The past 24 hours have been a difficult period for the Japanese central bank as they appear to be caught like a deer in the headlights as the dollar continues to depreciate against the yen. Subsequently, speculation is currently mounting that the Bank of Japan will shortly look to intervene in the market to depress the value of the yen. However, the question remains at what point the venerable BoJ will dip their toes into the water.

March has been a relatively negative month for the Japanese yen as the pair has faced not only some volatile domestic conditions but also a dovish FOMC. Subsequently, it was largely the US Federal Reserve’s dovish FOMC statement that started the latest bout of bearishness. In fact, the announcement that the Fed’s “Dot Plot” showed only two rate hikes for 2015 sent the pair tumbling.

So it really came as no surprise when late on Friday’s session the Bank of Japan started to do the proverbial ring around to find out what was going on in currency markets. Clearly, this type of action doesn’t rise to the level of quote seeking from the central bank, but it does point to rising levels of concern. It also points to a level of expectation setting by the BoJ as the noise around a possible FX market intervention starts to increase.

Subsequently, participants within the market are watching the 110.00 handle closely as historically it has been a key battleground for the pair. In addition, Japan’s central bank is unlikely to allow the currency to fall to far below the 110.00 handle given the expected impact upon Japanese trade. Historically, the BoJ have been relatively active in intervening in markets below the 100.00 mark and this pattern would likely repeat itself if the pair was to fall towards that level.

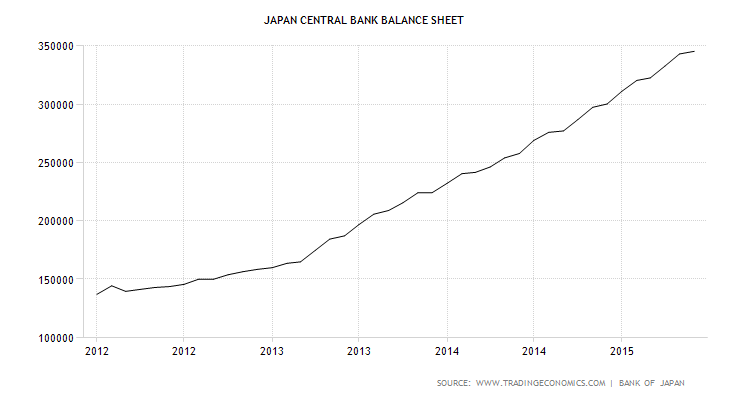

Additionally, the Bank of Japan has amassed a relatively large war chest of foreign currency reserves to fight off the rampantly bullish yen. Despite a burgeoning balance sheet filled to the brim with QE, the BoJ has maintained reserves in excess of 1.25 trillion US dollars. This is a significant sum that could be committed to depreciating the yen. Given the latest round of ring around from the bank, there is no doubt that all the signals are currently in place for a large move ahead for the yen.

Ultimately, the central bank is likely to sit on the side lines until the medium term USD trend arrives. Currently, the pair’s equilibrium has been shocked following the FOMC decision and it may take time for valuations to stabilise. However, if the yen continues to strengthen against the dollar, a valuation between the 109.00 and 110.00 handles could see a decisive intervention in the markets. It’s always difficult to predict central banks but all of the ingredients are in place for that to form the key battleground in the weeks ahead.