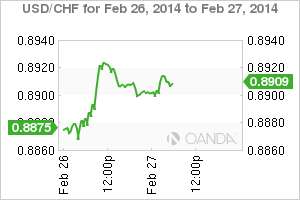

Aside from Crimea, the mighty dollar is currently holding its own – trading near a two-week high against its G7 and G10 contenders and just before Federal Reserve Chair Janet Yellen speaks later this morning. To scale back or not too - that is certainly part of the question that many expect her to clarify. The dollar is in the midst of its largest rally in a number of weeks ahead on data on joblessness and durable goods this morning that are expected to add to signs the US economy is fighting fit to weather stimulus reductions. Yesterday's unexpectedly increasing US new-home sales reports seems to be giving a decent percentage of the market more hope and comfort. Depending on how this mornings data does – the USD expects few other reasons to kick higher from this side of the Atlantic, now it requires solid fundamental backing.

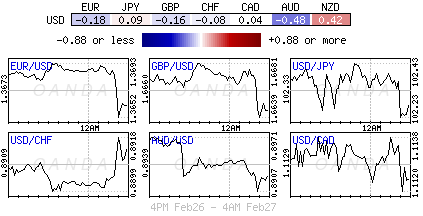

EUR/USD" title="EUR/USD" height="200" align="bottom" border="0" width="300">

EUR/USD" title="EUR/USD" height="200" align="bottom" border="0" width="300">

Expect the market to listen closely to whether Yellen mentions the recent weakness in economic data – the market has deeply discounted the weather factor. Maybe they have done so too aggressively, especially when it has come to soft reporting this year. Ms. Yellen testifies before the Senate Banking Committee at 10am EST in Washington. Will she back up her earlier statement from this month when she said, "the economy has strengthened enough to withstand further cuts to the Fed’s monthly bond purchases." She did add that only a notable change to the outlook would prompt the central bank to slow tapering.

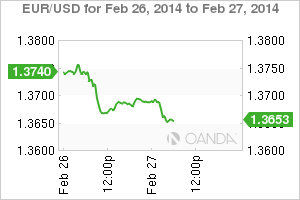

EUR/TRY" title="EUR/TRY" height="200" align="bottom" border="0" width="300">

EUR/TRY" title="EUR/TRY" height="200" align="bottom" border="0" width="300">

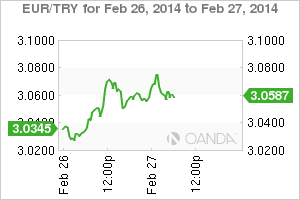

If US domestic data does not turn your crank then it's off to the Ukraine and Turkey for a little emerging action. What's occurring in both these regions is not necessarily new, but is beginning to drawn in more international interest, especially when it comes to the Ukraine. The IMF, the Euro and US are all trying to find ways to support democratic efforts in a country's that is under the global microscope. An emerging economy with relatively small GDP normally would not be on the Capital Markets radar, however, when Russia is involved and the potential outcome is never crystal clear, markets sit up and begin to take notice. Fixed income yields tend to ease, equities tread a little softer, and the historical go to safer haven currencies, life CHF and JPY get polished up just in case. For instance, UK gilt buyers (2.68%) are leading the way higher at the end of a Euro session as markets react to headlines that Russia has put fighter jets on alert on the Ukraine boarder. Conveniently just as the Olympic eyes have returned to their respective homes.

USD/CHF" title="USD/CHF" height="200" align="bottom" border="0" width="300">

USD/CHF" title="USD/CHF" height="200" align="bottom" border="0" width="300">

Saber rattling on the Ukraine boarder is beginning to reach dangerous heights for Putin and his Russia. How far will they go to protect Russian majority speaking Crimea, which is still part of democratic Ukraine? Despite the heed warnings Stateside, Putin is in danger of going down a slippery slope that will have immediate and deeper impact on emerging markets. For now, any emerging currency problems are regionally isolated – Argentina, Brazil, Turkey and South Africa are acting alone. Sometimes Capital Markets just needs one excuse to react. From an international perspective, Russia seems to be the most penalized so far – it's own currency, the RUB, continues to slump on the world stage, and yesterday it fell to a new five-year low outright.

USD/TRY" title="USD/TRY" height="200" align="bottom" border="0" width="300">

USD/TRY" title="USD/TRY" height="200" align="bottom" border="0" width="300">

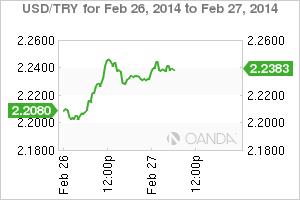

Not far from Ukraine is Turkey, and thanks to the political shenanigans going on there it remains in the public eye. The TRY continues to tread lightly against the dollar (2.2374). Consumer confidence numbers yesterday hit new lows and coupled with the domestic political risk perception, higher policy rates and weaker volatile forex landscape will eventually take a greater toll on the Turkish economy. Their next capital markets story seems to be only half-written. Domestic demand is expected to slow, affecting economic growth obviously, but by how much and in an election year no less? Expect Prime Minister Erodgan's Turkey to remain on investor's radars for some time – and not necessarily for the best of reasons.

EUR/JPY" title="EUR/JPY" height="200" align="bottom" border="0" width="300">

EUR/JPY" title="EUR/JPY" height="200" align="bottom" border="0" width="300">

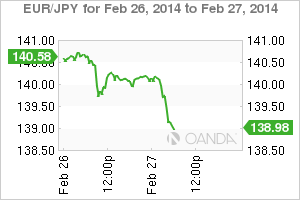

German data this morning has not had the "direct" impact on positions as expected - that has been left up to the BoJ. The German unemployment rate was unchanged at +6.8% last month, but the improvement in employment continues with the number of unemployed falling -14k in February (market was expecting -15k). Bank of Japan board member Sato, again acknowledged, that there is a "cry-out" for some affirmative action by policy members if domestic demand suffers from the sales tax hikes starting in April. His boss, Governor Kuroda has indicated that the 'two' sales taxes (April and next year) have already being factored into their growth equation – this would suggest that the BoJ is in no position any time soon to necessarily consider taking any additional QE steps. Statements like this will hurt those long 'weak' EUR outright positions, especially those investors who decided to focus on their bullish resumption line of €1.3680. As the EUR/JPY (€139.02) begins to navigate southbound, it will definitely want to push the weaker 'single' currency positions to the sidelines. BoJ's Sato suggesting that they could exit current policy before the +2% inflation target is achieved has definitely opened up the gates for JPY to climb higher both outright and on the crosses just as we head stateside this morning. EUR/JPY has broken down below its 21-DMA. This momentum seems to be aided by speculative larger month-end sales being reported. With Japanese names continuing to sell, the 100-DMA 138.78 must now be in focus.

Now the market has to wait and see if US data and Yellen are capable of adding to the 18-members single currency precarious position this morning.