Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

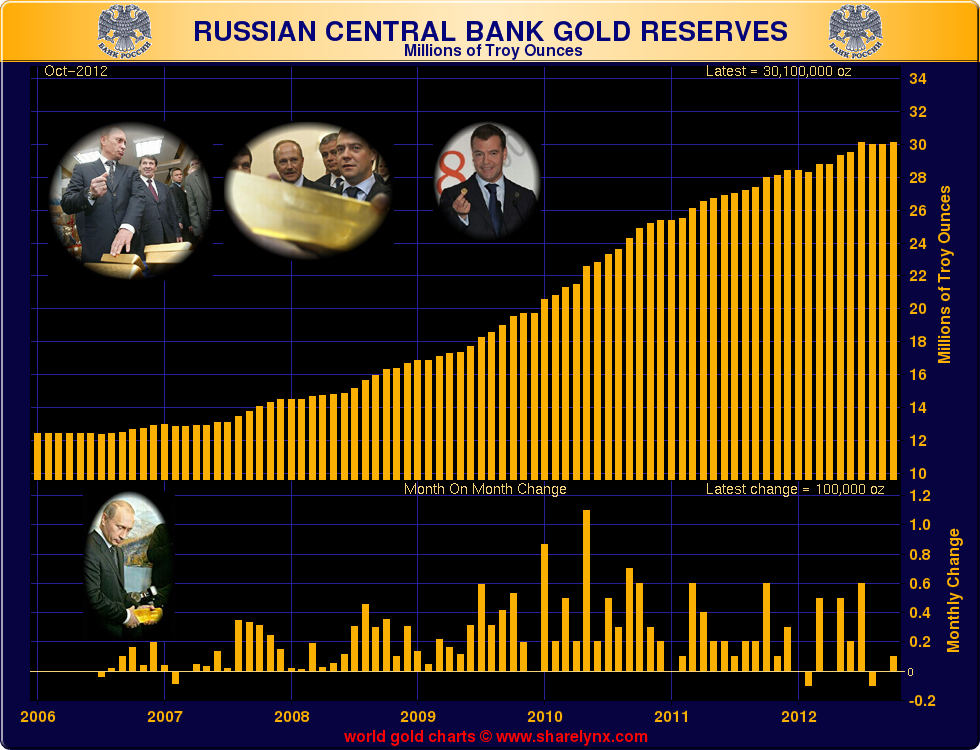

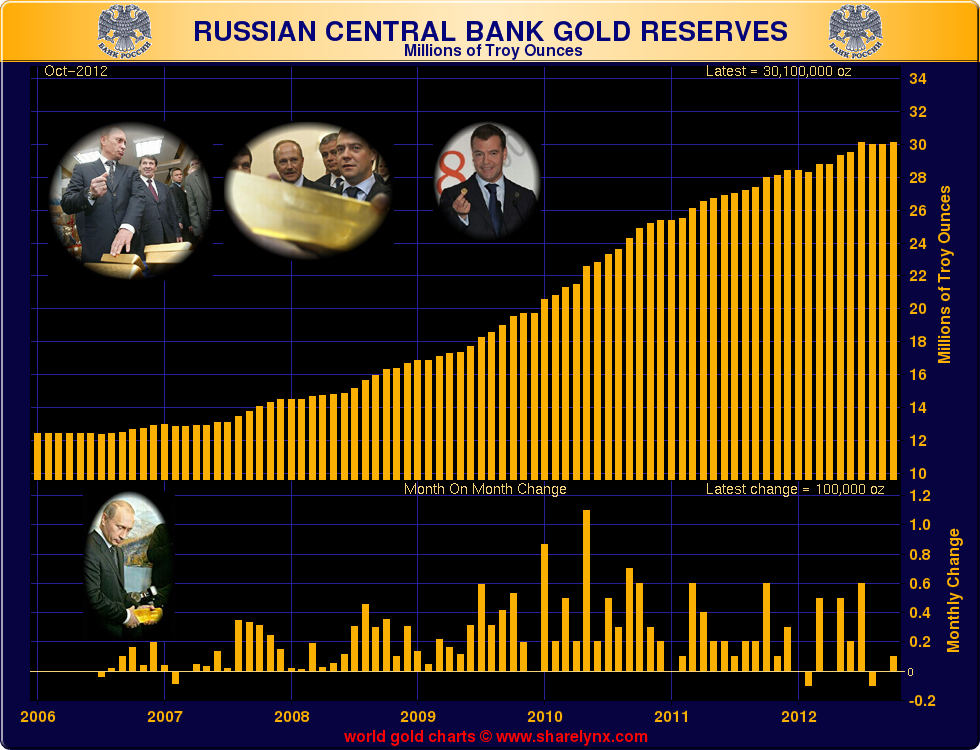

December Comex gold futures gained 0.1% yesterday, as improved Chinese manufacturing data and hopeful noises from European politicians about the prospects of reaching an EU budget agreement helped traders’ appetite for growth assets. Precious metals posted decent gains on Wednesday, following news that central banks in Russia, Kazakhstan, Turkey and Brazil boosted their gold reserves in October. As the following chart from Nick Laird of Sharelynx.com shows, the Russians in particular have been consistent buyers in the gold market over the last five years.

The EUR/USD has been helped by the relative calm on the continent, (no news is good news as far as the likes of Greece and Spain are concerned). U.S. markets were closed yesterday for Thanksgiving, but the Dollar Index is down 0.10% over the last 24 hours, at around 80.62.

Financial media is starting to devote an increasing amount of attention to the bond bubble. With interest rates at already rock bottom rates across the developed world and central bankers desperately trying (and to a large extent failing) to re-inflate credit markets, it begs the question of what exactly happens the next time we get what is euphemistically called “a credit event”. For how much longer will investors continue to pay governments and large-cap corporations for the privilege of holding their bonds? Many are surely sleepwalking towards the edge of a cliff.

The EUR/USD has been helped by the relative calm on the continent, (no news is good news as far as the likes of Greece and Spain are concerned). U.S. markets were closed yesterday for Thanksgiving, but the Dollar Index is down 0.10% over the last 24 hours, at around 80.62.

Financial media is starting to devote an increasing amount of attention to the bond bubble. With interest rates at already rock bottom rates across the developed world and central bankers desperately trying (and to a large extent failing) to re-inflate credit markets, it begs the question of what exactly happens the next time we get what is euphemistically called “a credit event”. For how much longer will investors continue to pay governments and large-cap corporations for the privilege of holding their bonds? Many are surely sleepwalking towards the edge of a cliff.