of insurance.

Betting on the “end of the bond bull market” is a trade I wouldn’t take.

Why? Interest rates are relative.

With global rates at zero-to-negative, money will continue to chase U.S. Treasuries for the higher yield. This will continue to push yields lower as the global economy continues to slow. What would cause this to reverse? It would require either an economic rebound last seen in the 50’s and 60’s or a complete loss of faith in the U.S. to pay its debts, such as a collapse of the Government and the onset of the “zombie apocalypse.”

We no longer have the drivers of manufacturing, demographics or credit expansion for the former, so I am ready for the apocalypse.