Market Brief

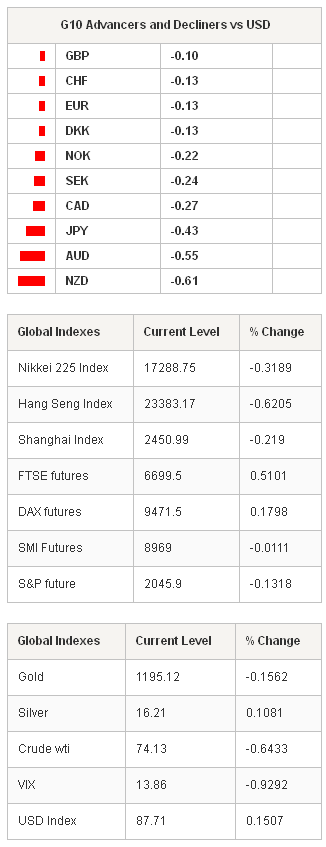

On top of the official announcement to delay sales tax hike and to dissolve parliament, the BoJ left its policy unchanged today; the annual monetary growth target was kept steady at 80 trillion yen. There is talk of more stimulus to come should the ruling coalition survive the snap elections in December. The JPY-bears jumped back on the trend, pushed USD/JPY to fresh high of 117.42 in Tokyo. The bullish momentum revived. Offers are seen at 107.50/108.00, while large option related bids at 117.00 should give support today. EUR/JPY hit a fresh 6-year high of 147.03.

Heavy EUR/JPY demand kept EUR/USD well bid above 1.2500 overnight. The pair currently tests the 21-dma (1.2541), offers stands at 1.2577/78 (Nov 4th & 17th highs). More resistance is eyed at 1.2721/44 (daily Ichimoku cloud base / Fib 23.6% on May—Nov sell-off). EUR/GBP clears offers at 0.80+, advances toward 200-dma (0.80549). Strong resistance is seen at this level as it has been more than a year the EUR/GBP has not traded above its 200-dma.

NZD printed biggest losses versus USD as the dairy prices and volumes dropped at latest Fonterra auction, the GDT fell 3.1%. Should the NZD/JPY demand stays, the sell-off should hit the bottom at 0.7800/33 (optionality / 21-dma).

The Bank of England and Fed release its meeting minutes today. GBP/USD failed to rebound on better CPI read yesterday. We expect little reaction to BoE minutes, given that last week’s QIR sufficiently revealed the dovish shift at the BoE. Trend and momentum indicators suggest the extension of losses toward 1.55 following Oct-Nov downtrend base. The USD is broadly stronger before the Fed minutes. Following the latest hawkishness, markets anticipate slight dovish shift in Fed outlook given the focus on global macro risks. We keep our bullish view on USD as sooner or later, the Fed is moving toward normalization.

USD/BRL holds ground above 1.58 before the inflation and unemployment data due today. Traders expect slight softening in consumer prices in November. A strong read should revive hawkish BCB expectations on December 3rd meeting yet remain insufficient to offset the political pressures on the Real. The downside risks prevail. USD/BRL tests 2.60/62-offers, stops are eyed above. According to interest rate markets the BCB will increase the Selic rate by additional 25 basis points to 11.50% before the year end. The 1-month implied vol spiked to 17.45% yesterday, we see room for higher volatilities and softer BRL.

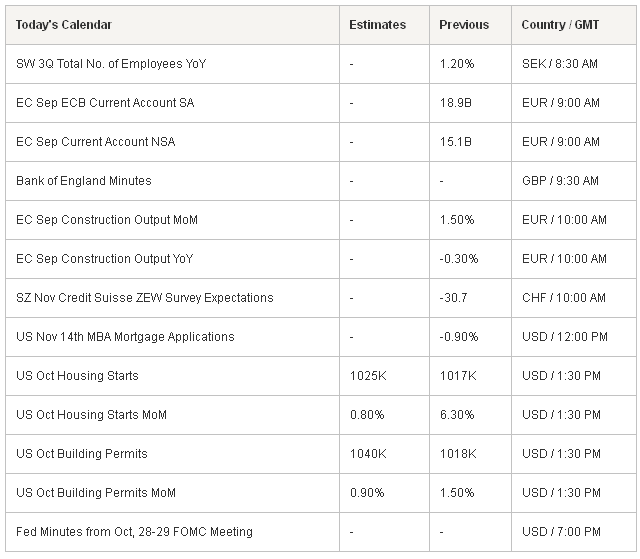

Traders also watch Swedish 3Q Total Number of Employees, Euro-Zone September Current Account and Construction Output m/m & y/y, Credit Suisse ZEW Survey for Swiss Expectations in November, US November 14th MBA Mortgage Applications, US October Housing Starts & Building Permits m/m.

Currency Tech

EUR/USD

R 2: 1.2744

R 1: 1.2578

CURRENT: 1.2491

S 1: 1.2444

S 2: 1.2395

GBPUSD

R 2: 1.5835

R 1: 1.5781

CURRENT: 1.5617

S 1: 1.5593

S 2: 1.5575

USD/JPY

R 2: 118.00

R 1: 107.50

CURRENT: 117.33

S 1: 115.46

S 2: 115.00

USDCHF

R 2: 0.9751

R 1: 0.9655

CURRENT: 0.9583

S 1: 0.9544

S 2: 0.9442