The yen was on a wild roller coaster ride throughout the week, first as the Fed increased rates, followed by the BoJ causing plenty of confusion after their monetary policy meeting. The end result is that the BoJ has expanded its asset purchase programme to include ETF but it was not the stimulus injection the market first thought it was. The holiday period could see further wide swings as volatility dries up.

The yen traded in a 320 pip wide range in a week that saw both the FED and the BoJ make changes to their respective monetary policies. The Fed announced the first rate hike in 9 years, but volatility was limited as the market expectations were more or less in line with the monetary policy statement.

Volatility peaked at the end of the week as the BoJ surprised the market by announcing an expansion to asset purchases which will see ¥300b directed towards buying ETFs. The cost will be offset by the selling of financial shares bought back in 2002 to stabilise the sector. The market was taken by surprise, initially thinking monetary policy had been significantly expanded, which cause the pair to spike.

The reality is that stimulus will largely stay the same, hence the late and substantial pull back in the pair. The BoJ will extend the average JGB purchase from 7-10 years out to 7-12 years and the JRIET programme was expanded by ¥90B, which is a drop in the bucket compared to the ¥80 trillion monetary expansion programme.

The week ahead will see no slowdown in the economic calendar just yet for the USD/JPY pair. The monthly Japanese CPI figures are due for release and could add volatility, also watch for the monetary policy meeting minutes. From the US side, keep an eye on quarterly GDP figures, home sales, durable goods orders and unemployment claims. As a side note, the markets could be choppy on light volumes as the markets wind down to Christmas and the end of the year.

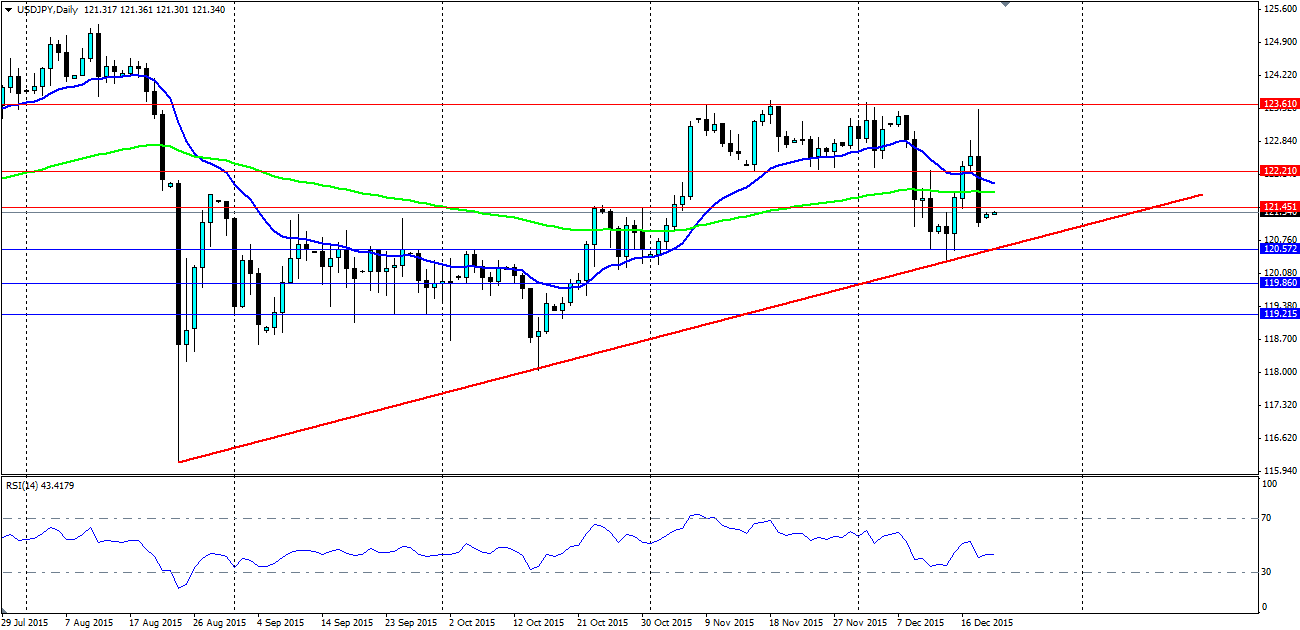

Technicals show the resistance at the top of the previous range remaining intact, providing a platform for a strong rejection. The pair has pushed below the 100 day EMA, but a bullish trend line is likely to provide dynamic support for a sustained climb higher. Look for firm support at 120.57, 119.86 and 119.21 with resistance at 121.45, 122.21 and 123.61.