Yesterday, the Bank of Japan released its most recent monetary policy statement. What does it say about the BoJ’s stance and what does it imply for the gold market?

On Tuesday, the Bank of Japan held its latest monetary policy meeting. It held its interest rate steady (at minus 0.1 percent) and kept the 10-Year government bond yield target unchanged. The BoJ also maintained its inflation forecast for fiscal year 2019/2020 unchanged (at 2 percent), but it lowered the projection for 2018/2019 from 1.1 percent to 0.8 percent. The stubbornly low inflation in Japan implies that the bank will not tighten its monetary policy anytime soon. In other words, the Bank of Japan will remain an outlier among other major central banks which began to wind down stimulus.

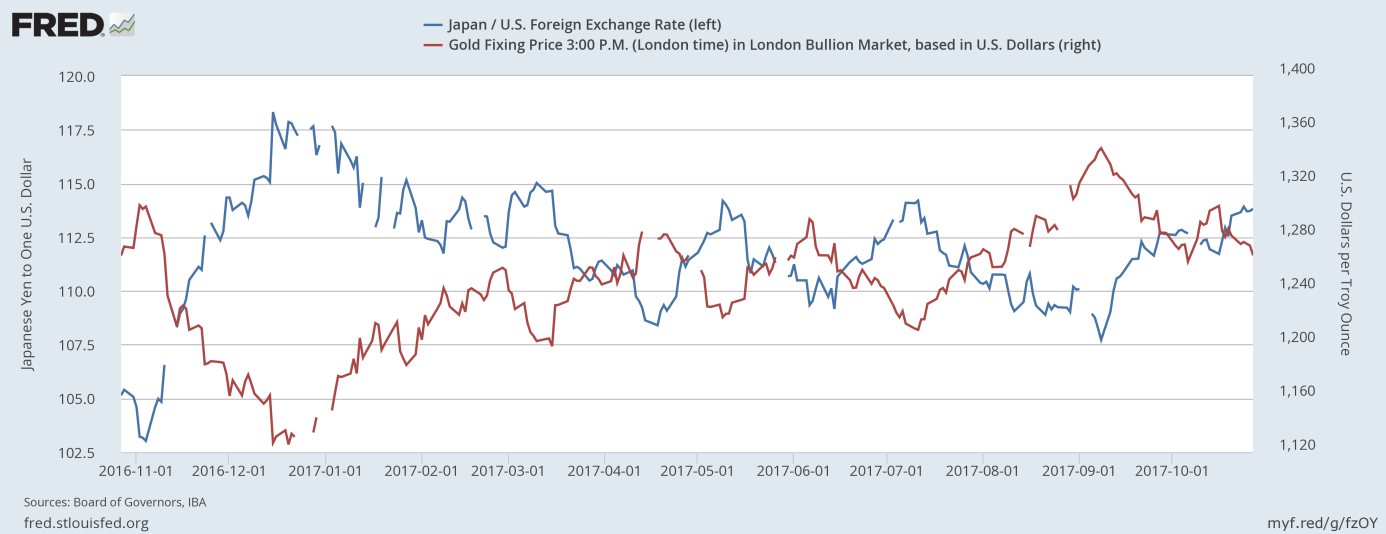

The implications are clear: a weaker yen against the U.S. dollar. Given the high correlation between the USD/JPY exchange rate and the price of gold (see chart below), a depreciation of the Japanese currency is bearish for the yellow metal.

Chart 1: USD/JPY exchange rate (blue line, left axis) and gold prices (red line, right axis, London P.M. Fix) over the last twelve months.

The divergence in monetary policy conducted by the Fed and the BoJ will be a headwind for gold prices in the long run. However, standing pat was in line with expectations. And in the very short run, the U.S. dollar may decline due to news about charges against President Donald Trump's former campaign manager. There might be also some volatility due to speculations about the next Fed chair. One thing is certain: this week will be very eventful and interesting for the markets. Today, the Fed will publish its latest monetary policy statement. Tomorrow, Trump is expected to announce his nomination to the Board of Governors of the Federal Reserve, while October payrolls will be revealed on Friday. Now, Powell definitely leads the polls – and his choice will be more dovish than in the case of Taylor, as Powell – who never dissented – will assure a continuation of Yellen’s policy. However, investors should not forget that John Taylor is expected to become the Fed Vice Chair. And a Powell-Taylor duo will be more hawkish than Yellen-Fischer, which is not good news for the gold market. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.