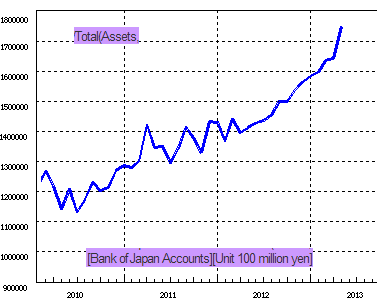

Japan's monetary experiment is truly unprecedented, both in size and scope. Not only is the overall central bank balance sheet growth accelerating, but the assets purchased are not just government securities.

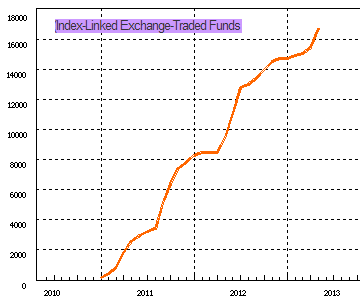

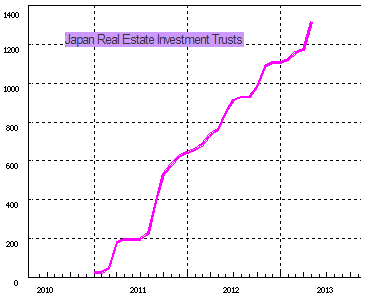

The Bank of Japan is buying up REITs and stock ETFs to prop up both asset classes. The amounts are still relatively small, but the buildup is quite rapid.

Sunday, May 19, 2013: BOJ says party on - in the long run we are all dead. Japan's monetary experiment is truly unprecedented, both in size and scope. Not only is the overall central bank balance sheet growth accelerating, but the assets purchased are not just government securities. Total Assets (source: BOJ)

The Bank of Japan is buying up REITs and stock ETFs to prop up both asset classes. The amounts are still relatively small, but the buildup is quite rapid. BOJ's holdings of ETFs

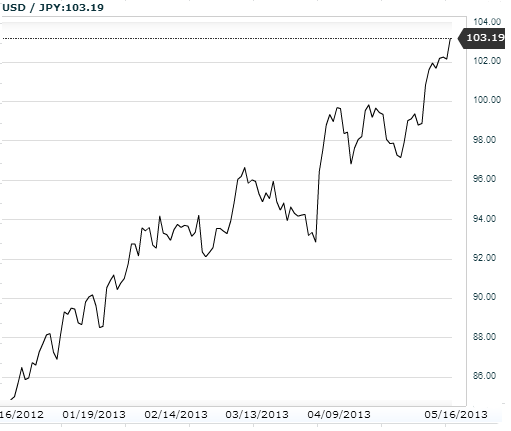

And with Keynesian economists cheering the BOJ on, the policy is rapidly achieving the desired result. Japanese authorities are ecstatic - dollar-yen just broke 103 as the yen "printing presses" quickly debase the currency. Japan will quickly have a competitive advantage over South Korea, Germany, and in some cases even China. Japan's exporters are popping the Champagne corks ...

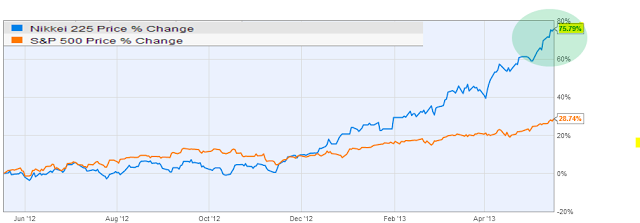

The nation's stock market is now up over 75% over the past year as investors celebrate the massive stimulus, BOJ's direct purchases of ETS and REITs, and a rapidly depreciating yen.

Japan's economy is quickly responding to this aggressive policy, with analysts frantically revising growth forecasts.

Goldman: - Strong Q1 growth, technical upward revision to our FY2013 forecast Jan-Mar real GDP growth came in at +3.5% qoq annualized, substantially outpacing the market consensus forecast of +2.7%. Consumption was the driver rising +3.7%, while exports turned positive for the first time in four quarters.

We raise our FY2013 real GDP forecast to 2.8% growth, from 2.5%, based on the strong GDP numbers for Jan-Mar.

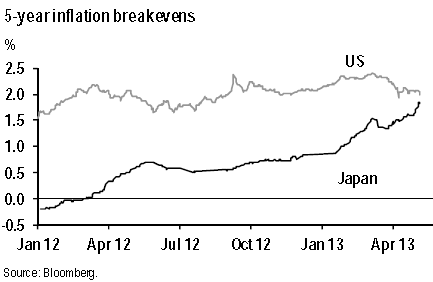

The Bank of Japan's biggest achievement of course is pulling the nation out of the prolonged deflationary spiral. Market-implied inflation expectations have risen sharply over the past year, quickly approaching those in the United States.

This is a great lesson for central banks around the world. If much needed structural changes fail or competitive pressures become too great, let you central bank resolve the situation. Just as the ECB "saved" the EMU with its OMT bond backstop policy, Japan is showing that highly aggressive central bank actions can work beautifully in the short term. But what happens in the long run some may ask? Don't worry about that, because as Keynes famously pointed out, "... this long run is a misleading guide to current affairs. In the long run we are all dead."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BOJ Says Party On, In The Long Run We Are All Dead

Published 05/20/2013, 01:10 AM

Updated 07/09/2023, 06:31 AM

BOJ Says Party On, In The Long Run We Are All Dead

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.