The price of Japanese government bonds rose on Wednesday following the BOJ’s outright bond purchases announcement which saw central bank refraining from specifically referring to any tweaks or alterations to its current bond purchase program.

The meeting, held with primary banks and financial institutions, had been expected to see the bank announce some adjustments to its purchases with a view to fuelling better volatility in the market.

Weak Selling Interest

Alongside the absence of any tweaks to the bank’s program, the meeting also saw very subdued selling interest from brokers, which added further support to the market which has already been boosted by stronger USTs and a decline in global equity prices.

JGB 10y futures rose .12 points while the yield on 10-y JGBs fell 0.01% to 0.135%, a three-week low.

Meanwhile, the yield on20-y JGBs and 40-y JGBs both fell 0.15% to 0.665% and 1.060% respectively.

BOJ Seeking To Curb Tightening Expectations

The size of the BOJs bond purchases operation was kept the same this month which is likely a move aimed to quell rising expectations of policy normalization which the market has started chattering about again recently.

Following the BOJ lifting the upper limit of its target on the YCC program, the market has been anticipating further moves which are seen as a precursor to outright tightening.

However, the BOJ has been keen to stress that it is not intending on tightening any time soon, saying that rates will stay at current low levels for a long time to come.

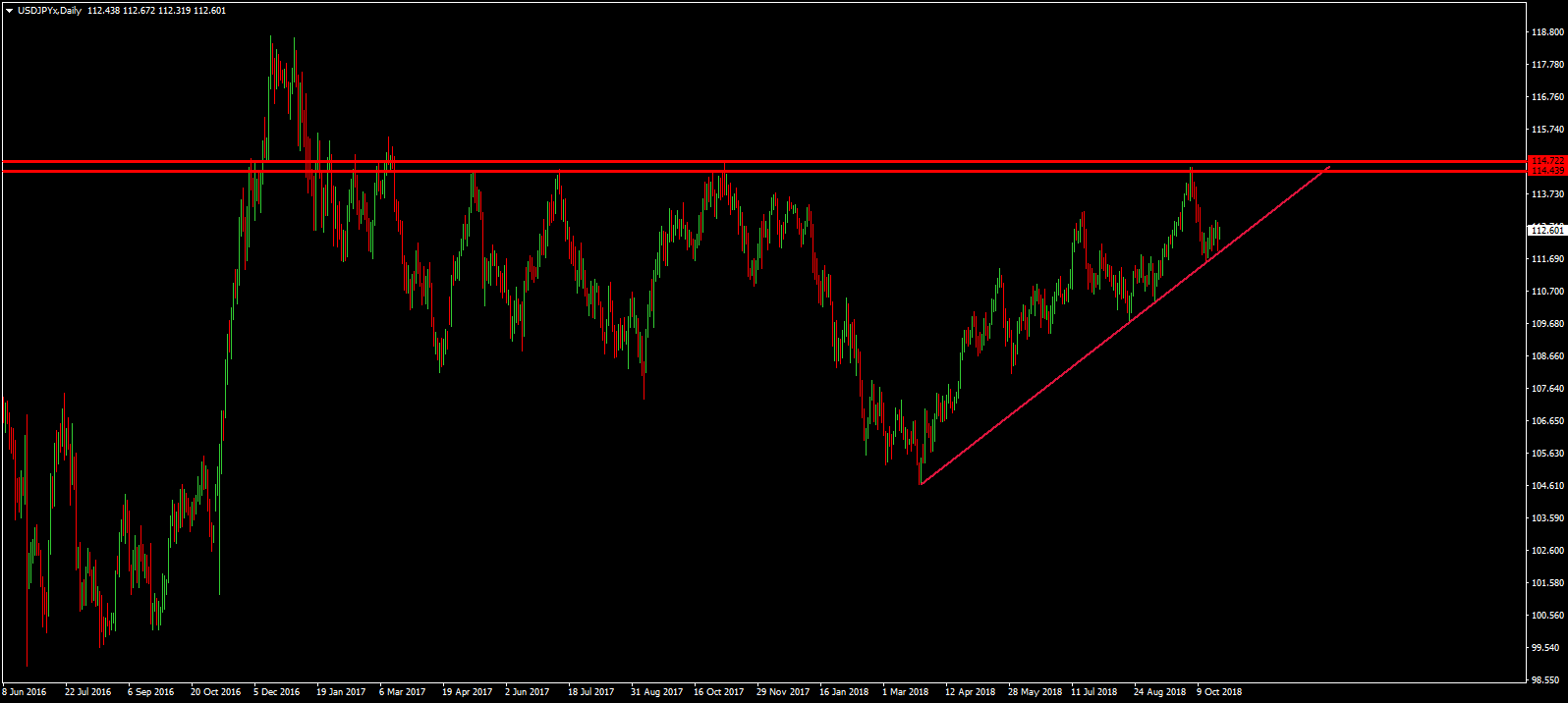

USD/JPY Technical Perspective

USD/JPY continues to trade along the rising bullish trend line from the 2018 lows putting further pressure on the big 114.43 – 114.72 level which has been major resistance over the last year and a half. For now, focus remains on further upside, with a break of the aforementioned level needed to see momentum players join the market.